As Arena International gears up for the ShaleTech conference in October 2010, key technology players are preparing to thrash out the various methods of producing shale using the very latest technology.

Industry experts will no doubt be keen to hear of the push to exploit shale reserves around the world, many of which were announced in mid 2010. Since the start of the year, some of the biggest energy projects to come online have been natural gas projects. With large-scale projects like the Gorgon LNG project in Australia and similar projects in Qatar, natural gas is a huge growth market, which looks set to continue to expand over the next few years.

Shale gas exploration

In September 2010, South Africa’s petroleum regulator Falcon Oil and Gas and Bundu Gas and Oil Exploration applied for shale gas exploration permits, signalling the latest move by global companies towards shale exploration to help meet energy needs, and in the case of South Africa, reduce dependency on oil imports. South Africa’s Petroleum Agency said it expected "the beginnings of significant production" in the next five to six years. Big hitters like ExxonMobil, Mitsubishi and Sumitomo are also expanding into shale as conventional energy reserves dip. India is also rapidly moving towards becoming a shale gas destination, according to Indian media.

Initial studies by state-owned Oil and Natural Gas Corporation of India (ONGC) on reserve estimation of shale gas in some of the country’s sedimentary basins such as Damodar and Cambay basin have revealed a resource potential of about 35 and 90 trillion cubic feet of gas. ONGC, which started exploring for shale gas five years ago, said shale sequences show promising results in Damodar, Cambay, Krishna Godavari and Cauvery basins. ONGC is now working with top technology companies including Schlumberger to carry out reserve estimation.

See Also:

In 2009, the US overtook Russia as the world’s largest producer of natural gas as shale-gas output rose to 10% of total supplies from 2% in 1990. Today, global economies are pushing technology to explore more and more reserves for a natural gas market projected to be worth billions of dollars.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe IEA estimates that Europe could be sitting on as much as 32.5 trillion cubic feet of unconventional gas reserves. The massive push to develop shale gas reserves in North America has served as a catalyst for Europe, with Sweden, France, Turkey, Poland, Germany and Austria already exploring their shale reserves.

This has created real potential for European countries to dramatically reduce their dependence on foreign gas imports. But Europe still faces the critical challenge of exploring its shale plays to identify to what extent shale gas production is viable. Once that is successful there could still be big demand to slash the production costs in drilling, fracturing and well completion. Overcoming regulatory and environmental rules and regulations could also pose threats to exploration and production activities.

Probing production problems

In a recent report by foreign affairs analysts Chatham House, geological, economic and environmental problems are highlighted as factors that could potentially seriously hamper the production and supply of shale gas. The report highlights the fact that the geology of shale deposits is complex and varies enormously from one place to another, meaning it may take a long time to develop drilling technology.

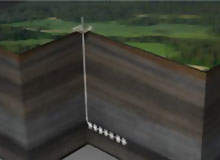

Shale is cracked by rigs that drill down thousands of feet. The rigs are able to turn 90° and drill horizontally to follow gas-rich streams. Once the hole is drilled, explosives are detonated to create a series of openings in pipes laid to keep the well open.A mixture of water and sand is then shot down at high pressure. When it spurts through the openings in the pipes, it shatters the surrounding rock and the gas is released. The process uses huge amounts of water, which is problematic in areas where water is scare. Drilling for shale can, according to the report, also contaminate drinking water as the chemicals used can poison water supplies.

Talking to the BBC, author of the Chatham House report Paul Stevens said "if shale fails to deliver on current expectations, then in ten years or so, gas supplies could face serious constraints."

In addition, the report reminds us that most shale deposits "do not enjoy the same access to pipeline infrastructure that exits in the US." The group also warns that uncertainty over shale is hurting investment in conventional gas wells, which in turn is threatening future supplies.

The report concludes that exploring for shale anywhere other than the US comes with its challenges, many of them too big to overcome, at least for the moment. To add to the argument, it is worth remembering that the US Government has also boosted shale exploration by providing companies with tax credits.

To counteract this argument, technology experts believe that with the latest advances, especially in drilling and rig designs, traditionally unworkable plays can now be lucrative ones. And as Arena International’s conference on shale technology hopes to demonstrate, there is huge interest in overcoming some of these challenges to compete with US success in drilling and producing natural shale gas, ultimately boosting global natural gas resources and helping meet rising energy demands.

Arena International’s ShaleTech conference will take place on 28-29 October in Vienna, Austria.