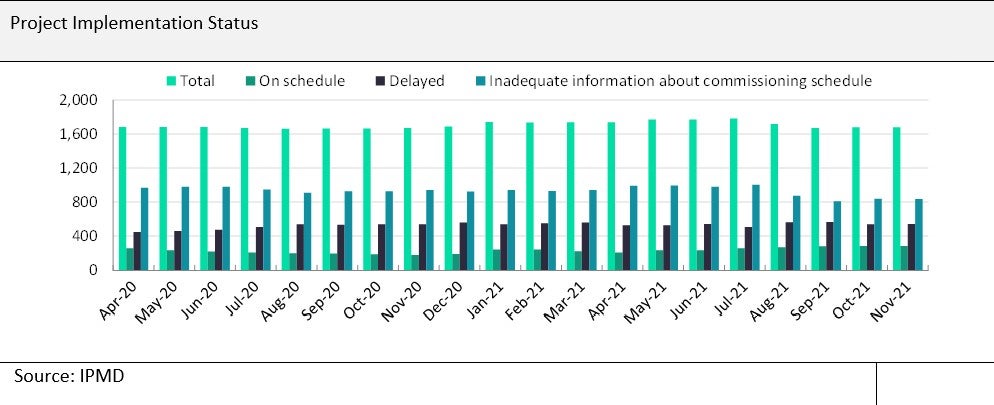

According to the Infrastructure and Project Monitoring Division (IPMD) of the Ministry of Statistics and Programme Implementation, as of December 1st 2021, it was managing a pipeline of 1,679 projects with an anticipated cost of INR26.7 trillion ($347.7bn). Of the total, it had 1,199 ‘major’ projects worth INR5.2 trillion ($67.1bn) and 480 ‘mega’ projects worth INR21.5 trillion ($280.5bn). In terms of project implementation status, 11 projects were ahead of schedule, 292 were on schedule, 541 were delayed and the commissioning schedule of 8,35 projects was unknown.

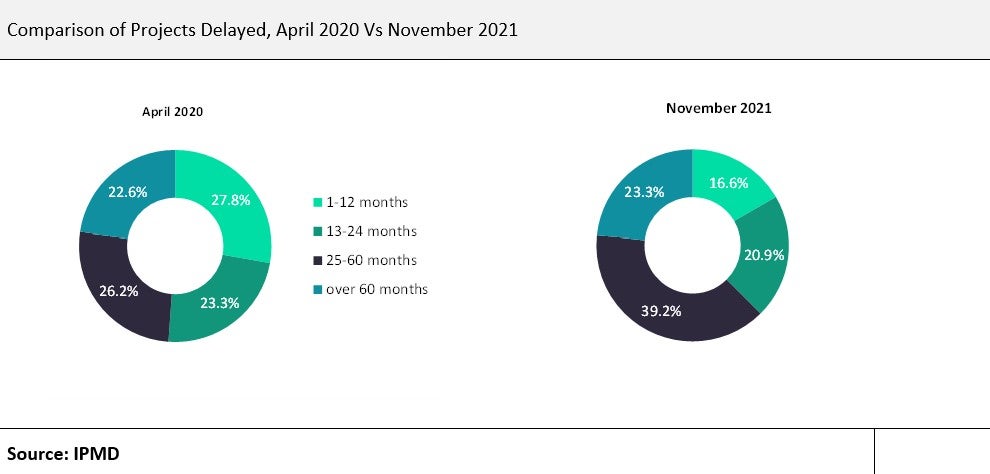

Of the total delayed projects in November 2021, 16.6% of the projects have been delayed in the range of one to 12 months, 20.9% in the range of 13 to 24 months, 39.2% in the range of 25 to 60 months while 23.3% projects have been delayed over 60 months. The overall percentage of cost overrun with respect to original estimates is equivalent to 19.7%, at the end of November 2021. As of April 2020, when a nationwide lockdown was introduced, 27.8% of projects had been delayed in the range of one to 12 months, 23.3% in the range of 13 to 24 months, 26.2% in the range of 25 to 60 months while 22.6% projects had been delayed over 60 months. The overall percentage of cost overrun with respect to original estimates was equivalent to 19.8% at the end of April 2020.

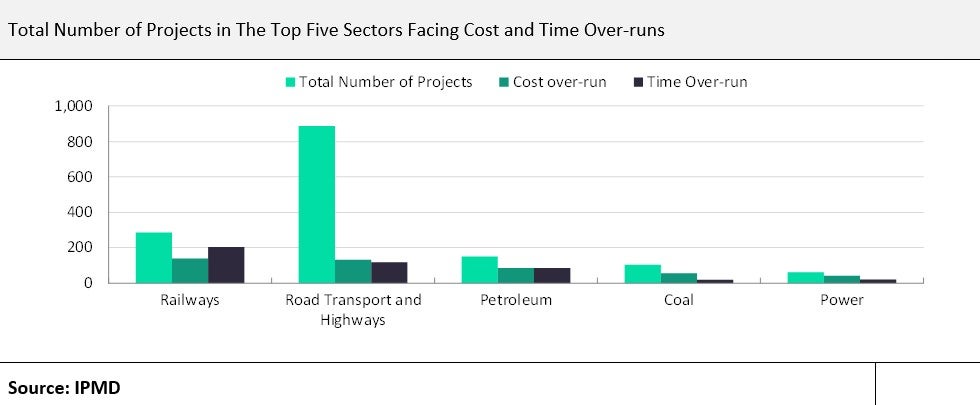

Projects in the road transport and highway sector account for the highest share of projects in the pipeline, equivalent to 52.9% of the total pipeline by number. This is followed by projects in the railways (17%), petroleum (9.1%), coal (6.3%), power (3.7%) and water resources (2.6%) sectors, among others. In terms of projects value too, as per the original cost of implementation, the road transport and highway sector accounted for the highest share, 24.1%, followed by railways (19.9%), petroleum (15.3%), urban development (13.1%) and power (9.3%). However, in terms of the anticipated cost of project values, the railway sector projects have recorded a cost overrun of 39.8% and as such account for the highest (25.7%) share of the total anticipated cost of implementation, followed by road transport and highway sector (20.8%), petroleum (13.3%), urban development (11.7%) and power (10.1%).

Of the total projects in the pipeline, 439 projects are facing cost overruns and 541 are facing time overruns, with respect to the original schedule. Projects in the railway sector have the maximum number of time and cost overruns, with 141 delayed projects and 202 projects facing cost overruns. The road transport and highways sector has the second-highest number of projects with time and cost over-runs, equivalent to 134 and 120 projects, respectively. Some of the main reasons for the delay in project implementation are problems with land acquisition, delay in receiving permits and state-wise lockdowns due to the Covid-19 pandemic while cost overruns can be attributed to change in scope of projects, inflation, changes in foreign exchange rates, underestimation of original costs, spiralling land acquisition costs and time overruns, among others.

See Also:

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

The Ministry Of Statistics And Programme Implementation

IPMD, Inc