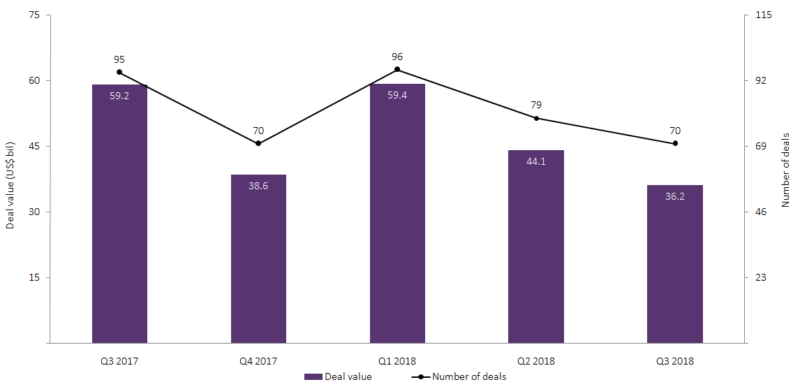

GlobalData’s latest report, ‘Quarterly Midstream Capital Raising Review – Q3 2018’, shows that global raising activity in the midstream sector totaled $36.2bn in Q3 2018. This was a decrease of 18% from the $44.1bn in capital raising deals announced in Q2 2018. On the volume front, the number of capital deals decreased by 11% from 79 in Q2 2018 to 70 in Q3 2018.

A year-on-year comparison shows a decrease of 39% in capital raising value in Q3 2018, when compared to Q3 2017’s value of $59.2bn. The quarter recorded 25 capital raising deals with values greater than $500m, together accounting for $29.2bn.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Midstream capital raising deal value and count, Q3 2018

Source: Deals Analytics, GlobalData Oil and Gas. © GlobalData

Capital raising, through debt offerings, witnessed a decrease of 21% in deal value, recording $27.7bn in Q3 2018, compared to $35bn in Q2 2018. Capital raising, through equity offerings, registered a significant increase of 76% in deal value, with $7.2bn in Q3 2018, compared with $4.1bn in Q2 2018. Further, four private equity/venture capital deals, with a combined value of $1.3bn, were recorded in Q3 2018, compared to six deals of a combined value of $5bn in Q2 2018.

One of the top deals of Q3 2018 was BP’s public offering of senior notes for gross proceeds of approximately $2bn. Citigroup Global Markets Deutschland AG & Co. KGAA acted as underwriter to the company for the offering.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataRegionally, Americas led the global capital raising market in terms of volume and deal value, with 31 deals worth a combined value of $19.7bn, in Q3 2018. The Europe Middle East and Africa accounted for 36% of the global capital raising deals in Q3 2018, with 25 deals of a combined value of $12.4bn; while Asia-Pacific accounted for 20% of global deals, with 14 deals worth a combined value of $4bn.