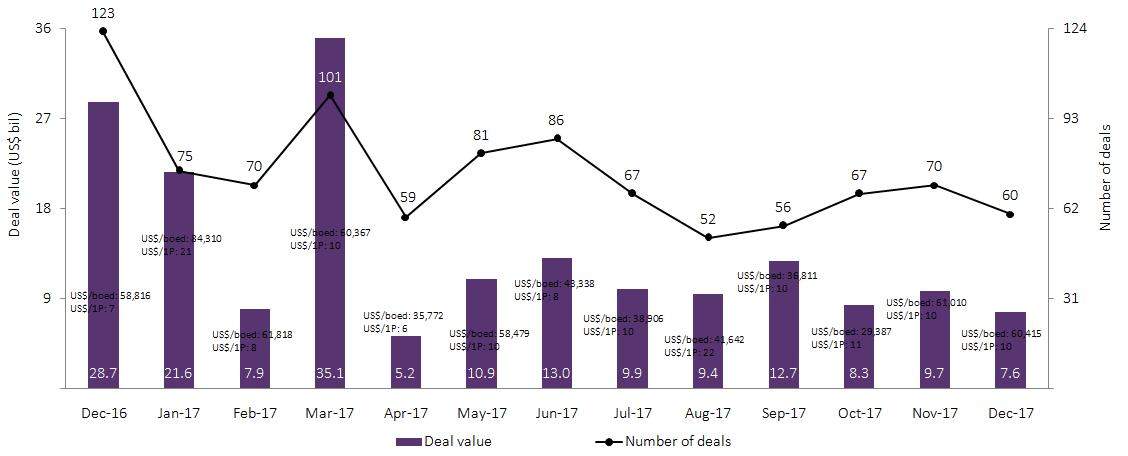

GlobalData’s latest report, ‘Monthly Upstream Deals Review – December 2017’, shows that a combined value of $7.6bn in mergers and acquisitions (M&A) were announced in the upstream sector in December 2017. This was a decrease of 22% from the $9.7bn in M&A deals announced in the previous month. A year-on-year comparison shows a substantial decrease of 74% in deal value in December 2017, when compared to December 2016’s value of $28.7bn. Of the total value, conventional acquisitions were worth $4.4bn; and unconventional acquisitions were worth $3.2bn. The month recorded 12 oil and gas M&A deals with values greater than $100m, together accounting for $7.1bn.

Statoil’s agreement to acquire a 25% interest in the Roncador oil and gas field located in Campos Basin, offshore Brazil, from Petrobras, for $2.9bn, was one of the top deals registered in December 2017.

The Roncador field, covering an area of approximately 111 square kilometres (km) (27,428.7 acres), is located approximately 125km off the coast of Brazil, northeast from Rio de Janeiro, at water depths of 1,500–1,900 meters (4,900–6,200 feet). The field has approximately 10 billion barrels of oil equivalent (boe) in place with an expected remaining recoverable volume of more than a billion boe. The production from the field was approximately 240,000 barrels per day (bd) of oil, and 40,000 barrels of oil equivalent per day (boed) of gas, during November 2017.

The field is currently owned by Petrobras (100%). Following the completion of the transaction, the partners in the Roncador field will be Petrobras (75%, operator) and Statoil (25%).

The transaction will enable Statoil to add material and attractive long-term production to its international portfolio, further strengthening the position of Brazil.

The transaction implies values of $41,428.57 per boe of daily production and $2.9 per boe of recoverable reserves.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataUpstream M&A Deal Value and Count, December 2017

Source: Oil & Gas Deals Analytics © GlobalData

On the volume front, the number of M&A deals decreased by 14% from 70 in November 2017 to 60 in December 2017, of which 13 were cross border transactions and the remaining 47 were domestic transactions. The Americas was the destination of choice for cross-border M&A activity in December 2017, recording nine cross-border transactions in the month.

Regionally, the Americas led the global M&A market in terms of volume and deal value, with 43 deals worth a combined value of $6.6bn, representing 72% of the global deals and 87% of the total value in December 2017. The Europe Middle East and Africa (EMEA) registered 11 deals or 18% of the total, of a combined value of $533.3m; while Asia-Pacific recorded six deals, or 10% of the total, with a value of $458.9m in December 2017.

Related Company Profiles

Equinor ASA

EMEA S.r.o.

UOP Asia Pacific Pte Ltd