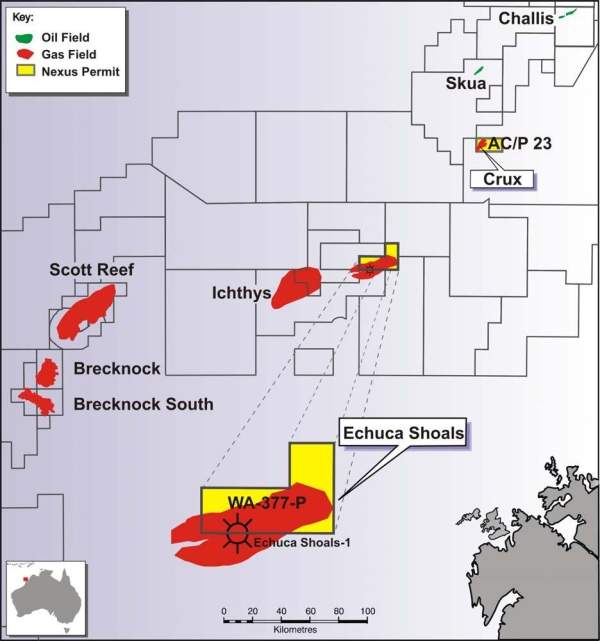

Echuca Shoals gas field lies in the exploration permit WA-377-P in the Browse Basin, off the coast of Western Australia. The field is 100% owned and operated by Nexus Energy. The company was awarded the exploration permit in March 2006.

The field lies close to the Ichthys and Prelude gas fields and is currently in the exploration stage.

Discovery

Echuca Shoals was discovered by the Echuca Shoals-1 well drilled in 1983. The well intersected a 70m low saturation gas column in the Tithonian sands but there was no gas water contact.

Data from the well indicated that a stratigraphically trapped gas accumulation column greater than 200m may be present at the field.

No gas sample was recovered from the well but data showed the presence of gas with richer condensate compared to nearby fields.

Geology and reserves

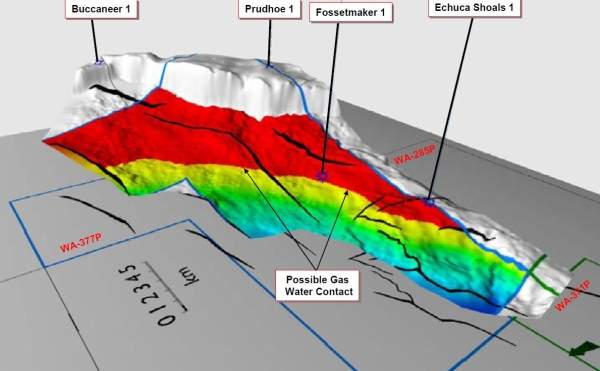

The Echuca Shoals-1 well detected gas in two reservoirs of the late Jurassic to early Cretaceous age.

The gas reserves of the field are currently estimated at around 0.5 trillion cubic feet (tcf). An additional 1.8tcf exists at the Backmaker prospect located north of the field. Further exploration of the prospect is expected to add up to 6tcf of gas in place.

Nexus has also identified another prospect called Mashmaker through 3D seismic surveys. The prospect lies northeast of the permit and is estimated to contain 0.4tcf to 3tcf of gas in place in the prospective Plover reservoir.

Drilling and exploration

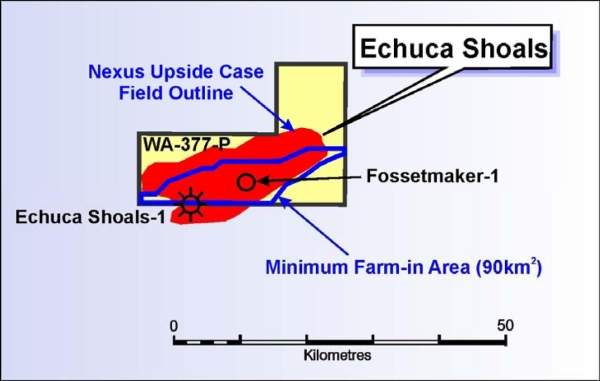

Nexus and Shell Development (Australia) finalised a farm-in agreement for the appraisal of the field in July 2007. Shell provided $5m for drilling of the exploration well, Fossetmaker-1, under the agreement.

Shell also planned to provide $30m to complete drilling of the Fossetmaker-1 well and the first appraisal well.

Shell was to provide another $25m to drill the second appraisal well and acquire 34% interest in the WA-377-P permit. It, however, withdrew from the permit area in 2010, giving Nexus 100% ownership of the field.

Nexus launched a drilling programme at the field in August 2007. The programme includes drilling of seven wells and an option to drill two more wells.

Fossetmaker-1 was the first well to be drilled in the programme about 7km east of the Echuca Shoals-1 well. It was drilled by the Ocean Epoch semi-submersible drilling rig to a depth of 3,822m. It encountered a 10m gas column in the Tithonian sands without gas water contact.

The well was drilled to evaluate the possibility of an eastern extension of the field and test the presence of a deeper gas accumulation. The thickness and quality of the sandstones present in the reservoir were also examined.

Both the Echuca Shoals-1 and Fossetmaker-1 wells confirmed the presence of Tithonian sands which have the potential to hold significant volumes of hydrocarbons. The optimum location for future appraisal wells will be determined based on the results of these two wells.

Two appraisal wells are planned to be drilled to determine the extent of reserves. Nexus is currently pursuing an equity farm-out of the permit area to fund the drilling of these wells. Appraisal drilling may also start without farm-out if the farm-out discussions for Longtom and Crux gas fields are successful. The appraisal drilling is expected to commence in 2011.

Field development

Further exploration and appraisal of the field is required to determine the extent of resources contained. A field development plan will be formulated depending upon the results of the exploration and appraisal activities.

The field will be a potential candidate for a standalone floating LNG (FLNG) project if the resources present are extensive. A 1.5 million ton per annum FLNG facility may be considered.

A potential liquid recycle project similar to Nexus’ Crux project will be chosen if the resources are less. A tie-back to nearby developments is also being considered.