Fairwood Group subsidiary Delfin LNG is developing a deepwater port and floating liquefied natural gas (LNG) export project in Cameron Parish, Louisiana, US.

The facility will be the first floating LNG project in the country once completed and is set to cost an estimated $7bn.

The project was approved by the Department of Energy (DOE) in June 2017 in order to export LNG to countries that do not currently have Free Trade Agreements (FTA) with the US.

Approval from the Federal Energy Regulatory Commission (FERC) is still pending.

The final investment decision on the project is expected to be taken in 2018, while commissioning is expected between 2021 and 2022.

The project will have an annual export capacity of roughly 13Mt with the potential to expand to 21Mt. It is also expected to create 200 jobs during the construction phase.

Delfin LNG project details

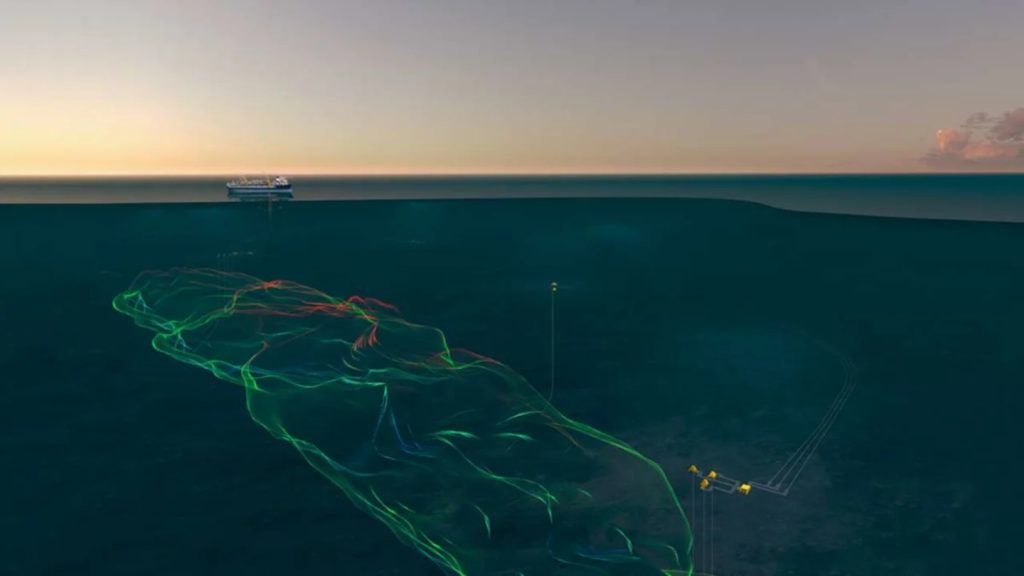

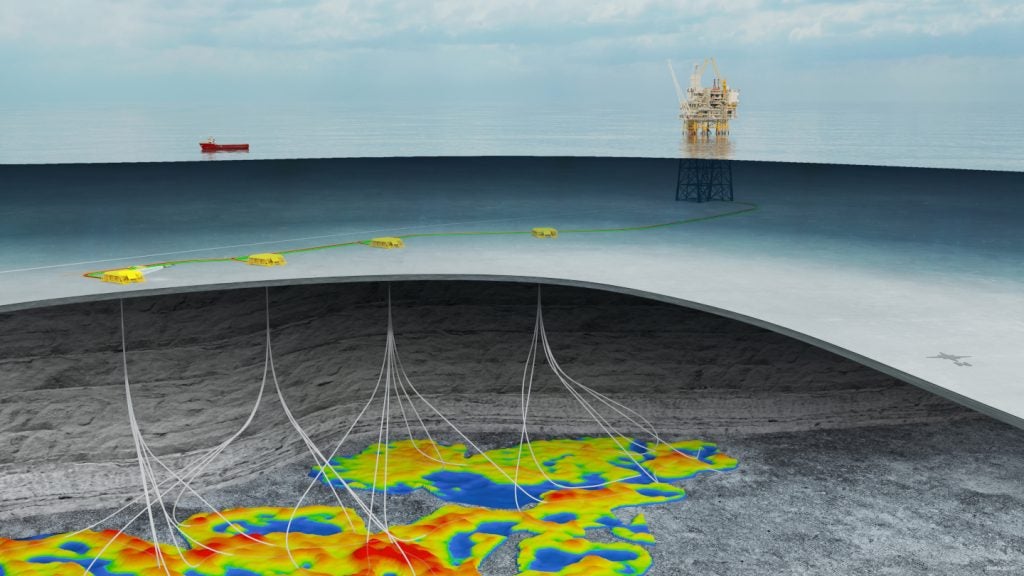

The project will make use of an existing subsea pipeline system to transport LNG from the current platform in Cameron Parish, Louisiana, to four floating LNG vessels (FLNGVs), which are moored roughly 50m (80.5km) offshore in the Gulf of Mexico.

The platform will serve as the connection point for the Enbridge Offshore Pipelines (UTOS) system. The FLNGVs will be moored to a single point mooring system located near the platform.

In addition, they are expected to receive and cool the natural gas on-board to -260˚F in order to convert it into liquefied natural gas (LNG).

The LNG will then be transported to international customers directly from the FLNGVs via LNG carriers.

Each of the five FLNGVs will be manned by a crew of 50 to 100 engineers and operators.

Infrastructure for the floating offshore project

The 42in, 30mi (48.2km) subsea UTOS pipeline system was originally built in 1978 to transport offshore oil and gas to on-shore connections.

It was connected to various interstate pipeline systems such as the Transcontinental Gas Pipeline (Transco), Natural Gas Pipeline Company of America (NGPL) and ANR Pipeline Company (ANR).

The pipeline was abandoned in 2011 due to decrease in flow volumes. Delfin subsequently acquired the pipeline system from Enbridge in 2014 and plans to restore the pipeline’s connections with the interstate networks, as well as perform modifications to reverse the flow.

A new onshore compressor station is also set to be built as part of the project, which will enable gas to flow from the UTOS system to the deepwater port in the Gulf of Mexico.

Development agreements and contracts

Delfin has signed an agreement with Golar LNG, which will see the two companies collaborate on the initiative’s financing, construction and general operation.

The first of the four FLNGVs is expected to use Golar’s Mark II solution, which is currently under development. The design includes a liquefaction capacity of less than 3Mmtpa.

Höegh LNG has also signed an agreement to act as the owner’s engineer and operator of the FLNGVs.

In addition, Enbridge has agreed to provide pipeline management support and expertise for the project in exchange for 5% equity in the Fairwood Group.

Delfin Floating LNG project benefits

The US has abundant natural gas resources, which provides the country an opportunity to decrease its trade deficit via the exportation of LNG.

The Delfin FLNG project will enable the country to supply clean-burning natural gas to countries that are currently using harmful hydrocarbons such as coal and oil.

It will also eliminate the need for the construction of on-shore liquefaction or storage facilities, which can disturb the existing surroundings and population.

Additionally, on-shore projects generally require 20-year contracts for operation, while FLNGV projects offer the flexibility of shorter 10 to 15 year agreements.

Contractors involved

Bechtel was awarded the front-end engineering design (FEED) contract for the development’s first FLNGV.

The company is also expected to construct and commission the project upon receipt of the final investment decision.

Moffatt and Nichol were contracted to carry out a variety of marine research works for the initiative, including metocean analysis and mooring studies.