With the US stance compelling France’s Total to pull out of the Islamic Republic, Tehran’s oil industry faces more hardship.

French energy giant Total has failed to secure a waiver from the administration of US President Donald Trump that would have allowed it to continue doing business in Iran post 4 November, when economic sanctions pertaining to Tehran’s energy industry would have taken effect.

Total has had to quit its operations in Iran, where it held the majority 50.1 per cent stake in phase 11 of the giant South Pars gas field, as part of a deal it signed with Tehran in July last year. It became the first western company to re-enter the country after a previous set of economic sanctions imposed as a penalty for Iran’s controversial nuclear programme were annulled in 2015.

The economic impact of Total’s departure from Iran will be $40m, but according to CEO Patrick Pouyanné, the real loss will be Iran’s. At a time when the Islamic Republic is bracing itself for crippling US economic sanctions, losing out on the expertise and investment plans of an international oil company of the magnitude of Total spells near-doom for the country’s energy sector.

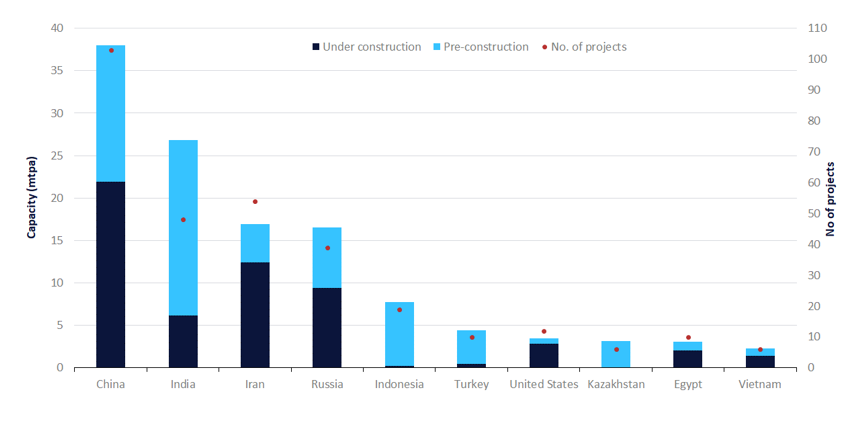

Iran’s sanctions-maimed oil industry will likely have to look on as other regional countries, along with their international partners, reap the benefits of the raft of exploration and production projects that have been spurred on by favourable oil prices.

Iran is now banking on China’s state-owned CNPC, which holds the second-largest 30% share in SP11, to step up and invest in the stake Total has abandoned. However, CNPC is reportedly yet to make a decision on further investments. Buying out all of Total’s stake would make CNPC the owner of 80.1% of the pie, rendering the deal commercially untenable for Tehran.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataReports of Russian energy firms looking to pump a total of $50bn into Iran in the upcoming period have been surfacing, although concrete details and the gains of the deals are yet to emerge.

There is little doubt that Iran’s closest allies Russia and China will spring to Tehran’s aid to alleviate the distress of sanctions. How real the effect of that help will be however is open to debate.

This article is sourced from Offshore Technology sister publication www.meed.com, a leading source of high-value business intelligence and economic analysis about the Middle East and North Africa. To access more MEED content register for the 30-day Free Guest User Programme.

Related Company Profiles

Sp 11 S.R.L.

Offshore Technology Corp