GlobalData’s latest report, “Quarterly Upstream Benchmarking of NOCs – Gazprom Leads in Total Production Outlook,” shows that among NOCs considered – Gazprom, Rosneft, Statoil, Oil and Natural Gas Corporation Ltd. (ONGC), Ecopetrol SA and Petróleo Brasileiro S.A. (Petrobras), and Petroliam Nasional Berhad (Petronas) – Gazprom has the highest remaining reserves for producing, planned and announced fields with 84.5 billion barrels of oil equivalent (bnboe). Rosneft followed with 37.3bnboe.

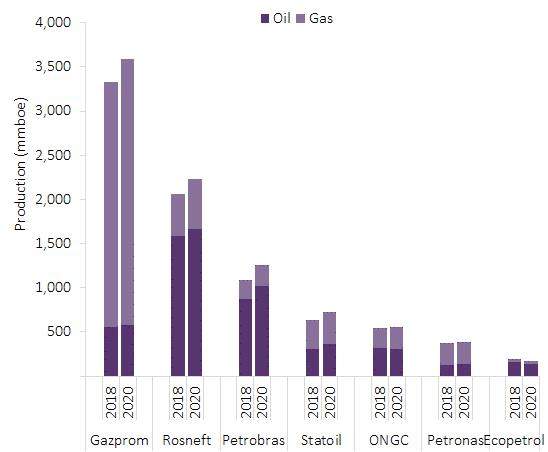

Russian NOCs also lead in terms of oil and gas production entitlement by 2020. Gazprom has the highest production, which is expected to increase marginally from 3,333 million barrels of oil equivalent (mmboe) in 2018 to 3,591mmboe by 2020. The production of Rosneft would also increase from 2,064mmboe in 2018 to 2,235mmboe by 2020. Only Ecopetrol’s production is expected to decrease from 194mmboe in 2018 to 175mmboe in 2020.

Total production outlook of NOCs

| Source: Upstream Analytics © GlobalData |

In terms of break-even oil price, Petronas leads with lowest median of US$7.0 per barrel (/bbl), across all of its planned and announced projects expected to start by 2025. Rosneft is distant second with break-even price of US$13/bbl.

Rosneft, Gazprom and Petrobras have the lowest median for break-even gas price, US$2/mcf for each of the companies, across their planned and announced projects expected to start by 2025.

Rosneft and Gazprom have the lowest median for full cycle capex per boe, with US$7.7/boe each. Petrobras follows with US$8.2/boe.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAmong the NOCs considered, Rosneft reported the highest annual total revenue of US$107bn in 2017 followed by Petrobras with US$90.2bn. In terms of operating income, Statoil is in lead with US$13.8bn in 2017, followed by Petrobras with US$12bn.

Rosneft had the highest M&A activity in 2017 with total deal value of US$10.1bn from seven transactions, followed by Petronas with US$8.5bn from five transactions.

In terms of capital raising activity, Rosneft also leads among the NOCs considered with US$14.6bn in 2017 from three transactions followed by Petrobras with US$13bn from 12 transactions.

For more insight and data, visit the GlobalData Report Store – Offshore Technology is part of GlobalData Plc.

Related Company Profiles

Petroliam Nasional Bhd

Rosneft

Gazprom

Ecopetrol SA

PETRONAS