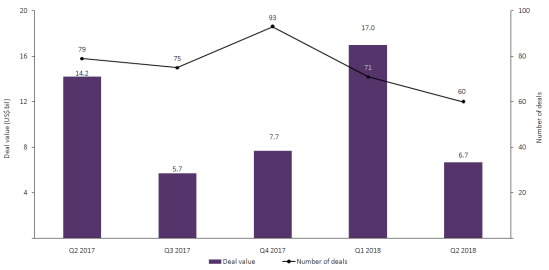

GlobalData’s latest report, Quarterly Upstream M&A Activity in US Shales – Q2 2018, shows that M&A activity in the US shale areas totaled $6.7bn in Q2 2018. This was a significant decrease of 61% from the $17bn in M&A deals announced in Q1 2018. On the volume front, the number of deals decreased by 15% from 71 in Q1 2018 to 60 in Q2 2018.

There were 14 deals worth over $100m registered in Q2 2018, representing a decrease of 18% from the previous quarter’s 17 deals. Deals worth more than $100m accounted for 94% of the total deal value in Q 2018, compared with 95% in Q1 2018.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Of the total deals in Q2 2018, 55 were domestic M&A, with a combined value of $6.7bn, and the remaining five were cross–border M&A, worth a combined value of $6.9m. Peregrine 1031 Energy was the active buyer in the domestic vertical, recording three M&As in Q2 2018, followed by Ascent Resources, Viper Energy, Northern Oil & Gas, and Black Stone Minerals, reporting two deals each during the quarter.

US oil & gas shales, M&A deal value and count, Q2 2018

Source: Deals Analytics, GlobalData Oil and Gas © GlobalData

One of the top M&A deals of Q2 2018 in the US shale was Ascent Resources’ acquisition of certain oil and gas properties located in Ohio, the US, from Hess, CNX Resources, Utica Minerals, and an undisclosed seller, for a purchase consideration of US$1.5 billion. The properties include approximately 113,400 net leasehold acres and royalty interests on approximately 69,400 fee mineral acres, across all three hydrocarbon windows in the Utica Shale.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe net production from the properties is approximately 216 million cubic feet of gas equivalent per day (mmcfed) (19% liquids) from 93 operated wells. The properties have proven (1P) reserves of approximately 1,100 billion cubic feet of gas equivalent (bcfe) and total reserves of approximately 5,600 bcfe. The transaction implies values of $41,111.11 per boe of daily production, $8.07 per boe of 1P reserves, and $13,051.15 per net acre of land.