The collapse of the Venezuelan economy has been fed by a continuing drop in crude oil production. The country’s annual production has gone from an estimated 2.86 million barrels per day (mmbd) in 2010 to 2.07 mmbd in 2017. The steepest production declines in the country have occurred in the mature fields of the Maracaibo and East Venezuela basins.

This collapse in production has been somewhat mitigated by crude oil production growth in the Orinoco Belt but as the central government has increasingly required more funds to manage the country’s economic crisis and to comply with scheduled debt payments, the capital expenditure allocated to development of Petróleos de Venezuela, S.A.’s (PDVSA’s) upstream projects has dwindled.

In spite of the overall underinvestment in the country’s upstream sector, the Orinoco Belt has seen growth over the last decade, with only a few years having experienced declines of around 5%.

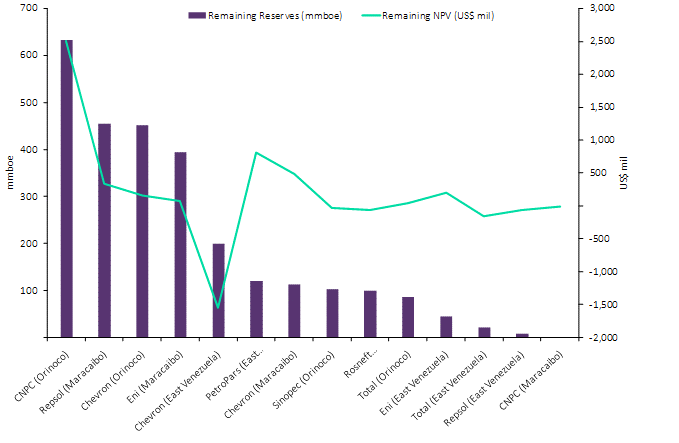

The Orinoco Belt is where foreign operators have concentrated the bulk of their development activity. Most of the International Oil Companies that originally developed the Belt still maintain their operating assets. Operators like Total and Statoil recovered their initial investment in the Orinoco at the end of the 1990s. These operators have now reduced their personnel to a minimum and entered somewhat of a holding position. Repsol and Eni have also taken a step back even after having invested an estimated US$2.4 billion over the last five years in the offshore Perla field in the Maracaibo Basin. ENI recently de-booked the reserves of the field and Repsol noted a clear reduction in capital expenditure for the project.

There are some companies that have expanded their presence in the country recently due to specific agreements, in particular China National Petroleum Corporation (CNPC).

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataForeign companies remaining reserves by basin vs remaining NPV

| Source: Upstream Analytics © GlobalData |

As long as there is no tangible regime change, it is implausible to conceive an effective modification to the regulatory framework of the oil and gas sector to improve the trajectory of the country’s industry.

Related Company Profiles

SAS AB

PDVSA

Repsol SA

China National Petroleum Corp

Eni SpA