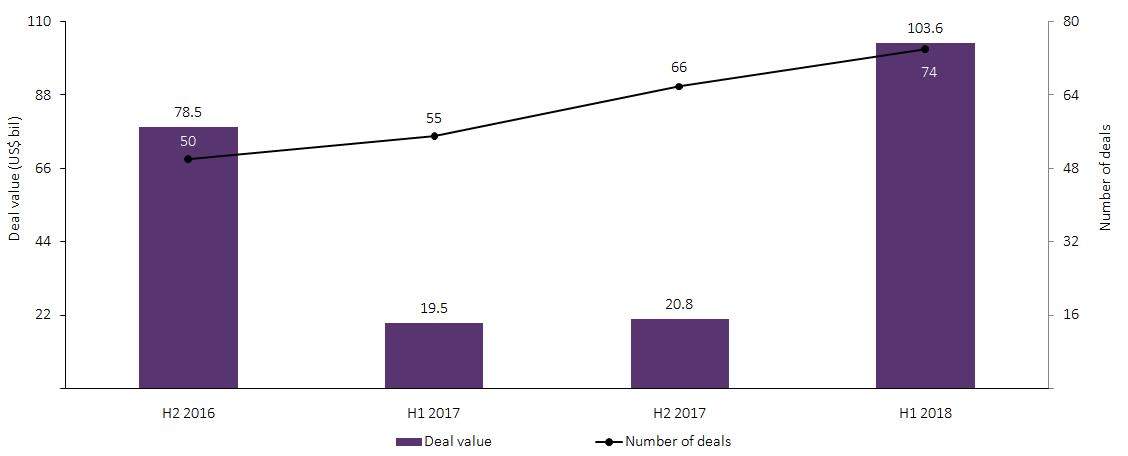

GlobalData’s latest report, Biannual Downstream Deals Review – H1 2018, shows that a combined value of $103.6bn in mergers and acquisitions (M&A) were announced in the downstream sector in H1 2018. This represented an enormous increase in value from the $20.8bn in M&A deals announced in H2 2017. A year-on-year comparison shows a sharp increase in deal value in H1 2018, when compared to H1 2017’s value of $19.5bn. There were 23 M&A deals with values greater than $100m, together accounting for $103bn in H1 2018.

Marathon Petroleum’s agreement to acquire Andeavor for a purchase consideration of $35.6bn was one of the top deals registered in H1 2018.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Andeavor is an integrated marketing, logistics, and refining company and is the owner of Andeavor Logistics and its non-economic general partner. Barclays is acting as financial adviser and Jones Day is acting as legal adviser to Marathon, while Goldman Sachs & Co. is acting as exclusive financial adviser and Sullivan & Cromwell is acting as legal adviser to Andeavor in the transaction. Following the completion of the transaction, Marathon’s shareholders will own an approximately 66% stake and Andeavor’s shareholders will own an approximately 34% stake in the combined company. The transaction will enable Marathon to strengthen its business operations.

Downstream M&A deal value and count, H1 2018

Source: Deals Analytics, GlobalData Oil and Gas © GlobalData

Financing through equity offerings, debt offerings, private equity, and venture financing in the downstream oil and gas industry totalled $55.4bn from 91 deals in H1 2018. The majority of the investment came from the debt offerings market, which accounted for 75% of the total, at $41.7bn, in H1 2018. On a year-on-year basis, the total value of announced capital raising deals decreased by 16% in H1 2018, compared with $66.2bn in H1 2017.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData