Arguably, the bull market in oil began with the recovery from the price

collapse in 1999, but there is no doubt that the rally truly kicked off in

2004, following an unexpected surge in global demand. A year of supply-side

woes followed, due to slowing Russian production growth and the hurricane

damage from Rita and Katrina.

The year 2006 was a year of dramatic inventory shifts. The 33mb rise in OECD

total oil stocks in September was more than reversed by a 40mb stock draw in

October, despite exceptionally mild weather in Europe at the start of the

fourth quarter and relatively normal weather in the US. To this, we can add

November’s near 20mb draw on US stocks, a 3.7mb fall in Japanese inventories

and a decline in independent storage in northwest Europe.

Heavy and protracted refinery maintenance in the US resulted in a sharp

decline in product inventories, but the accompanying fall in global crude

production appears to have dampened the usual offsetting rise in crude stocks.

Admittedly, some of October’s primary inventory draw may have been exaggerated

by consumer and wholesale restocking but the draws would appear to confirm

recent trends in the primary balance.

GLOBAL UNCERTAINTY

There is considerable uncertainty over the levels of supply and demand over

coming months. Global GDP, Iraqi and Nigerian output, and OPEC discipline are

all unpredictable. But it is still a useful exercise to try to estimate the

impact of recent changes in OPEC output on future stock levels. Figure 1 shows

the cumulative stock change implied by three scenarios for OPEC production,

based on:

- September OPEC production and the current ‘call on OPEC and stock change’

(call) (light blue) - November OPEC production and the call (dark blue)

- November OPEC production and the call, plus an adjustment for statistical

difference (green)

The light blue area shows the outcome had September production been

maintained. The dark blue and green areas represent the cumulative stock build

/ draw implied by the current OPEC cuts, based (respectively) on the call and

the call together with an adjustment for the miscellaneous-to-balance.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAlthough the miscellaneous-to-balance could represent either under-reported

demand, over-reported supply or unreported stock builds, including it in the

calculation shows a more realistic range of outcomes. It could be argued that a

further adjustment should be made for known risks to non-OPEC supply, which can

average 300–400kbpd, but for now we feel that there are offsetting

downside risks to global GDP, and thus oil demand growth.

Without doubt, November’s output cuts could tighten the oil market this

winter, and offer little prospect, allowing for demand growth, of a recovery in

stock cover above the current 54 days – cold comfort for a risk-prone

global economy already facing another winter with high oil prices.

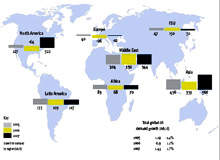

GLOBAL DEMAND

Global oil product demand growth remained unchanged at +1.1% in 2006

(84.5mbpd) and +1.7% in 2007 (85.9mbpd), as minor downward adjustments in OECD

countries were offset by upward revisions in non-OECD countries. The 2007

forecast, though, faces downside risks, given uncertainties surrounding the US

economy.

OECD oil product demand projections have been more or less maintained at

49.4mbpd in 2006 and 49.6mbpd in 2007. Support from strong US demand continues,

even after accounting for last year’s hurricane-affected baseline. OECD Europe

and the Pacific, meanwhile, will likely continue to see a gradual fall in

demand.

Non-OECD oil product demand was also unchanged at 35.1mbpd in 2006 and

36.3mbpd in 2007, despite a slight downward adjustment in China’s oil product

demand growth rate for 2006 (from 6.2% to 5.6% annually). This revision is

related to the country’s relatively lower apparent demand growth over the past

three months, possibly due to the drawdown of stocks. This could justify

revising Chinese demand upwards in 2007, but the IEA is waiting for

confirmation of the stock hypothesis.

WORLDWIDE OVERVIEW

The IEA has kept unchanged its global growth forecast for 2006 (+1.1% to

84.5mbpd) and 2007 (+1.7% to 85.9mbpd), as downward adjustments in OECD

countries were largely offset by upward revisions in the rest of the world.

There is, however, a big question mark over US economic growth prospects in

2007, which could have a powerful influence on the oil market. Although most

observers concur that economic activity is slowing, the jury is still out

regarding the magnitude and timing of the slowdown, amid a host of

contradictory signals.

As a result, the IEA has decided to continue to base its forecast on the

IMF’s US GDP projection for 2007 (+2.9%, compared with an emerging current

consensus of 2.5%), but it will review this figure. Moreover, it can be argued

that slower US economic expansion will not translate into much lower domestic

oil demand next year. US citizens are likely to maintain their driving and

flying habits in the short term.

The oil price fall after last summer’s highs encouraged the marginal

substitution of hitherto cheaper natural gas with naphtha and fuel oil in the

US. However, this effect has diminished following the rebound in oil prices

over the past month. As a result, demand for the heavy end of the barrel has

resumed its long-term downward trend.

SUPPLY PICTURE

World oil supply slipped by 50kbpd in November to 85.4mbpd, with lower OPEC

crude supply outstripping an OECD-inspired rise from non-OPEC. August and

September production estimates have been revised down by close to 90kbpd, based

on a lower baseline for non-OPEC Africa and the North Sea. October supply has

been revised up by 120kbpd, on the strength of higher FSU and OPEC crude

availability. A yearly comparison shows 3Q06 global output 1.3mbpd above

disrupted year-ago levels.

Non-OPEC supply estimates have been revised down by 40kbpd for 2006 and by

115kbpd for 2007. Next year’s adjustments are focused in the 1Q–3Q

period, when Australia, Russia, Brazil, Sudan, Egypt and Mauritania now appear

headed for lower than previously expected output. A partial offset comes from

higher expectations for North America and China.

All told, non-OPEC supply rose by 650kbp d in 2006 (constrained by weak 2Q

performance) and could rise by1.7mbpd in 2007, reaching 52.6mbpd. OPEC NGL

supply growth is expected to remain unchanged at 0.2mbpd both years, averaging

4.7mbpd and 4.9mbpd respectively for 2006 and 2007.

Total OPEC crude supply fell by 555kbpd in November, after a 225kbpd

reduction in October. November supply averaged 28.9mbpd, after substantial

reductions from Saudi Arabia, the UAE, Venezuela and Iran. There were ongoing

disruptions to supply from Iraq and Nigeria.

OPEC-10 (excluding Iraq) output fell 500kbpd in November to 27.1mbpd. In

all, OPEC-10 production is running 610kbpd below September, compared with a cut

of 1.2mbpd pledged at the October OPEC meeting. Notional spare capacity reached

3.8mbpd, but effective spare capacity (excluding Iraq, Nigeria, Venezuela and

Indonesia) rose only modestly to 2.4mbpd.

The call on OPEC is revised up by 0.1mbpd to 28.4mbpd for 2007, based on

lower expectations for non-OPEC supply in the first three quarters of the year.

The current quarter’s call stands at 29.8mbpd, nearly 1mbpd above prevailing

OPEC supply, suggesting the potential for a substantial 4Q stock draw unless

winter weather proves markedly milder than normal. Similarly, the 1Q07 call

stands marginally above recent OPEC output, at 29.0mbpd.