Italian energy company Eni has joined with Quicksilver Resources to evaluate, explore and develop shale oil reservoirs in Pecos County, Texas.

Eni will earn a 50% share in 52,500 gross acres held by Quicksilver in the Leon Valley area, located around 800km northwest of Houston.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

As part of an initial three phase programme, up to five exploration wells will be drilled and a 3D seismic survey carried out to determine the hydrocarbon potential of the area and the subsequent development plan. Exploration and development activities will be conducted by a joint evaluation team with members from each company with Quicksilver as operator.

Eni will pay up to $52m, representing 100% of the drilling, completion and seismic costs in order to earn the interest in the Quicksilver acreage. Following this, future expenditures will be shared equally between both the companies.

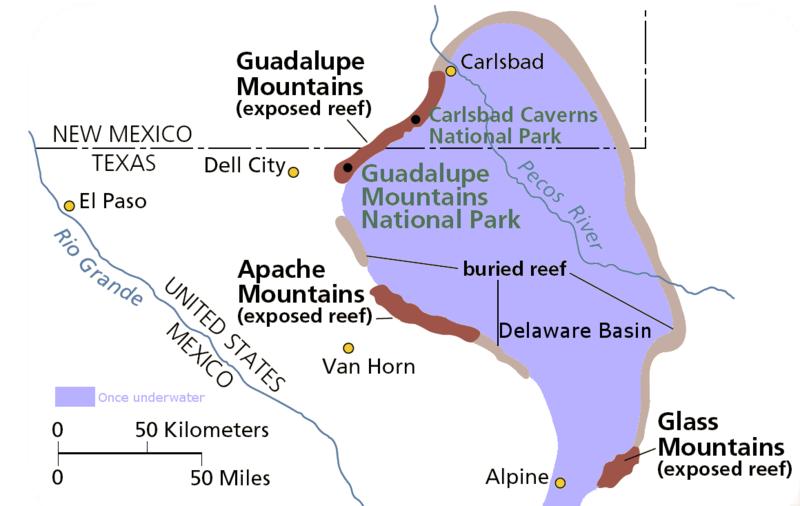

Eni will also earn 50% of Quicksilver’s interest in 7,500 gross acres located in the Leon Valley area in the prolific Delaware basin. Production at the basin currently amounts to nearly 500,000 barrels of oil equivalent per day, both from conventional as well as from unconventional reservoirs.

The Delaware basin production is expected to double within five years, due to the rapid growth of oil production from unconventional reservoirs.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataImage: The Delaware basin in West Texas and southern New Mexico holds large oil fields. Photo: courtesy of Mav.