Australian energy major Woodside Petroleum intends to acquire its rival Oil Search for A$11.6bn ($8.1bn) to form a combined entity.

The firm has already offered a confidential and non-binding proposal to the Papua New Guinea (PNG) focused Oil Search, which is expected to be carried out under the Papua New Guinea Companies Act.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Under the proposal, Woodside will acquire all Oil Search shares at a consideration of 0.25 Woodside shares for each Oil Search share.

It will, however, be subject to due diligence completion by Woodside on Oil Search and execution of a confidentiality agreement between the two parties.

Oil Search is also expected to grant an agreed period of exclusivity and secure approval from its key stakeholders and shareholders for the deal to be finalised.

Woodside also intends to ensure that the transaction is approved by the PNG Government on acceptable terms.

This merger is in line with Woodside’s strategy to maximise core asset values, leverage capabilities and expand portfolio in order to deliver superior shareholder returns.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe deal is expected to drive the firm’s growth prospects since it presently has no major projects under its portfolio, which will start production by the end of the decade, reported Reuters.

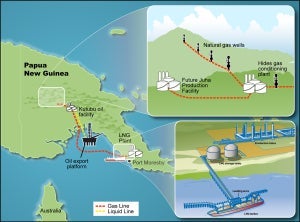

Oil Search, on the other hand, has 29% stake in the PNG liquefied natural gas project, which is being operated by Exxon Mobil. It also holds equity interests in fields in the area, including the Elk and Antelope gas field which are being developed by Total.

Image: The PNG LNG Project. Photo: courtesy of ExxonMobil.