Over $10.2bn in capital expenditure (capex) will be spent by South America-focused operators on gas projects over the next four years, and the region’s production will remain around 17.3 billion cubic feet per day (bcfd) in 2021, according to GlobalData. Over 10.7bcfd in 2021 will be produced by conventional gas projects, while unconventional gas projects will contribute 1.9bcfd. Conventional, unconventional, and heavy oil projects will contribute 3.9bcfd, 0.4bcfd, and 0.3bcfd of associated gas respectively.

Petrobras will drive South America’s gas production, with a 21.1% share of all production in 2021. Petroleos de Venezuela and YPF follow with 20% and 10.1% respectively. South America has 16 key upcoming gas projects, of which 14 will be producing by 2021. Petrobras will lead in greenfield gas projects, with participation in seven upcoming projects in the near future. Repsol SA and Yacimientos Petroliferos Fiscales Bolivianos follow with three projects each. YPF SA has the largest number of producing unconventional positions with 13 in total and 3 new pilot projects.

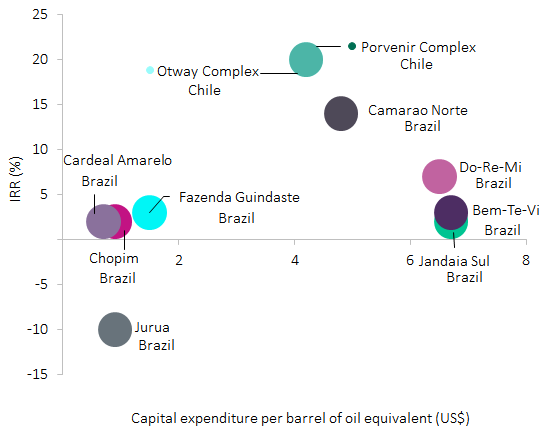

Top planned and announced gas projects in South America

Source: GlobalData Upstream Analytics

South America is expected to spend $10.2bn as capex on conventional and unconventional gas projects from 2018 to 2021, with spending peaking in 2018 at $4.5bn.

Average full cycle capex per barrel of oil equivalent (boe) for South America gas projects is $8.30. Unconventional gas projects have full-cycle capex of $9/boe, while conventional gas projects need $8.20 per boe in full cycle capex. Ultra-deepwater projects have an average full- cycle capex of $13.5 per boe, followed by deepwater, shallow water and onshore projects with an average full-cycle capex per boe of $10.8, $10.3 and $6.6 respectively. New conventional gas projects average $10.7 per boe in full-cycle capex, while new unconventional projects average $14.3 per boe.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe average development break-even price for gas projects in South America is about $7.50 per thousand cubic feet (mcf). Onshore projects require a gas price of $7.90 per mcf to break even, while the deepwater and shallow water projects have a development break-even price of $6 per mcf. Ultra-deepwater projects require a gas price of $5 per mcf to break even.

Related Company Profiles

Yacimientos Petroliferos Fiscales Bolivianos

YPF SA

Repsol SA

Petroleos de Venezuela SA