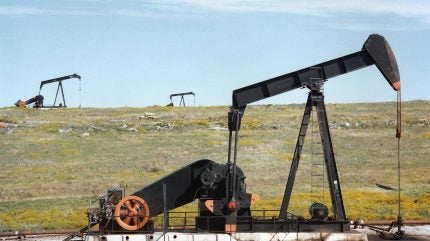

Australian oil and gas exploration and production firm International Petroleum (IPC) has acquired Canadian oil producer Granite Oil.

Granite Oil owns high netback, light oil-producing assets in southern Alberta, Canada.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

IPC has also acquired the existing infrastructure, which enables the current gas injection enhanced oil recovery (EOR) scheme.

The companies first announced the agreement in January.

IPC said that the acquired assets create the potential for further field development.

The company acquired all issued and outstanding common shares of Granite for about C$37.1m ($27m). It also assumed Granite’s net debt of C$40m ($30m).

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAccording to IPC, each former Granite shareholder will receive C$0.95 ($0.70) for each Granite Share they held before the transaction.

International Petroleum in a press statement said: “Pursuant to the letter of transmittal mailed to Granite shareholders in connection with the special meeting of Granite shareholders held on 5 March 2020, in order to receive the cash consideration, registered holders of Granite Shares are required to deposit a duly completed the letter of transmittal together with their share certificates, with Computershare Trust Company of Canada.

“Shareholders whose Granite Shares are registered in the name of a broker, dealer, bank, trust company or other nominee should contact their nominee with questions regarding receipt of the cash consideration.”

In October 2018, IPC agreed to acquire all shares of Canadian oil and natural gas company BlackPearl Resources. This created an entity with an enterprise value of $1.36bn.

In September 2017, a subsidiary of IPC signed an agreement to acquire Cenovus Energy’s interests in the oil and natural gas assets in the Suffield and Alderson areas of southern Alberta for C$512m ($414.72m).