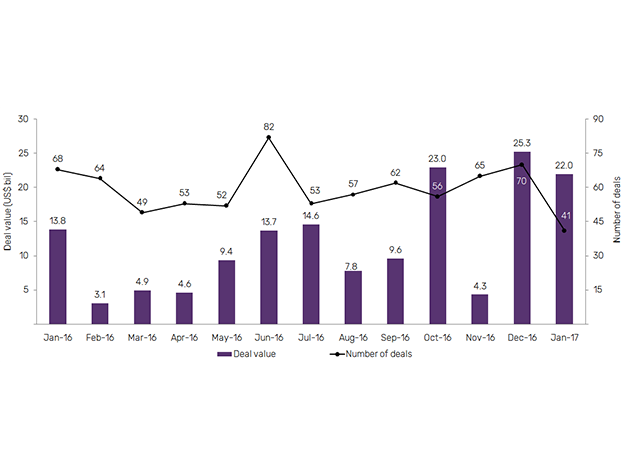

A combined value of $22bn in mergers and acquisitions (M&A) were announced in the upstream sector in January 2017. This was a decrease of 12 percent from the $25.3bn in M&A deals announced in the previous month. A year-on-year comparison shows a significant increase in deal value in January 2017, when compared to deal value of $13.8bn in January 2016. Of the total value, conventional acquisitions were worth $5.8bn; and unconventional acquisitions were worth $16.2bn. The month recorded 13 oil and gas M&A deals with values greater than $100m, together accounting for $21.4bn.

ExxonMobil’s agreement to acquire the Bass family’s oil and gas companies, for a purchase consideration of up to $6.6bn, was one of the top deals registered in January 2017. The companies, which include operating entity BOPCO LP, own approximately 275,000 acres of leasehold, of which approximately 250,000 acres of leasehold is located in the Permian Basin, New Mexico, and has net production of more than 18,000 boed (70 percent liquids). The companies have estimated resources of more than 3,400 mmboe (75 percent liquids). The companies also hold producing acreage in other parts of the US. The transaction will enable ExxonMobil to strengthen its presence in the US growth area for onshore oil production. The transaction implies values of $366,666.67 per boe of daily production and $24,000 per net acre of land.

On the volume front, the number of M&A deals decreased significantly by 41 percent from 70 in December 2016 to 41 in January 2017, of which 12 were cross border transactions and the remaining 29 were domestic transactions. Americas and EMEA were the destination of choice for cross-border M&A activity in January 2017. Both the regions recorded six and five cross-border transactions, respectively.

Regionally, Americas led the global M&A market in terms of volume and value, with shares of 80 percent and 74 percent respectively, in January 2017. This comprised 33 deals, with a combined value of $16.2bn. EMEA registered seven deals, or 17 percent of the total, with of a combined value of $4.8bn; while Asia-Pacific recorded one deal, or 2 percent of the total, with a value of $900m in January 2017.

See Also:

Related report

Monthly Upstream Deals Review – January 2017

GlobalData's “Monthly Upstream Deals Review – January 2017” report is an essential source of data and trend analysis on M&A (mergers, acquisitions, and asset transactions), in the upstream oil and gas industry. The report provides detailed comparative month-on-month data, on the number of deals and their value, sub-divided into deal types by geographies.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData