Royal Dutch Shell subsidiary Shell Offshore has taken the final investment decision for the PowerNap project in a bid to bolster its deep-water portfolio in the US Gulf of Mexico region.

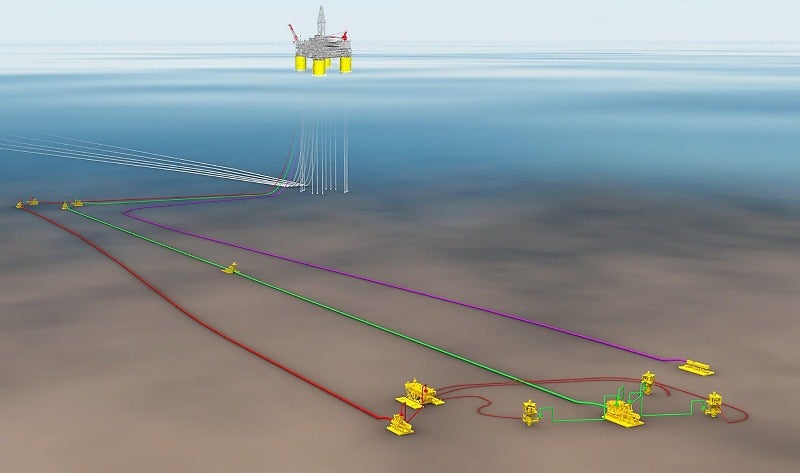

Situated around 240km from New Orleans, the PowerNap deep water project is a subsea tie-back to the Shell-operated Olympus production hub. The project was discovered in 2014 and is estimated to host more than 85 million barrels of oil equivalent recoverable resources.

Shell aims to commence production from the offshore resource in late 2021. The production will be transported to market through the Shell Pipeline Company-operated Mars pipeline. At peak levels, the PowerNap project is expected to produce up to 35,000 barrels of oil equivalent.

Shell upstream director Wael Sawan said: “PowerNap further strengthens Shell’s leading position in the Gulf of Mexico.

“It demonstrates the depth of our portfolio of Deep Water growth options, and our ability to fully leverage our existing infrastructure to unlock value.”

Currently Shell is one of the leading oil and natural gas producers in the US Gulf of Mexico, operating nine production hubs and a network of subsea infrastructure.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataRecently, the British-Dutch oil and gas company completed the sale of a 22.45% non-operated interest in the Caesar-Tonga asset in the US Gulf of Mexico to a subsidiary of Equinor. The deal was valued at $965m.

In the second quarter (Q2) of 2019, Royal Dutch Shell reported current cost of supplies (CCS) earnings of $3.6bn, down from $5.3bn in Q1 2019.