Following their discovery in 2010 in the offshore Rovuma Basin of north-east Mozambique, Area 1 and Area 4 are now estimated to hold approximately 113 trillion cubic feet of recoverable natural gas reserves.

In June 2017, the Eni-operated Area 4 Coral South Floating Liquefied Natural Gas (FLNG) project was granted a final investment decision with start-up expected in 2022. In February 2018, the council of ministers in Mozambique approved the Area 1 development plan for the Golfinho-Atum Complex, an important step towards onshore development.

Evaluation of the Coral South FLNG project shows sanction was achieved with marginal economics at current Japan LNG Import Prices ($8.00 per Mcf) held constant and a discount rate of 10%.

The development break-even gas price for Coral South is estimated at $9.57 per mcf, which may have been achieved in the confidential 2016 LNG long-term gas sales and purchase agreement (SPA) signed with BP covering total output from the project.

As the first Rovuma LNG project, Coral South FLNG will de-risk the play and develop infrastructure and services that can be used in the development of the onshore trains, where most value resides.

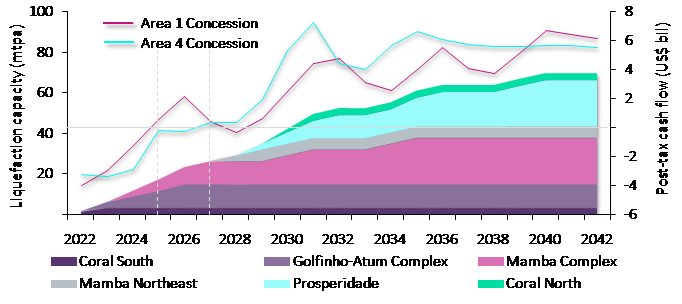

Rovuma Basin fields estimated LNG production and post-tax cash flow

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataSource: GlobalData Upstream Analytics

Under the same assumptions, there are stronger economics for the onshore projects in comparison with the FLNG projects, with internal rates of return (IRRs) ranging from 11% to 15%. The onshore liquefaction projects also have a high remaining net present value at 10% discount, which benefit from the massive volume of recoverable reserves. Even though the projects’ IRRs are modest, the very large NPV10s and resulting average annual free cash flows above $1bn will be significant contributing factors in sanctioning these projects.

Considering the expected increase in LNG demand in the next five years, there is a window of opportunity for projects that will come online from 2022 onwards if prices rise. An increase of $2.00 per mcf to $10.00 leads to an increase of $12bn in remaining NPV10, from $10bn to $22bn, as well as IRRs above 15% for all onshore liquefaction projects, assuming each project is being evaluated individually.

Considering ring-fencing on a block level, with an LNG price of $10.00 per mcf, Area 1 and Area 4 are estimated to achieve an NPV10 of $11bn each and an IRR of 17% and 15%, respectively.

Related Company Profiles

BP Plc