Strategies for managing risk associated with capital expenditure and realised sales prices form differentiators for floating liquefied natural gas (FLNG) projects across Africa. Adoption of phased development plans, flexible gas offtake agreements and leased surface facilities are key enablers for competitive returns to be earned from long-lifecycle projects.

Africa contains seven of the 14 planned, announced and producing FLNG projects globally, with Tortue (Mauritania and Senegal), Fortuna (Equatorial Guinea) and Etinde (Cameroon) scheduled for start-up by 2021. Liquefaction technology is mature, with 47 onshore liquefaction facilities currently active globally. Application of this technology to the offshore, however, is relatively untested, with only the PFLNG 1 Satu vessel (Malaysia) currently producing. As such, Africa is poised to become the leading region for implementation of FLNG technology worldwide, with the seven projects anticipated to produce approximately 5.2 billion boe of remaining reserves throughout their collective life.

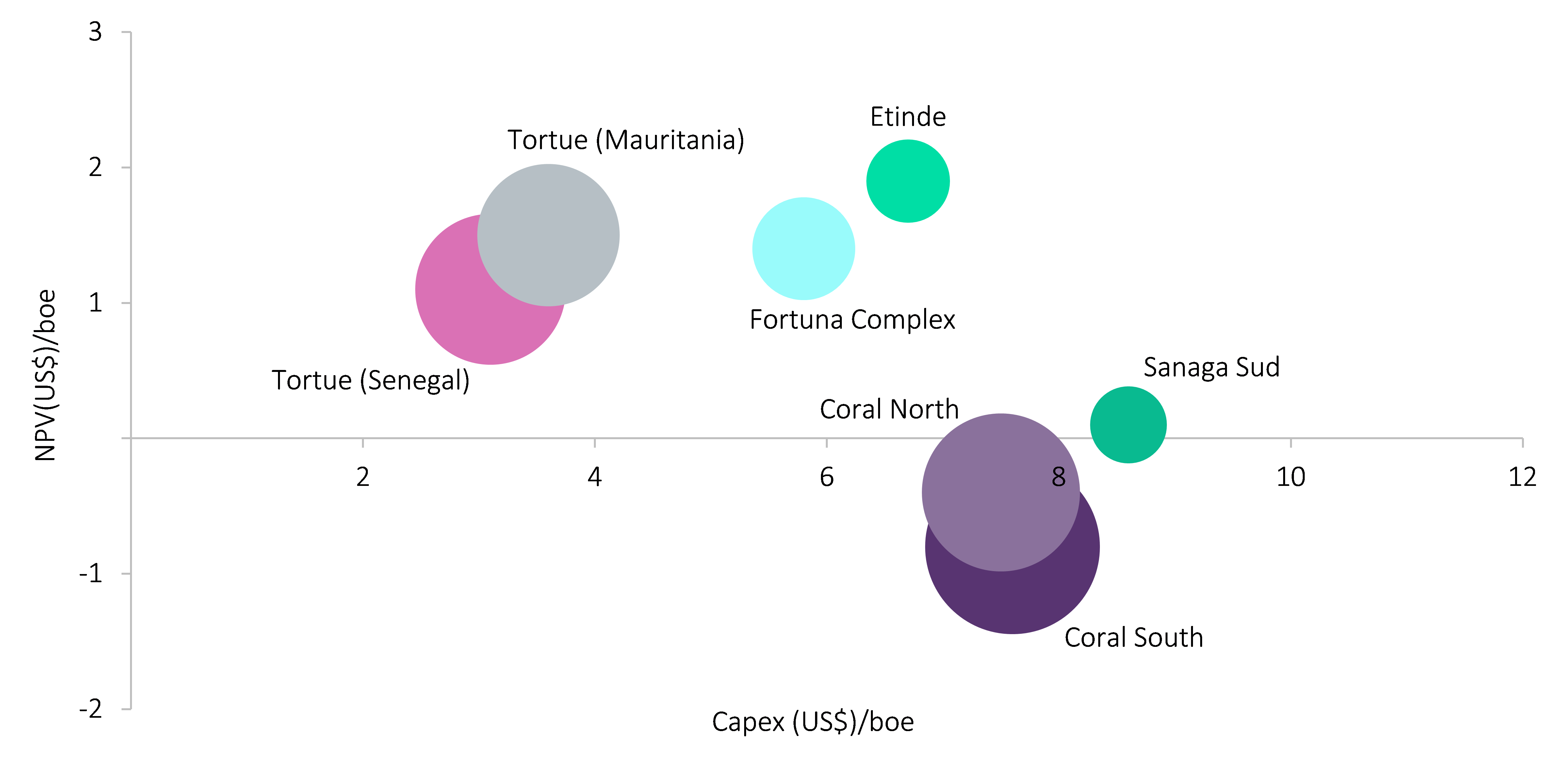

Figure 1: African FLNG projects – planned, announced and producing (bubble size scaled to remaining reserves). $ values relate to development spend.

Source: GlobalData. © GlobalData

FLNG technology offers a development solution for relatively small and isolated gas fields that may be located in regions with weak domestic gas demand, thus enabling the monetisation of natural resources in countries such as Mauritania. The scalability of FLNG technology also means that additional FLNG trains can be added or removed from projects relatively easily, allowing for phased development of fields, a strategy that dramatically lowers the commercial risk associated with under-filling a plant.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataOne example, the Tortue Project (Maritania and Senegal), will be developed across two phases with the first phase using one FLNG vessel and scaled-back subsea infrastructure at an estimated cost of $1.8bn (gross between Mauritania and Senegal). Should phase 1 prove a success, then an additional FLNG vessel and an inshore pipeline will be installed, allowing the project to scale up to full production, with a total development expenditure (phase 1 and 2) of $5bn (gross between Mauritania and Senegal).

African FLNG projects: three key sensitivities

Three key sensitivities are prevalent within African FLNG projects – capital expenditure, commodity price and production – though each project has unique risks and opportunities, and the management of these risks will be key to determining project success.

Full-cycle capex/boe values range between $3.1 (Tortue, Senegal) to $8.6 (Sanaga Sud, part of the greater Kribi Development, Cameroon) across African FLNG projects, something that is largely dependent on FLNG vessel class, project financing strategy and engineering variables. Pioneering projects sanctioned before the 2014 oil price crash (for example Prelude in Australia) used development plans based on bespoke and expensive high-tech FLNG vessels with large-scale gas processing capabilities.

Recent trends have shown a reluctance by operators to pay the premium associated with bespoke engineering, instead focusing on fit-for-purpose solutions, with projects such as Fortuna FLNG (Equatorial Guinea) targeting resources that need very little pre-liquefaction processing. One of the trends to emerge is for repurposing of LNG carriers as floating liquefaction vessels, a strategy that can allow capital savings of 25-30% relative to commissioning a new hull. In the case of Fortuna, the FLNG vessel is estimated to cost in the region of $1.2bn (paid for through leasing), for a 2.3 mtpa capacity vessel ($545m per mpta of capacity), compared to Coral South (Mozambique), which will cost approximately $6bn for a 3.4 mpta capacity vessel ($1.8bn per mpta of capacity), with the majority of the cost disparity coming from differing gas-processing requirements.

The significant expenditure associated with the Coral North and Coral South FLNG vessel is a key driver to the project returning a negative NPV10, with the sanctioning of the projects potentially indicating a political focus on long-term energy supplies and the operator using a lower discount rate. The Coral projects are scheduled to sell all LNG production to BP, with the offtake agreements likely accounting for the breakeven prices of $8-9 per mcf. As such Coral North and Coral South are somewhat insulated from future open-market LNG pricing risks but have a negative NPV at our standard 10% discount rate.

Procurement and commercial strategies also form significant differentiators between projects. For example, the Coral South FLNG project in Mozambique is anticipated to use debt financing, resulting in full capital expenditure being borne by the operator, and to result in a low Internal Rate of Return (IRR) ($7.6 capex/boe, 8% IRR). In comparison, the Fortuna Complex FLNG project (Equatorial Guinea) is expected to use a tolling structure to pay for the FLNG vessel, thereby reducing the capital intensity of the project ($5.8/boe) and elevating the internal rate of return (18.8% IRR).

Further to this, the commercialisation strategy of individual projects serves as another key differentiator, allowing sensitivity to price to be partially mitigated. For example, the Coral South (Mozambique) development will use a 20-year gas sales agreement, with BP purchasing all LNG production, offering stable long-term cash flows. In comparison, the Fortuna project (Equatorial Guinea) will use a flexible sales structure, with Guvnor Group committing to purchase the full contract output from the Gandria FLNG vessel while still offering the flexibility for Ophir, the operator, to chase upside by diverting up to 50% of production into higher-priced markets.

Despite production being a key sensitivity for five of the African FLNG projects, NPV and IRR do not correlate directly with the total recoverable reserves of multi-phase developments (as shown in the table above), with value from FLNG developments coming from their ability to achieve long-term cash flows. Although the financial success of an upstream project is clearly tied to the volumes of hydrocarbons recovered, both reserves, and associated development expenditures are typically distributed unevenly between FLNG project phases and over very long periods of time.

For example, phase 1 of the greater Tortue project is anticipated to recover 2.06 TCF of gas reserves at a capital cost of $1.8bn compared to phase 2, which will recover an additional 3.74 TCF of reserves at an additional capital cost of $3.2bn, with the second phase of development commencing approximately five years after the first. Such lengthy allocations of capital expenditure can cause a dampening effect for some financial metrics, notably IRR. For this reason, LNG developments in Africa are increasingly choosing to lease FLNG vessels to reduce capital burdens while also fixing long-term gas offtake contracts to secure long-term cash flows.

For more insight and data, visit the GlobalData Report Store – Offshore Technology is part of GlobalData Plc.