Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

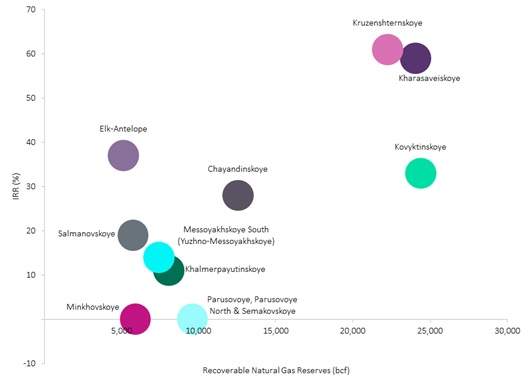

Top Ten Upcoming Onshore Gas Projects

Over $103.4bn in capital expenditure will be spent over the lifetime of the top ten onshore gas projects to produce 125 trillion cubic feet (tcf) of natural gas, according to research and consulting firm GlobalData.

These 10 projects, selected from 101 upcoming onshore projects globally, will contribute incremental capacity of 13,385 million cubic feet per day (mmcfd) to global supply by 2025. Kharasaveiskoye, a planned field in Russia, is the largest with anticipated peak production at 3,997 mmcfd in 2025 at an estimated cost of $17.8bn.

GlobalData reports the average development breakeven gas price for top upcoming onshore gas projects at $1.4 per million cubic feet (mcf), with projects in onshore Russia having the lowest breakeven price at $1 per mcf and projects in onshore Papua New Guinea – the highest at $3 per mcf.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe company notes that three of the top ten global onshore projects do not meet the return threshold of 20% for internal rate of return, necessitating reductions in capital expenditure, better than forecast reserves recoveries, or better price markets. Kruzenshternskoye in Russia has the highest net present value per barrel of oil equivalent at $7.1.

GlobalData estimates $103.4bn will be spent to bring the top ten onshore projects online, with $37.5bn forecast by 2025. Kovyktinskoye in Russia leads capital investment with $22.8bn over its development lifetime, followed by Kharasaveiskoye and Kruzenshternskoye also in Russia with $17.8bn and US$16.7bn respectively.

GlobalData expects full-cycle capital expenditure per barrel of oil equivalent to average $4.7 for onshore projects.