GlobalData expects that an average capex of $18.2bn per year will be spent on 382 oil and gas fields in Brazil between 2018 and 2020. Capital expenditure into Brazilian traditional oil projects will add up to $47.2bn over the three-year period, while heavy oil fields will require $6.2bn over the same period. Investments into gas projects in Brazil will total $1.1bn in upstream capital expenditure by 2020.

Ultra-deepwater projects will be responsible for over 82% of $54.5bn of upstream capital expenditure in Brazil, or $44.7bn by 2020. Brazil’s deepwater projects will necessitate $5.1bn in capital expenditure over the period. The country’s shallow water and onshore projects will require a capex of $3.4bn and $1.3bn, respectively.

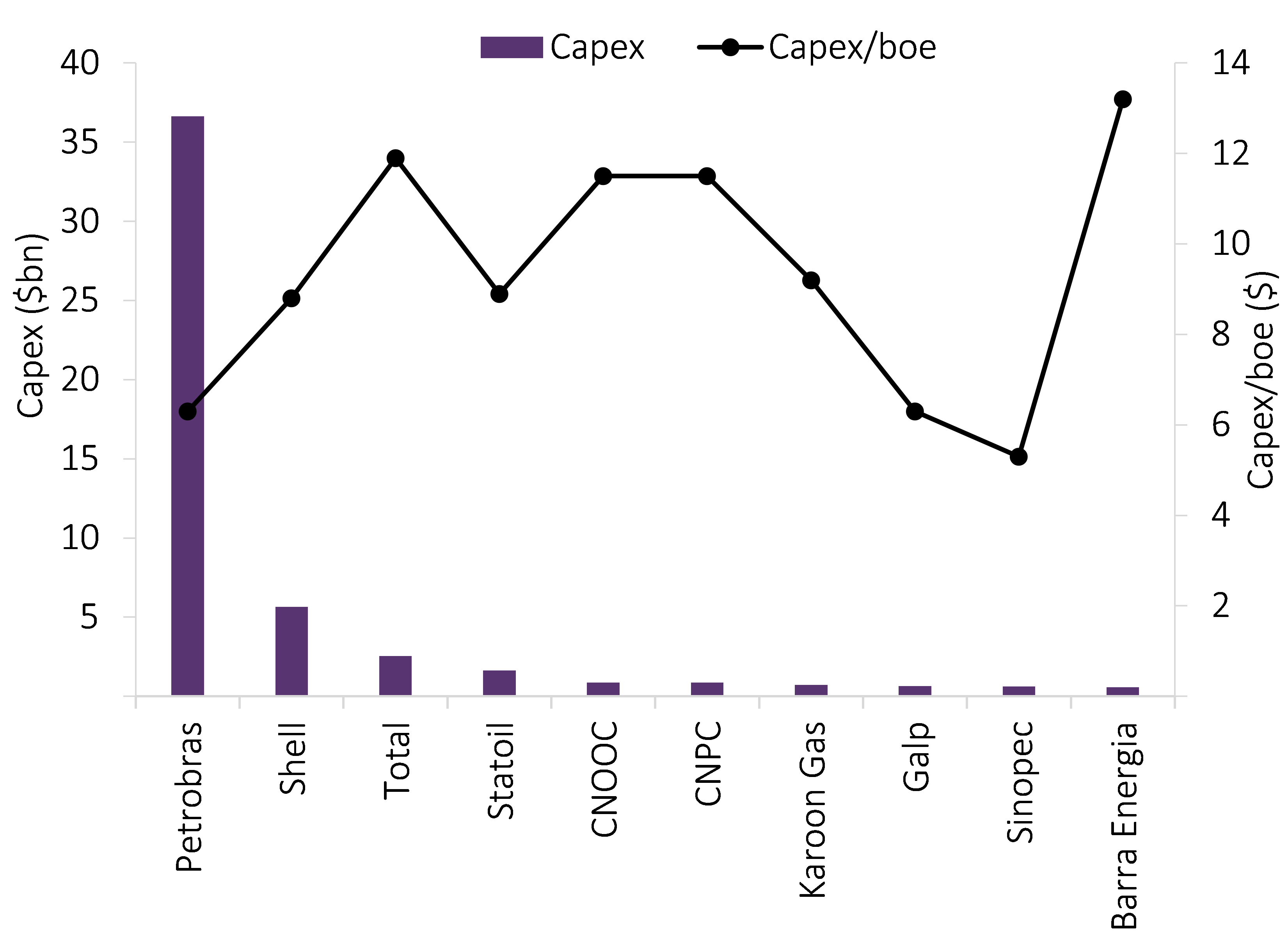

GlobalData expects that Petroleo Brasileiro (Petrobras) will lead the country in capital expenditure, investing $36.6bn into upstream projects in Brazil by 2020. Royal Dutch Shell and Total will follow with $5.7bn and $2.6bn, respectively, invested into Brazilian projects over the period.

Capital expenditure by Brazil’s major companies

Source: GlobalData Upstream Analytics

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe producing, ultra-deepwater Libra field will lead capital investment with $4.8bn to be spent between 2018 and 2020, followed by planned ultra-deep field Lula Oeste with a capex of $4.1bn, and another planned ultra-deep field, Buzios V (Franco), with a capex of $3.4bn. Petrobras is the operator for all the above fields.

GlobalData reports the average remaining capital expenditure per barrel of oil equivalent (capex/boe) for Brazilian projects at $8. Shallow water projects have the lowest remaining capex/boe at $7, followed by onshore, ultra-deepwater and deepwater developments with $7.2, $10.6 and $12.3 respectively.

Related Company Profiles

Shell plc

Petroleo Brasileiro SA