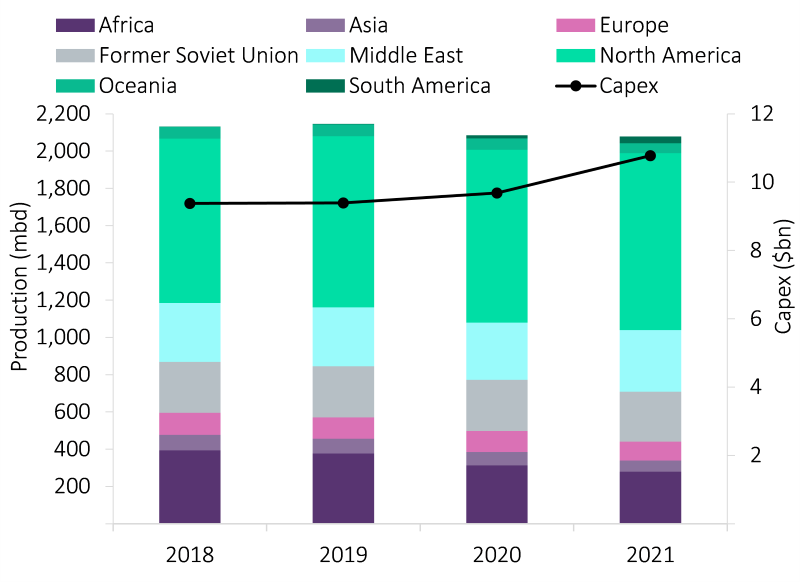

GlobalData’s latest research on upstream crude oil production predicts that over $39.2bn in capital expenditure (capex) will be spent by ExxonMobil on oil projects over the next four years to ensure that its production remains around 2.1 million barrels per day (mmbd) in 2021.

The Upper Zakum field will drive the company’s oil production with over 8.3% share of all production in 2021. Kearl Oil Sands Project (Imperial Oil) and Permian Basin Unconventional (ExxonMobil) will follow with 7.4% and 7% respectively.

ExxonMobil has participation in about 546 fields, which are expected to have an equity-weighted production of over 2.1 mmbd in 2021, with new projects contributing about 62,500 barrels of per day (mbd).

Conventional oil fields would be responsible for 1.2 mmbd of production in 2021 while heavy oil would contribute 84.6 mbd. Onshore fields will produce 1.1 mmbd, which accounts for half of the total crude produced by the ExxonMobil- operated fields. Shallow water fields contribute about 33.7 percent or 700.6 mbd, while deepwater and ultra-deepwater fields together contribute about 308.7 mbd or 14.8 percent of the total crude production.

Exxonmobil’s crude and condensate production and capital expenditure

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataSource: GlobalData Upstream Analytics

ExxonMobil is expected to spend $39.2bn over the next four years on crude projects, with capex peaking in 2021 at $10.8bn. Chad is expected to have the highest remaining capex per boe with $40.5/boe, followed by the UK and the Netherlands with $37.3/boe, and $28.3/boe respectively.

Among the fields in which ExxonMobil has equity stake, the shallow-water Upper Zakum field in United Arab Emirates is the major oil producing field with contribution to ExxonMobil of about 172.9 mbd of oil in 2021. The project has a remaining break-even oil price of $5 per barrel and ADNOC Offshore is the operator of this shallow water field.

The Kearl Oil Sands Project in Canada is another major onshore oil producing field, which is expected to contribute about 153.5 mbd of oil to ExxonMobil in 2021. Imperial Oil Ltd is the current operator of this field, which has a remaining break-even oil price of $38 per barrel.

The company-operated Permian Basin Unconventional in the US is the next major onshore oil producing field, which is expected to contribute around 145.6 mbd of oil in 2021 with the remaining break-even of $48 per barrel.

Related Company Profiles

Exxon Mobil Corp

ADNOC Offshore

Imperial Oil Ltd