Oil sands production is a victim of its own success since infrastructure limitations are the result of a steady demand for this type of crude outside of Canada. Current export capacity from Alberta is limited and at the moment the province has an estimate of 16 million barrels (mmbbls) of excess crude oil in storage. The production curtailment is aimed at both increasing the price of oil sands and lowering the glut by having excess stored crude find its way to downstream markets.

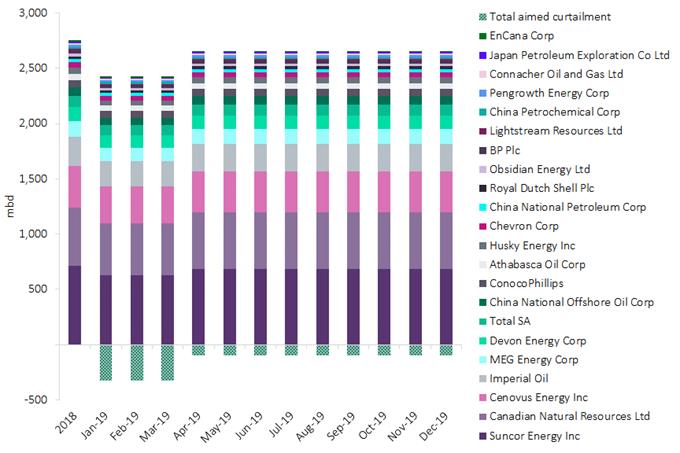

The mandate from the Alberta government is to reduce production by 325,000 barrel per day (b/d), from operators with crude oil production levels above 10,000b/d based on their highest six months of production in 2018. The expectation is for this curtailment of production to be achieved in three months freeing pipeline capacity to alleviate the glut. Once this is achieved the production cut will be lowered to 95,000b/d and if necessary the cut can remain enforceable throughout all 2019.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

2018 and 2019 estimated production for companies subject to curtailment

| Source: GlobalData Analytics © GlobalData |

The curtailment is not a long term solution and it brings to the fore the more persistent issue of not being able to timely build the required infrastructure in Alberta. Alberta’s Premier reiterated the need for federal investment support in the medium to long term. This necessary infrastructure will be to export the crude out of the province including not only to the US but also to Asian markets.

The market intervention is definitely uncommon for the liberalised Canadian oil markets. Ideally the curtailment will have to gradually dissipate in favour of the additional transportation capacity for oil sands output to continue growing. If the announced pipelines to Canada’s west coast and to the US are not brought on line in the near term, the oil sands’ depiction as a secure source of energy will lose terrain against opposing narratives that deem this type of production too energy-intensive and highly polluting. Surely in the current context of energy transition and decarbonisation, more strict environmental policies and activism will add to the existing restrictions for oil sands production growth.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData