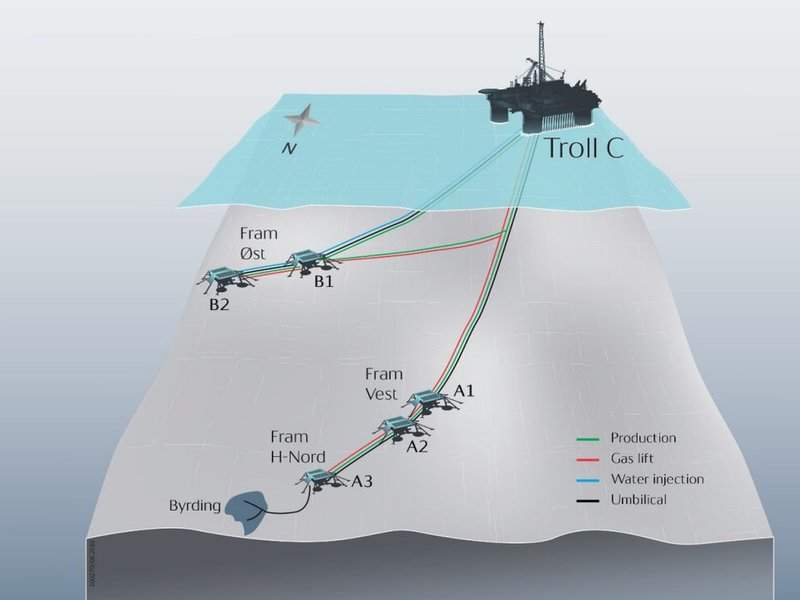

Statoil has started production from the Byrding field north of Troll field in the North Sea with help from partners Engie E&P Norge and Idemitsu Petroleum Norge.

The field is estimated to host nearly 11 million barrels of oil equivalent.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The partners have invested a combined Nkr1bn ($130m) in Byrding, which represents a significant reduction from the original estimate of nearly Nkr3.5bn ($440m).

Statoil west cluster operations senior vice-president Gunnar Nakken said: “Good utilisation of existing infrastructure has resulted in a cost-effective development that will add profitable resources to the Troll field.”

A two-branch 7km multilateral well drilled from the existing Fram H-Nord subsea template is part of the Byrding development. The well splits into two branches after a few kilometres.

After processing on Troll C, oil will be transported through existing pipelines to Mongstad and the gas through Troll A to natural gas processing plant Kollsnes.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn October last year, Statoil acquired Wintershall Norge’s 25% share in Byrding to increase its stake from 45% to 70%.

Engie E&P Norge and Idemitsu Petroleum Norge each own 15% interest in the field.

Separately, Statoil has received drilling permit for well 7435/12-1 from the Norwegian Petroleum Directorate.

Situated within production licence 859, the well will be drilled using the Songa Enabler drilling facility. The production licence was awarded in the 23rd licencng round held in last year.

Statoil Petroleum operates the licence with a 30% interest.

the remaining stakeholders. Chevron Norge owns (20%), Petoro (20%), ConocoPhillips Scandinavia (15%) and Lundin Norway (15%).

Image: Byrding field illustration. Photo: © Statoil ASA.