To gain insight into confidence levels and the mood of the oil and gas sector ICD Research carried out a survey of the industry’s top executives. The results also revealed the likely effects that the recession and recovery will have on competition within the industry.

57% of respondents in the upstream and downstream oil and gas industry are more optimistic about revenue growth for their companies over the next 12 months, relative to the previous 12 months (Figure 1). A further 26% are neutral about revenue growth compared with 13% who were less optimistic about their company’s revenue prospects.

The overall high level of optimism in the oil and gas industry compared with Q2 2009 might suggest either a strong belief in the imminent end to the global economic upheaval or successful steps being taken by companies to increase revenues and reduce costs, and the emergence of new profitable markets.

Downstream and midstream

Companies in the downstream and midstream segment are more optimistic about revenue growth over the next 12 months (Table 1). The rise in fuel use for road and air transportation is primarily driving demand for refined petroleum products such as air turbine fuel and diesel.

See Also:

Moreover, the use of natural gas in commercial vehicles and industrial use is further driving investment in storage infrastructure for the refined petroleum products of compressed natural gas and liquefied natural gas.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCompanies are focusing on increasing their revenue generation by means of adding their refining and storage capacities with much of the global refining capacity additions coming into play in 2009-10 within Asian countries.

Companies are also focusing on sustaining high operating rates, improving efficiency and reducing operating costs.

Upstream oil and gas

Explorers/producers and suppliers in the upstream oil and gas industry have voiced optimism about the industry growth rate. The majority of buyers and suppliers expect the industry to grow at a faster or equal rate against the global GDP growth rate of 2%. The GDP of advanced economies is expected to grow by 1% in 2010.

In general, buyer companies are more optimistic compared with suppliers about revenue growth in the next year. Overall, suppliers’ optimism level has increased considerably from 2009 due to the growth in optimism levels among the buyer companies across different industries. Some suppliers also have long-term contracts set up and greater selling power than buyers or are not unduly affected by reduced demand.

The optimism level in the upstream oil and gas sector has considerably increased in 2010 from that of 2009 fueled by improved cash flows and credit metrics during the year as a result of higher oil prices. In the case of the downstream and midstream oil and gas sector, contract backlogs and the rise in oil prices are expected to provide the required support to activity levels and credit profiles of companies operating in the sector.

Globally, the optimism level is high in the oil and gas sector due to a rise in exploration successes and a more stable oil price, indicating that the sector is on the recovery path.

Regional growth expectations

Analysis of respondents’ expectations by region reveals that 45% of European respondents are optimistic about revenue growth over the coming year compared with 56% of North American respondents, 61% of Asia Pacific respondents and 63% from the rest of the world region (Table 2).

The optimism level of European respondents is lower compared with other respondents as some countries in the region (for example, Russia) are facing major challenges due to a steep slowdown in production levels and credit difficulties faced by many companies across the oil industry value chain.

The European oil and gas sector should rebound by 2010-11 driven by the increased funding for capital expenditures, leading to a considerable rise of investment in the sector.

Optimism in North American companies substantially increased in 2010 over 2009 in tandem with the growth of the economy and GDP. The credit worthiness of large integrated upstream oil and gas companies is set to improve in North America driven by their oil-heavy upstream portfolios, sizable cash balances and reasonably low net debt levels.

The optimism level is high in the rest of the world and the Asia-Pacific region due to the fast economic growth in countries such as China, India and in the Middle East. Investments in the oil and gas sector are expected to increase in Asia and the Middle East in sectors such as drilling, transportation and storage infrastructure segments.

Essar Oil’s gas reserve discovery in the Raniganj field in India is expected to drive up investment in this sector. Investment in natural gas transportation is exemplified by the recent signing of a gas transportation agreement between Origin Energy and Epic Energy for building a gas pipeline to connect Eastern Australia with the rest of the country.

The International Energy Agency estimates that global refining capacity will increase by 1.8mbpd in 2009, with Asia accounting for around 80% of the increase. Successes in crude oil drilling sites in African countries such as Nigeria and Egypt also aided in increasing the optimism levels in these regions. The increase of spending in technology development such as high level engineering services and reliable engineering management further helped in boosting the optimism level of respondents across all regions.

Small oil and gas companies

Around 61% of respondents from smaller oil and gas companies, with revenues up to $100m, are more optimistic about revenue growth as compared to respondents from medium and large-sized companies (Table 3). This indicates that the recession might have leveled out the competition, resulting in smaller companies having fair access to a wider audience to impress and gain business.

Many companies are forming partnerships to optimise working capital and reduce costs, and they are also planning to venture into low-cost countries in Asia for reducing production costs.

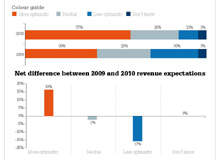

The net difference in optimism trends for the oil and gas industry was mapped with the individual results of 19 other industries. The global and extensive nature of the ICD Research Survey 2010 helps us understand the position of the oil and gas industry in relation to other major industries. The oil and gas industry occupies seventh position in the list with a relative optimism trend of 44% in its favour. This indicates that the sector is well into the recovery path along with other sectors that are driving the economy.