Chesapeake Energy Corporation has signed an agreement to sell a section of its acreage and producing properties at Haynesville Shale operating area located in northern Louisiana to a private company for nearly $450m.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The sale comprises approximately 78,000 net acres that includes core acreage area of 40,000 net acres. The company also sold 250 active wells that produce 30 million cubic feet of gas per day.

Chesapeake expects to close this transaction by the first quarter of 2017.

Furthermore, the company is marketing nearly 50,000 net acres around the north-eastern part of its Haynesville Shale operating area. It also intends to close by the first quarter of 2017.

After the completion of these transactions, Chesapeake will have approximately 250,000 net acres in the core of the Haynesville Shale.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe company's 2017 development programme in the Haynesville will be focused on longer laterals and further enhanced completions, resulting in projected adjusted production growth of approximately 13% from its Haynesville operations in 2017.

Chesapeake CEO Doug Lawler said: “We are pleased to announce the first of two proposed Haynesville asset sales for $450m.

"With this proposed transaction and our previously announced Devonian asset divestiture, the company has reached approximately $2bn gross proceeds from divestitures either signed or closed in 2016, excluding certain volumetric production payment repurchase transactions.

“We expect this total to grow in the 2017 first quarter with our second proposed acreage sale in the Haynesville. With our long-term target of $2bn to $3bn in debt reduction, we will continue to look for opportunities to accelerate value through the sale of additional non-core assets in 2017 and beyond.

“Through the continual optimisation of our asset base, reduction in our net leverage, improvement in liquidity and cash flow generating capabilities, we believe Chesapeake is well positioned for the years ahead."

With its headquarters at Oklahoma City, Chesapeake Energy focuses on discovering and developing large and diverse onshore resource bases in the US unconventional oil and natural gas sector.

It also owns oil and natural gas marketing and natural gas gathering and compression businesses in the country.

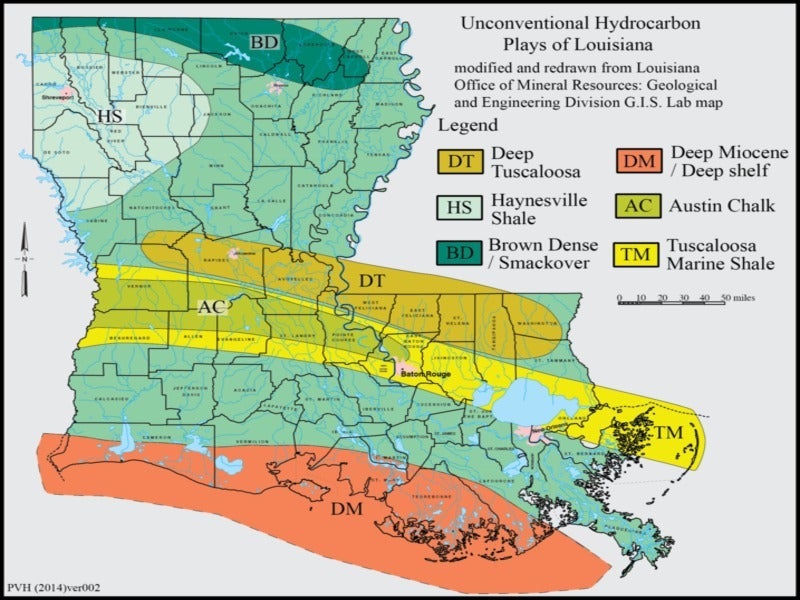

Image: Unconventional hydrocarbon plays of Louisiana – Haynesville Shale. Photo: Courtesy of Cristellaria / Wikipedia