Occidental Petroleum acquires Anadarko Petroleum for $55bn

International offshore exploration and production company Occidental Petroleum completed its acquisition of Anadarko Petroleum in a $55bn deal.

Proposed in April, the transaction also includes the assumption of Anadarko’s debt.

Occidental Petroleum president and CEO Vicki Hollub said: “With Anadarko’s world-class asset portfolio now officially part of Occidental, we begin our work to integrate our two companies and unlock the significant value of this combination for shareholders.”

Adnoc awards $3.6bn contracts for wells and drilling materials

The Abu Dhabi National Oil Company (Adnoc) awarded three contracts worth AED13.2bn ($3.6bn) to procure materials for well construction and drilling activities.

The contracts were awarded to Consolidated Suppliers Establishment representing Tenaris, Abu Dhabi Oilfield Services Company representing Vallourec, and Habshan Trading Company representing Marubeni.

The companies will deliver a total of one million metric tonnes of casing and tubing over five years. The contracts were awarded on the basis of forecasted requirement for casing and tubing across the group.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataExxonMobil considers sale of UK North Sea assets

Energy company ExxonMobil reportedly held talks with several North Sea operators with regard to the sale of its assets in the UK North Sea.

Citing industry sources, Reuters said that the deal could generate more than £1.6bn ($2bn).

The latest move follows the sale of UK portfolios by US operators ConocoPhillips and Chevron to Chrysaor and Ithaca, respectively, this year.

Oil & Gas UK launches new industry tool to boost North Sea production

The UK Oil and Gas Industry Association (OGUK) launched a new industry tool to enhance recovery from existing oil and gas assets in the North Sea.

The Reserves Progression self-verification checklist tool was developed by a group supporting the Oil and Gas Authority (OGA’s) Assets Stewardship Task Force. OGUK said the tool will help companies identify and share best practice and information.

The tool intends to provide operators and licensees with a framework to re-evaluate methods to improve recovery from existing North Sea fields and expand the productive life of the UK Continental Shelf.

BOEM approves Equinor’s stake acquisition in Caesar Tonga field

The Bureau Of Ocean Energy Management (BOEM) granted its approval to Equinor Gulf of Mexico for its acquisition of an additional 22.45% stake in Caesar Tonga oil field from Shell Offshore, a subsidiary of Royal Dutch Shell, for $965m in cash.

The deal was announced in May. With this transaction, Equinor now holds a 46% stake in the Caesar Tonga field.

Anadarko Petroleum is the operator of the field with 33.75% interest, while Chevron holds 20.25% interest.

Equinor makes light oil discovery in Barents Sea Sputnik well

Norwegian energy company Equinor made a light oil discovery in the Sputnik exploration well in the Barents Sea, with estimated recoverable resources of 20-65 million barrels of oil (MMbbl).

The Sputnik well was drilled in the PL855 licence, located approximately 30km northeast of the Wisting discovery. It was drilled to a vertical depth of 1569m below the seabed by the West Hercules semi-submersible drilling rig.

Equinor is the operator of the PL855 licence, with an operating interest of 55%. Partners in the licence include Austrian oil and gas company OMV (25%) and Norwegian oil and gas company Petoro (20%).

Lundin Norway finds oil in North Sea’s Goddo prospect

Lundin Norway, a wholly owned subsidiary of Lundin Petroleum, discovered oil by spudding an exploration well at the Goddo prospect in the North Sea.

The discovery was made by the 16/5-8s exploration well, located in the production licence (PL) 815 around 14km south of the Edvard Grieg field.

The primary objective was to find oil in the porous basement similar to what the company encountered in the Rolvsnes discovery to the North-West.

BHP to invest $283m in Ruby project development

Australian firm BHP approved a $283m investment in developing the Ruby project situated in Trinidad and Tobago.

The total investment in the offshore project will be nearly $500m, including pre-commitment capital.

BHP Petroleum Operations president Geraldine Slattery said: “This is an important milestone for BHP in Trinidad and Tobago. Ruby aligns well with our strategy of maximising value from our existing assets, bringing competitive near-term value and volume growth.”

Shearwater begins seismic survey in North Sea licence

Shearwater GeoServices commenced a 3D seismic survey over the Pensacola Prospect on Licence P2252 in the Southern North Sea.

The survey is being conducted by Shearwater’s Polar Empress vessel, with field operations expected to be completed in two weeks.

Following the completion of seismic acquisition, the procured data will be processed and final results will be due in the third quarter of 2020.

Shell takes FID for PowerNap project in Gulf of Mexico

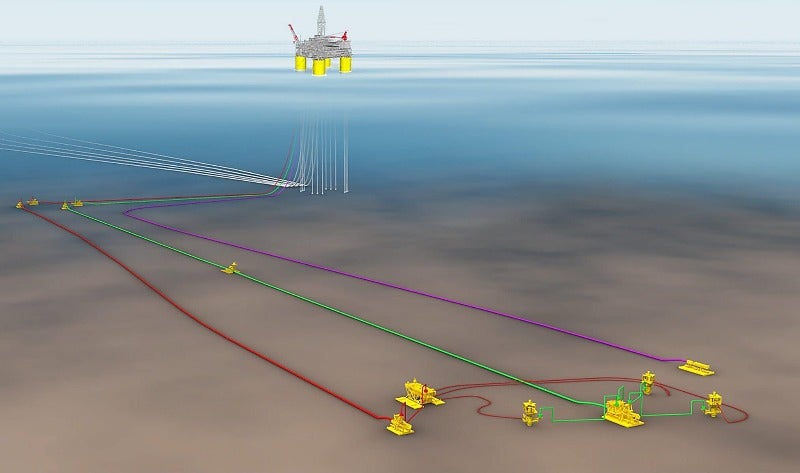

Royal Dutch Shell subsidiary Shell Offshore took the final investment decision for the PowerNap project in a bid to bolster its deep-water portfolio in the US Gulf of Mexico region.

Situated around 240km from New Orleans, the PowerNap deepwater project is a subsea tie-back to the Shell-operated Olympus production hub. The project was discovered in 2014 and is estimated to host more than 85 million barrels of oil equivalent recoverable resources.

Shell aims to commence production from the offshore resource in late 2021. The production will be transported to market through the Shell Pipeline Company-operated Mars pipeline. At peak levels, the PowerNap project is expected to produce up to 35,000 barrels of oil equivalent.