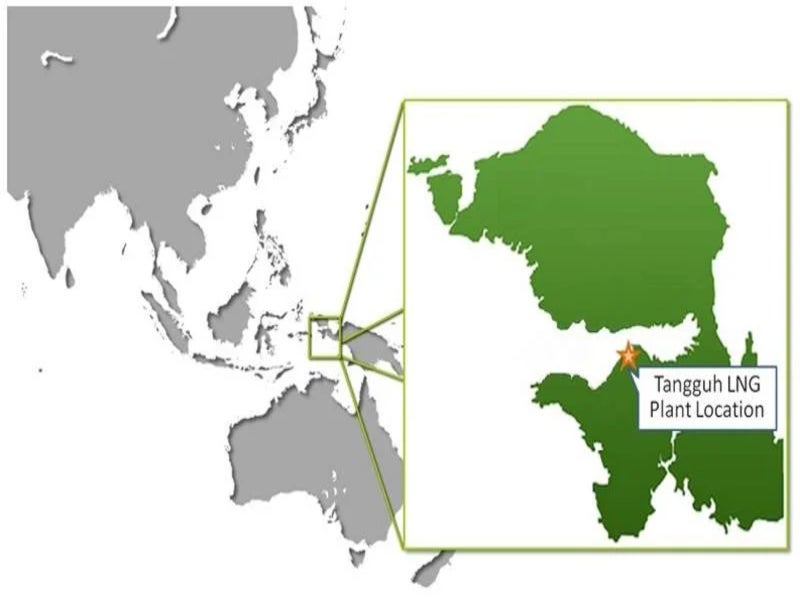

The Tangguh expansion project involved the expansion of the existing Tangguh liquefied natural gas (LNG) facility.

bp Berau (40.22%) operates the project on behalf of the other partners, including MI Berau (16.30%), CNOOC Muturi (13.90%), Nippon Oil Exploration (12.23%), KG Berau Petroleum (8.56%), Indonesia Natural Gas Resources Muturi (7.35%), and KG Wiriagar Petroleum (1.44%).

The expansion involved the modification of offshore gas production facilities, along with the addition of a third LNG train with a liquefaction capacity of 3.8 million tonnes per year. The two existing LNG trains have a combined production capacity of 7.6 million tonnes per year.

The third LNG train commenced commercial operations in October 2023.

Background

The expansion plan for the LNG plant was approved by the Indonesian government in 2012. The project received AMDAL approval and an environmental permit in August 2014. The final investment decision was taken in July 2016.

The project suffered delays after natural disasters rocked Indonesia in 2018 and affected the shipment of construction materials required for the Tangguh Expansion.

The expansion faced further delays and the project partners were not expected to meet the new deadline as the Covid-19 pandemic caused a significant reduction in the workforce due to the social distancing norms in place.

An estimated 13,500 workers worked on the project and approximately 155 million workhours were spent to complete the project, giving a boost to both the Indonesian and Papua Barat Province economies.

The project will help to meet the rising energy demand in the country as most of the produced LNG will be sold to the state electricity company.

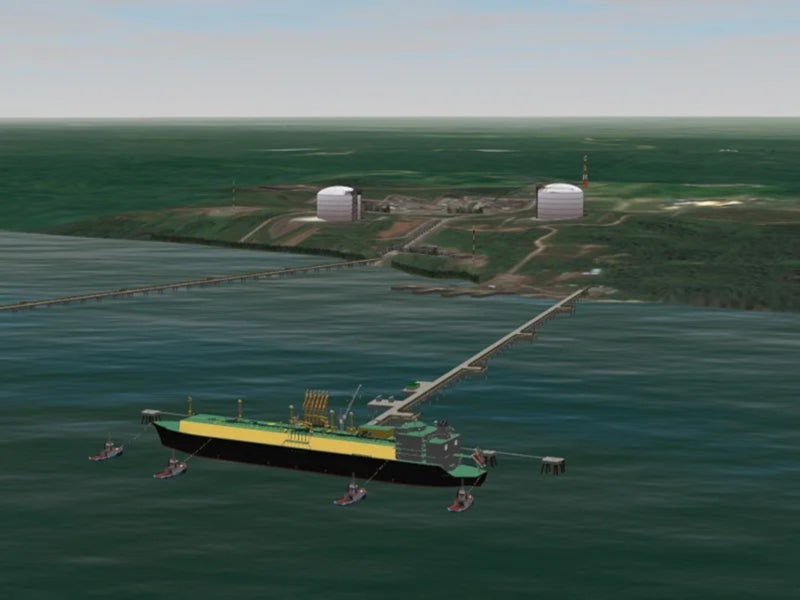

Tangguh LNG project offshore infrastructure

Tangguh gas field was discovered in 1994. The gas for the LNG plant is sourced from six natural gas fields, including Vorwata, Wiriagar Deep, Ofaweri, Roabiba, Ubadari, and Wos.

The offshore production facilities supply natural gas to two 3.8 million tonnes per year liquefaction trains and feature natural gas and associated liquids production, collection, and transmission facilities.

Gas is procured from 14 production wells situated at two offshore platforms, VR-A and VR-B, at the Vorwata gas field. The onshore LNG plant receives the produced gas via two subsea pipelines, where it is purified and processed before being exported by LNG tankers.

The multiphase subsea pipelines are 19km and 18 km long and 24in in diameter. Power supply, control, and chemical injection are managed from onshore.

Tangguh Expansion Project details

The expansion project includes the construction of two offshore platforms, 13 new production wells, an expanded loading facility, a new LNG jetty, and associated infrastructure. With the addition of the third train, the production capacity of the LNG plant is increased by approximately 50% to 11.4 million tonnes per year.

An increase in the Vorwata gas field reserves to 16.9 trillion cubic feet provides benefit to the expansion project with the potential reserves of Wiriagar Deep, Roabiba, Ofaweri and Ubadari fields expected to increase the total reserves to 20.8 trillion cubic feet.

An expandable hub platform was installed at the field for easy mixing of liquids from the fields and to enable processing from future tie-ins. Infill wells from the existing two platforms provide additional feed gas to the two LNG trains.

Saipem and its joint venture partners completed the expansion project and handed it over to bp in August 2023. The project took 6.5 years to complete.

A fourth LNG train is also planned to be constructed as part of the future development and will comprise nine offshore platforms with 16 well slots each, nine subsea pipelines, supporting facilities, and a condensate tank.

Integrated subsea power and fibre-optic cables will be installed on the ring-main topology as part of the offshore development and will provide electricity, communication, and control for platform operations.

The Tangguh LNG project partners will develop the next phase of the project, which will include a carbon capture utilisation and storage project is an effort to reduce carbon dioxide emissions from LNG production.

Offtake agreements

A long-term sales and purchase agreement (SPA) was signed in 2014 for up to 2.8 million tonnes per year of LNG produced by Train 3 to be supplied to Indonesia’s state-owned power generator, Perusahaan Listrik Negara. A SPA was also signed in 2013 to supply 1.0 million tonnes per year of LNG to Kansai Electric Power in Japan.

Financing

The project, with an estimated cost of $8bn, is financed by both international and domestic banks. JBIC provided a direct loan of $1.2bn while ADB granted $400m. A consortium of international commercial banks lent $2.04bn, and domestic banks provided $100m taking the total debt to $3.75bn.

The international banks participating in the project include BTMU, Mizuho Bank, SMBC, Shinsei Bank, DBS, OCBC, UOB, Bank of China, China Construction Bank, BNP Paribas, Credit Agricole, KDB, and KfW. The domestic banks include four Indonesian banks such as BNI, BRI, BTN, and Bank Mandiri.

Japan Oil, Gas and Metals National Corporation extended support for the project by entering loan guarantee deals with Nippon Oil Exploration, KG Berau Petroleum and KG Wiriagar in August 2016.

Contractors involved

Saipem won the engineering, procurement, construction, and installation contract, encompassing the unmanned platforms and subsea pipelines for the offshore facilities.

CSTS, a consortium comprising Chiyoda, Saipem, Tripatra, and Suluh Ardhi Engineering received an EPC contract for the marine construction work of the project.

McConnell Dowell (Indonesia) conducted the detailed design and construction of the jetty. It subcontracted HR Wallingford to perform the navigation simulation studies to determine the jetty design sustainability.

A joint venture of KBR, Rekayasa Industri and JGC Indonesia received the contract to provide onshore front-end engineering and design services for the third liquefaction train of the project in October 2014. Luxsolar received a contract to provide LED Aircraft Warning Light systems for dangerous areas.

SB Submarine Systems, a submarine cable installation and maintenance solutions provider, was subcontracted by Saipem in September 2017 to install three composite cables for the project.

Asiatek Energi Mitratama was awarded the detailed design engineering for the horizontal direct drilling works, which involved work barge stinger and sheet pile anchor design and associated fabrications, pull deck assembly design, and drill pipe stability and recovery.

The company also conducted pipe stress analysis and other miscellaneous structural component designs.

Other contractors include Pelayaran Taruna Kusan Jaya, Clough, Sojitz, Fls, Synergy Engineering, Add Energy, Sucoot, Junttan, ABB, Flenco Fluid System, Mechademy, Multipanel Intermitra Mandiri, Jare Industries, Butting. Samudera Bahana, and Entrepose Group.

Mott MacDonald served as the environmental and social monitoring external panel for the project.