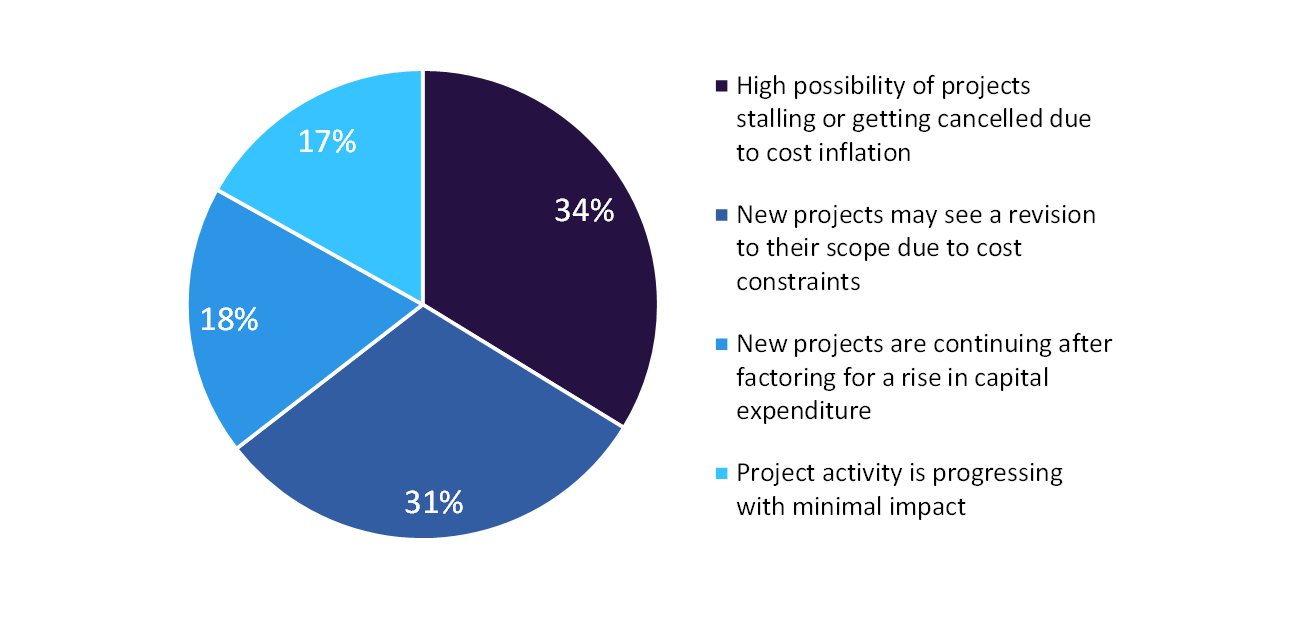

Following the pandemic shock and subsequent Ukraine-Russia conflict, the global supply chains were stressed. Particularly the stress on energy and mineral supply chains was the main driver for a spike in inflation in the last two years. Inflation has weighed heavily on economic growth across the world. The International Monetary Fund (IMF) predicted that the global real GDP growth in 2024 would slow down slightly to 2.9% as compared to 3.0% in 2023 amid economic headwinds. This is likely to impact job growth as well as commodity markets, which influence industrial capital allocation. During August-October 2023, GlobalData conducted a poll about the impact of inflation on upcoming oil and gas projects. Over one-third of the respondents feared that there was a high possibility of oil and gas projects getting stalled or cancelled on account of inflation. Companies could be wary of cash erosion due to cost inflation while financing the projects. Some projects with longer time horizons could withstand cost inflation for one bad year, whereas some of the projects might prove unaffordable. Therefore foregoing planned projects could be preferred by the oil and gas companies in 2024.

On the other hand, about 31% of the respondents said that new projects may see a revision in scope due to cash constraints. Oil and gas companies might opt to reduce the scope of upcoming projects by limiting production to a fraction of their planned targets set during the feasibility stage. The upstream sector could reduce the construction of wellheads and limit overall exploration and production in 2024. The downstream sector could opt to build lower capacities than initially planned. Companies could also choose to defer the works related to the latter phases of the projects until more clarity is available on the economic front.

About 18% of the respondents felt that the development of new projects might still be pursued after factoring in the expected rise in capital expenditure. Oil and gas companies might try and procure additional investments to fund their projects. Besides, projects with long-term horizons stretching over multiple decades, would generally also have longer payback periods. These projects could comfortably absorb any cost pressures for a year or two. Moreover, the global demand for oil and gas is expected to remain strong in 2024, while oil prices are also expected to remain over $80/bbl for most of 2024, as per the US Energy Information Administration (EIA) short-term energy outlook, published in December 2023. Additionally, strong revenue earnings by oil and gas players in 2022 and 2023, would help shield the companies from brief inflationary discomforts about upcoming projects.

About 18% of the respondents felt that development of new projects might still be pursued after factoring in the expected rise in capital expenditure. Oil and gas companies might try and procure additional investments to fund their projects. Besides, projects with long term horizons stretching over multiple decades, would generally also have longer payback periods. These projects could comfortably absorb any cost pressures for a year or two. Moreover, the global demand for oil and gas is expected to remain strong in 2024, while oil prices are also expected to remain over $80/bbl for most part of 2024, as per the US Energy Information Administration (EIA) short-term energy outlook, published in December 2023. Additionally, strong revenue earnings by oil and gas players in 2022 and 2023, would help shield the companies from brief inflationary discomforts pertaining to upcoming projects.

Finally, about 17% of the respondents dismissed the impact of global inflation on the upcoming oil and gas projects. They felt that upcoming project activity would advance as planned with minimal influence from inflation.

See Also:

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData