North America is poised to witness substantial oil and gas trunk/transmission pipeline length additions, accounting for approximately 15% of the total upcoming (planned and announced) global pipeline length by 2030. This growth is primarily driven by the region’s ongoing shale gas production boom, substantial investments in liquified natural gas export infrastructure, and continued efforts to build new pipeline networks to meet energy demand.

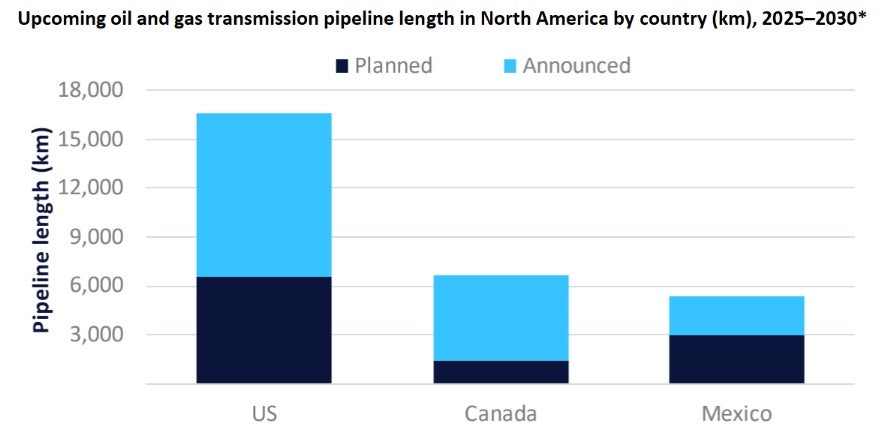

The US is set to dominate oil and gas pipeline length additions in North America, accounting for about 58% of the region’s length additions by 2030. This can be attributed to several factors, including robust shale production, which continues to drive demand for expanded midstream infrastructure. Additionally, the US is rapidly increasing its export capacity for both crude oil and natural gas, necessitating new pipelines to connect production hubs with processing facilities and export terminals.

Notably, projects in the pre-construction stages, including feasibility, front-end engineering design (FEED), and approval, are set to account for nearly three-fourths of the country’s upcoming pipeline length by 2030. The Permian-Louisiana gas pipeline is a major upcoming, announced project that extends from Texas to Louisiana with a length of 1,262km. Dela Express is the operator while Moss Lake Partners is the equity owner of this onshore pipeline. Currently in the approval stage, the project is expected to commence operations in 2028. Other significant projects such as the WEST Header Project (gas pipeline) and the Bahia NGL (natural gas liquid pipeline) further underscore the US’ commitment to expanding its pipeline infrastructure during the outlook period. Canada is expected to follow the US in terms of pipeline length additions, accounting for nearly 23% of the total length additions in the region by 2030. The majority of the pipeline length additions are from the projects in the pre-construction stages (feasibility and approval). The Canadian Prosperity Project (oil pipeline) is a major upcoming project with a length of 4,500km. Canadian Prosperity Pipeline Project Corp is the operator and equity owner of the pipeline, currently in the feasibility stage and is set to begin operations in 2030. The Prince Rupert Gas Transmission Project (gas pipeline) and NEBC Connector Project (NGL pipeline) are some other major projects with significant length additions during the outlook period.

Mexico accounts for the remaining pipeline length additions in North America, with nearly 5,377km of length expected to be added by 2030. Pipelines in the early stages of development (feasibility, FEED, approval) are set to make up half of the upcoming length in the country while the projects in the construction and commissioning stages account for the rest. San Fernando-Cactus (gas pipeline) is a major upcoming pipeline with a length of 1,609km. WPF Mexico Pipelines S de RL de CV is the operator while Mirage Energy Corp is the equity owner of this pipeline, currently in the approval stage. Sierra Madre and Southeast Gateway (both gas pipelines) are some other major upcoming pipelines in the country. Further analysis on global oil and gas pipeline projects can be found in GlobalData’s new report, Oil and Gas Pipelines Industry Outlook by Length and Capital Expenditure Including Details of All Operating and Planned Pipelines to 2030.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData