Statoil has completed the acquisition of Wintershall Norge’s (Wintershall) 25% interest in the Byrding project on the Norwegian Continental Shelf (NCS).

With completion of this transaction, Statoil’s operated interest in Byrding (PL090B) has increased from 45% to to 70%.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

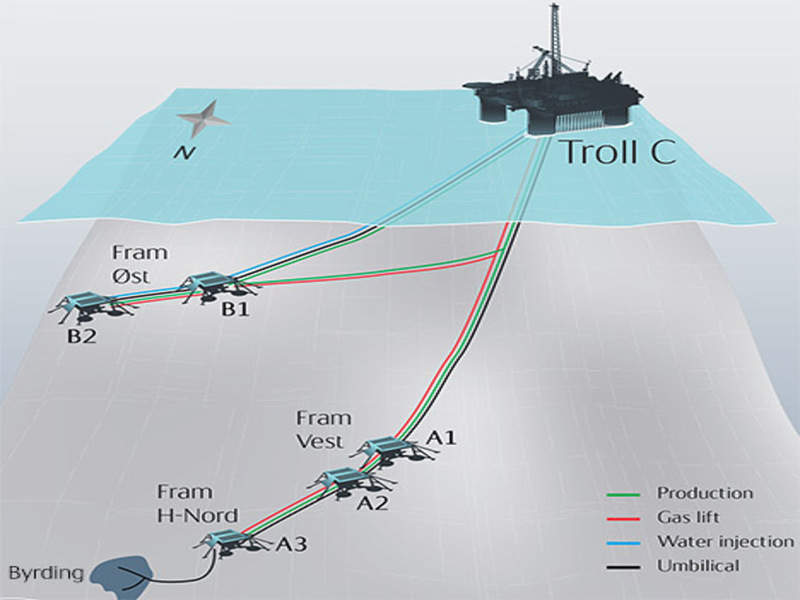

Scheduled to start production in the third quarter of 2017, Byrding is located in the northern part of the North Sea.

It is situated in proximity to the Troll / Fram area, which is thought of as the focal point of Norway's oil and gas production.

At the time of announcement of this acquisition, Statoil’s senior vice-president for Operations West had said: “Byrding is a low-cost project that is profitable in the current oil price environment. Through this transaction, we further deepen our position in a core area for Statoil.”

With its partners, Statoil submitted the Plan for Development and Operation for Byrding to government authorities last August.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataInitially, the capital expenditure associated with this project was estimated to be Nkr3.5bn ($0.4bn); however, the final cost was reduced to Nkr1bn ($0.12bn).

Statoil expects to recover nearly 11 million barrels of oil equivalent from this acquired property.

The acquisition also strengthens Statoil’s asset portfolio in core areas after an increase in the Wisting discovery in the Hoop area located in the Barents Sea last September.

The latest transaction has met all customary closing conditions, including authority approval.

Image: Graphical illustration of Byrding disocvery. Photo courtesy of Statoil.