Cenovus Energy has unveiled plans to proceed its divestiture plan to raise between $4bn and $5bn through asset sale agreements by the end of the year.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

In addition, the company intends to achieve $1bn of cumulative capital by reducing operating and general, and administrative costs over the next three years.

The plans are part of a five-year programme that aims to generate 14% annualised free funds flow growth through to 2021 while enhancing production at a 6% compound annual growth rate and reducing the company’s debt.

Furthermore, the company seeks to maintain current oil sands production and add barrels from expansion phase G at Christina Lake, as well as boost volumes at its newly acquired Deep Basin assets.

Cenovus Energy president and CEO Brian Ferguson said: “We’ve had significant interest in our assets by a variety of potential purchasers and we’re confident we can achieve our divestiture target.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Reducing our debt position is our number one priority and we remain committed to strengthening our balance sheet and maintaining investment grade credit ratings.”

According to the company, the divestiture programme is expected to more than satisfy the $3.6bn asset sale bridge facility used to help fund its recent acquisition of oil sands operations from ConocoPhillips.

The company further noted that the divestiture processes for its Pelican Lake and Suffield assets are underway.

It is also currently engaged in the process of preparing data rooms for its Palliser asset in southern Alberta and its Weyburn CO2 enhanced oil operation in southern Saskatchewan.

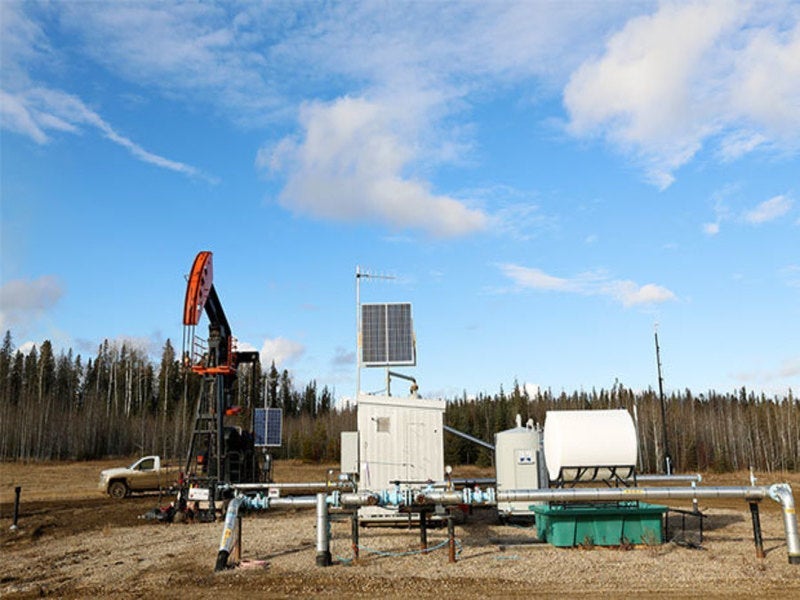

Image: A pumping oil well located just west of Drayton Valley. Photo: © Cenovus Energy.