Iraq’s crude-oil production is gradually increasing thanks to expansion at previously delayed oil projects. However, the existing contracts are still not able to reach their full potential. At the same time, it appears that the terms for the new contracts are not sufficiently attractive to get major investments in the country. Iraq’s policies to support gas development appear stalled, having negative repercussions on the country’s overall economic development.

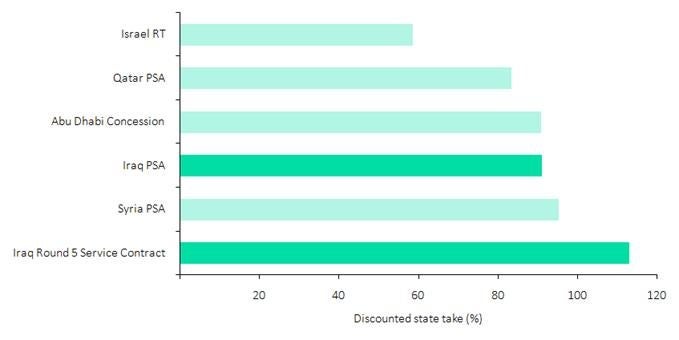

Regional comparison: oil discounted state take (%)

| Source: GlobalData Oil and Gas (Nov. 2018) © GlobalData |

Policies to support development of gas resources also appear stalled, which may hamper the country’s economic prospects. Iraq aims to increase the volume of natural gas production as feedstock for its power plants. In support of this aim the government published a roadmap at the end of 2017 containing several specific provisions linked to natural gas development. The Ministry of Oil had to provide advice on how to implement a natural gas market framework safeguarding national interests and eliminating gas flaring. However, the regulatory process necessary to move ahead with the development of the gas sector seems stalled.

Overarching regulatory uncertainty and political instability throughout Iraq might cloud the outlook for the sector. In March 2018, Parliament passed legislation, still to be implemented by the government, to completely reform the management of the petroleum sector. The most important element of the legislation would be the re-establishment of the Iraq National Oil Company (INOC), which would take control the petroleum sector. This complete control is being challenged by a coalition of Iraq’s oil technocrats because it would reduce the Ministry of Oil’s oversight and economic control of the sector.

Political instability is also still a major risk. Oil-producing provinces continue to complain that they are not adequately compensated for their oil production with little revenue reinvested locally while they have to bear relevant environmental damage. Similarly, the tensions between the federal government and the Kurdistan Regional Government (KRG) are far from being solved and, one year after the failed KRG independence referendum, they might resurface again once the formation of the new federal government is complete.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData