GDF Suez has signed a deal with Dart Energy to acquire a 25% share in 13 UK onshore licences located in Cheshire and the East Midlands.

GDF Suez will pay an upfront cash consideration of $12m to Dart Energy at closing and will carry the company on exploration and appraisal costs of $27m.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

A 75% interest will be retained by Dart Energy, as well as operatorship of the licences.

The acquisition marks GDF Suez’s first entry into licences with shale gas potential and the UK’s onshore exploration activities.

GDF Suez executive vice-president in charge of the global gas and liquefied natural gas business line Jean-Marie Dauger said: "GDF Suez is pleased to enter its first investment in UK shale gas as it complements the large presence of the group in the UK. We look forward to working with our partner Dart Energy to unlock the potential of these licences."

The deal is subject to Department of Energy and Climate Change (DECC) approval and will allow the companies to accelerate the exploration and appraisal of the potential of the licence areas, which cover 1378km².

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe companies plan to drill a number of exploration wells, including up to four wells, as part of the initial work programme. They will target shale gas potential in different areas of the Bowland basin and other wells that target coal bed methane (CBM).

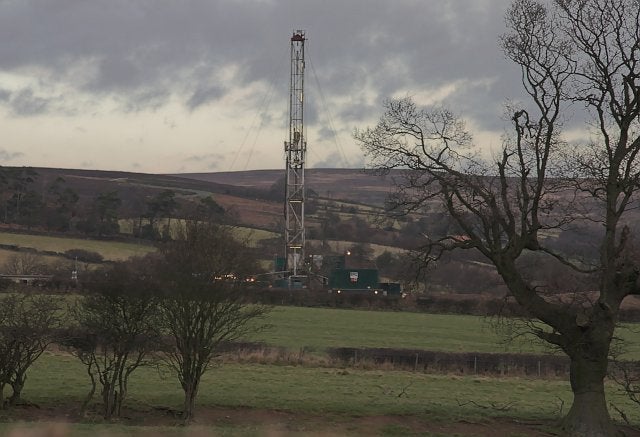

Image: 13 UK onshore licences located in Cheshire and the East Midlands. Photo: courtesy of colin grice.