Oil and gas producer Santos has revealed plans to shore up its financial position during the coronavirus pandemic. It will reduce its 2020 capital expenditure (capex) and defer the final investment decision (FID) on its Barossa project.

The Australia-based producer said it would cut its full-year capital spending by $550m, about 38% of its planned budget. It will also cut another $50m from its production costs.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

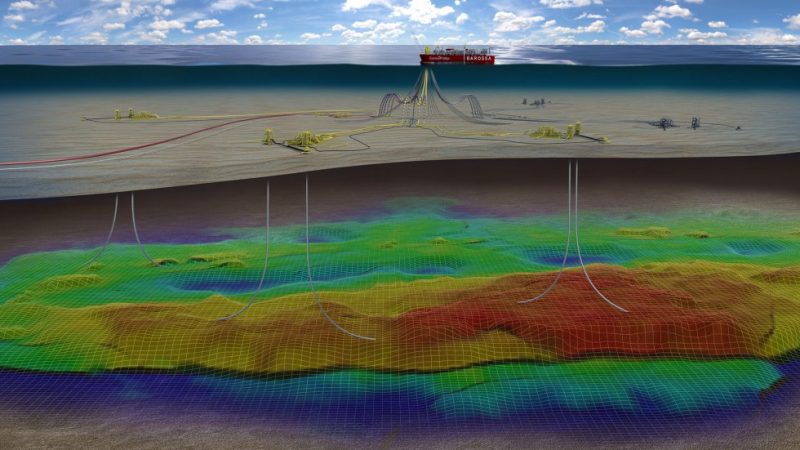

It has delayed the $7bn FID on the Barossa offshore development project, but not yet given a new timeline.

As part of the announced measures, Santos is aiming for free cash flow breakeven at an oil price of $25 a barrel.

Santos managing director and CEO Kevin Gallagher said: “We are confident in the business continuity and contingency plans that have been implemented and will continue to monitor and introduce additional measures in accordance with Australian Government health advice to protect our people and maintain operations.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData