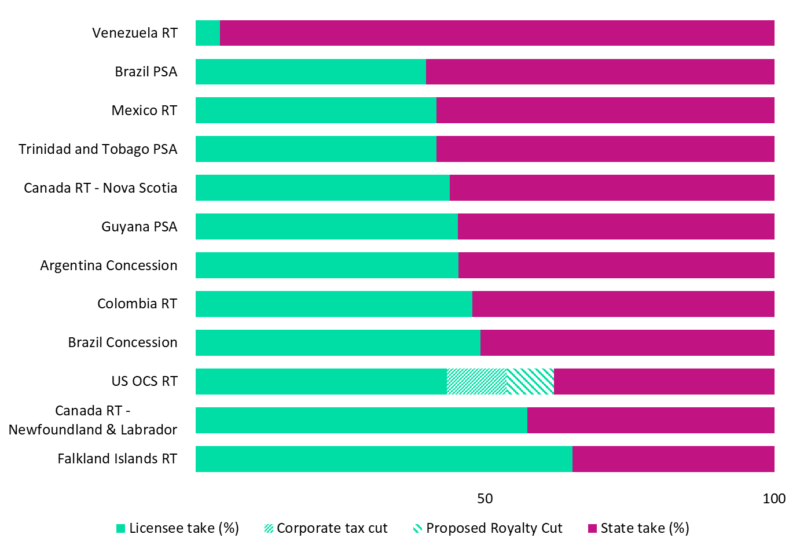

Cutting the US deepwater royalty rate from 18.75% to 12.5% for new leases, as proposed by the US Royalty Policy Committee in its meeting of 28 February, would significantly improve the attractiveness of the country’s fiscal regime. The same rate cut has already been made for shallow water areas in 2017.

The passage of the US tax bill in December 2017, which cut the corporate tax rate from a 35% top rate to 21% and introduced immediate deductions for capital expenditure through 2022, already increases investors’ shares of cash flow to make the regime more competitive than those in Brazil, Mexico and Guyana.

The proposed royalty cut would further reduce the fiscal burden and would advance the regime to the most attractive among oil-producing countries in the region. In boosting the competitiveness of the fiscal regime, the proposed measure would hope to incentivise new exploration in the mature Gulf of Mexico.

US cash flow split vs regional peers (deepwater oil terms)

Source: GlobalData Upstream Economics

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData