The oil and gas industry continues to be a hotbed of patent innovation. Activity is driven by the need for improved productivity, emissions reductions and long-term sustainability. Therefore, the industry is pursuing clean energy transition, alongside which there has been a growing interest in technologies such as green hydrogen, fuel cells, and carbon capture and storage (CCS). In the last three years alone, there have been over 523,000 patents filed and granted in the oil and gas industry, according to GlobalData’s report on Innovation in oil & gas: oil recovery CWI. Buy the report here.

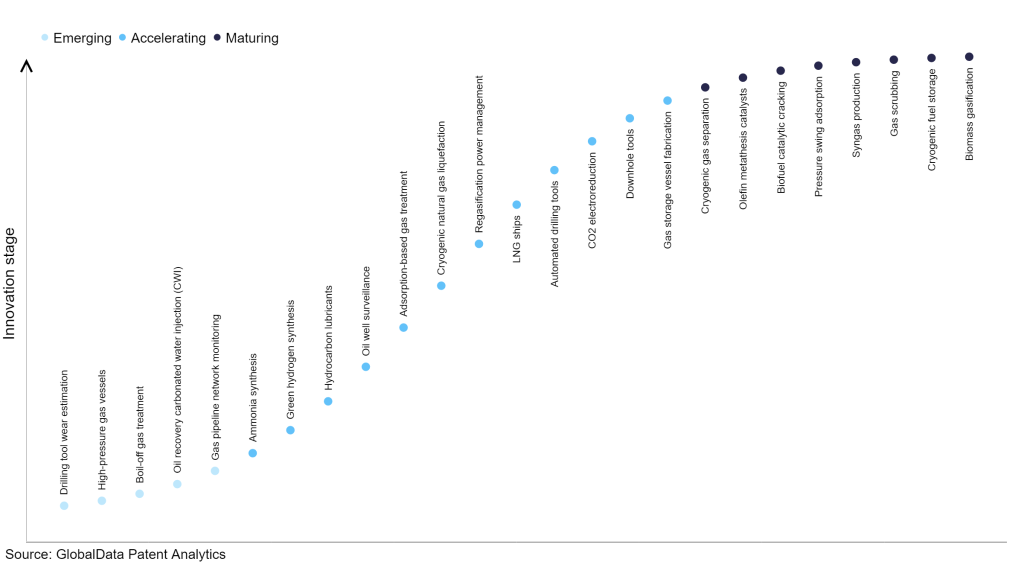

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

See Also:

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

60+ innovations will shape the oil & gas industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the oil & gas industry using innovation intensity models built on over 196,000 patents, there are 60+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, high-pressure gas vessels, boil-off gas treatment, and oil recovery CWI are disruptive technologies that are in the early stages of application and should be tracked closely. Green hydrogen synthesis, hydrocarbon lubricants, and oil well surveillance are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are cryogenic gas separation and olefin metathesis catalysts, which are now well established in the industry.

Innovation S-curve for the oil & gas industry

Carbonated water injection (CWI) for oil recovery is a key innovation area in oil & gas

Carbonated water injection (CWI) is an innovative technique used in the secondary and tertiary phases of oil recovery. In this technique, CO2 dissolved in water is injected into the oil reservoir from an injection well, to sufficiently mobilise oil flow at the production well. As oilfields deplete over time, the CWI technique can help oil and gas companies to increase the oil recovery from such wells, thereby extending their production life. Thus, companies can generate higher return from their hydrocarbon assets. It could also help companies conserve their capital that would have otherwise been spent on bringing additional fields online.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 70+ companies, spanning technology vendors, established oil & gas companies, and up-and-coming start-ups engaged in the development and application of carbonated water injection (CWI) for oil recovery.

Key players in carbonated water injection (CWI) for oil recovery – a disruptive innovation in the oil & gas industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to carbonated water injection (CWI) for oil recovery

| Company | Total patents (2010 - 2022) | Premium intelligence on the world's largest companies |

| Equinor | 71 | Unlock Company Profile |

| Schlumberger | 34 | Unlock Company Profile |

| Halliburton | 31 | Unlock Company Profile |

| Exxon Mobil | 31 | Unlock Company Profile |

| Saudi Arabian Oil | 28 | Unlock Company Profile |

| China Petrochemical | 26 | Unlock Company Profile |

| BP | 25 | Unlock Company Profile |

| China National Petroleum | 22 | Unlock Company Profile |

| Equinor | 21 | Unlock Company Profile |

| GreatPoint Energy | 21 | Unlock Company Profile |

| Dow | 20 | Unlock Company Profile |

| ConocoPhillips | 20 | Unlock Company Profile |

| Baker Hughes | 19 | Unlock Company Profile |

| PALMER LABS | 16 | Unlock Company Profile |

| Tokyo Gas | 15 | Unlock Company Profile |

| 8 Rivers Capital | 14 | Unlock Company Profile |

| TerraCOH | 14 | Unlock Company Profile |

| Mitsubishi Heavy Industries | 13 | Unlock Company Profile |

| Linde | 13 | Unlock Company Profile |

| Chevron U. S. A. | 12 | Unlock Company Profile |

| M-I | 11 | Unlock Company Profile |

| Pioneer Energy | 10 | Unlock Company Profile |

| Air Products and Chemicals | 10 | Unlock Company Profile |

| Eni | 7 | Unlock Company Profile |

| Paramount Resources | 7 | Unlock Company Profile |

| Heat Mining | 7 | Unlock Company Profile |

| Colt Engineering | 6 | Unlock Company Profile |

| Sure Champion Investment | 6 | Unlock Company Profile |

| Lurgi | 6 | Unlock Company Profile |

| Raytheon Technologies | 5 | Unlock Company Profile |

| Pilot Energy Solutions | 5 | Unlock Company Profile |

| Vestlandets Innovasjonsselskap | 5 | Unlock Company Profile |

| Arcadis | 5 | Unlock Company Profile |

| Ocean Resource | 5 | Unlock Company Profile |

| Prad Research And Development | 4 | Unlock Company Profile |

| Wojskowa Akad Tech | 4 | Unlock Company Profile |

| Doosan | 4 | Unlock Company Profile |

| Shaanxi Yanchang Petroleum (Group) | 4 | Unlock Company Profile |

| China National Offshore Oil | 4 | Unlock Company Profile |

| Statoil Gulf Services | 4 | Unlock Company Profile |

| Southwest Petroleum | 3 | Unlock Company Profile |

| Stillwater Energy Group | 3 | Unlock Company Profile |

| Sichuan Xingzhi Zhihui Intellectual Property Operation | 3 | Unlock Company Profile |

| China Petrochemical | 3 | Unlock Company Profile |

| Occidental Petroleum | 3 | Unlock Company Profile |

| Air Liquide | 3 | Unlock Company Profile |

| TotalEnergies | 2 | Unlock Company Profile |

| Horisont Energi | 2 | Unlock Company Profile |

| International Energy Consortium | 2 | Unlock Company Profile |

| Daqing Dongyou Ruijia Petroleum Technology | 2 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Leaders in patent filings for carbonated water injection (CWI) include Equinor, Schlumberger, Halliburton, and ExxonMobil. Maximising oil production is the primary business of oil and gas operators and oilfield service companies. Naturally, these companies are at the forefront of technology development for EOR.

Equinor has pursued the development of CWI and filed 71 patents in this regard. R&D efforts in the CWI technology are likely to help the company extend production from its mature oilfields in the Norwegian Continental Shelf.

Halliburton, a leading oilfield services company, has vast expertise in delivering EOR services in the US as well as in other markets around the world. It has helped numerous clients implement EOR strategies for extending the production life of their oilfields.

ExxonMobil has filed 31 patents on the CWI technology making it one of the leaders in this space. The company applies internally developed technologies to improve its production and competitiveness in the industry.

To further understand the key themes and technologies disrupting the oil & gas industry, access GlobalData’s latest thematic research report on Oil & Gas.

Premium Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.