On 18 April, Russia’s Ministry of Energy proposed widening the application of the pilot scheme for a profit-based tax (NDM) system on oil production to stimulate greater levels of investment and production. However, the scope of the NDM pilot scheme will still be limited in the context of Russia’s upstream sector.

Fields operating under the new system will pay a 50% tax on profits while enjoying a significant reduction in Mineral Extraction Tax (MET), Russia’s main tax on the upstream sector. MET is a production-based tax and can therefore only account for higher costs through specific exemptions, hence the desire to move towards a profit-based system. A minimum NDM payment will still apply based on a cost deduction cap of RUB9,520/tonne (~US$21/bbl), or RUB7,140 (~US$16/bbl) in 2019 and 2020.

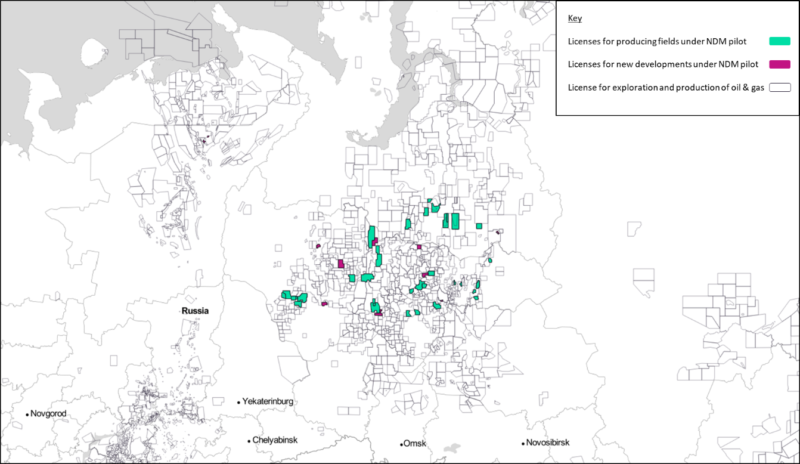

The system will automatically apply in 2019 to two categories of fields, primarily in the established West Siberian and Timan-Pechora regions. The first category is a specific group of producing oil fields operated by Rosneft, Lukoil, Gazprom Neft and Sugutneftegaz in the Tyumen, Khanty-Mansi, Yamalo-Nenets and Komi regions. The government hopes that the new tax system can spur investment to increase recovery at these fields. However, they currently contribute less than 3% of Russia’s total oil production and less than 2% of the country’s oil reserves.

The second category that will automatically fall under the new system is new developments located in 11 specifically designated subsoil licenses, though these developments must have initial oil reserves of less than 10 million tonnes (approximately 73 million barrels) and will therefore be relatively small.

The Ministry of Energy’s proposed change would raise the cap on the total amount of reserves that can be developed across all licenses in this category, currently set at 50 million tonnes (~365 million barrels) to 150 million tonnes (~1.1 billion barrels). Even if this change achieves the additional annual production of 900,000 tonnes (approximately 6.6 million barrels or 18,000 bd) mooted by First Deputy Energy Minister Alexei Texler, this would represent an increase of less than 0.2% on Russia’s production.

Figure 1: map of licenses specified for application of NDM pilot scheme

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Source: GlobalData. Map tiles by Stamen Design, under CC BY 3.0. Data by OpenStreetMap, under ODbL.

In addition to these categories, the NDM system will also be optional for fields that benefit from reduced export duty or any new development in Sakha, Irkutsk, Krasnoyarsk, Nenets, Yamalo-Nenets (north of 65N) regions or the Caspian Sea.

This will increase the scope of the system over time as new production comes on stream. However, a truly large scale roll-out of the NDM scheme remains uncertain. The pilot scheme was already beset by political wrangling and delays, and these issues would likely only be multiplied with higher levels of production and taxes at stake.

For more insight and data, visit the GlobalData Report Store – Offshore Technology is part of GlobalData Plc.

Related Company Profiles

LUKOIL Holding GmbH

STAMEN DESIGN LLC

Offshore Technology Corp

Ministry of Energy, Tourism and Digital Agenda, Spain

Rosneft