For the past two years, North Sea oil and gas production has been hit by a double whammy. Declining output from mature fields has combined with oil prices mired below $50 per barrel to produce a general mood of despondency in the offshore industry.

As the industry searches for solutions that will help drive down operating costs significantly enough to push profits back up, could unmanned installations come into their own?

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

Normally unmanned installations (NUIs) have been used for decades in the shallow waters of the Danish and Dutch sectors of the North Sea.

However, in the deeper Northern waters of the UK and Norwegian North Sea the technology has hitherto faced a much tougher challenge. Now, following a recent study carried out by Ramboll Oil & Gas – part of the Danish headquartered global consulting engineering company Ramboll Group – the unmanned concept could soon see greater use across the Norwegian Continental Shelf (NCS). The study, which looked into the benefits and disadvantages of unmanned wellhead platforms, was carried out for the Norwegian Petroleum Directorate (NPD).

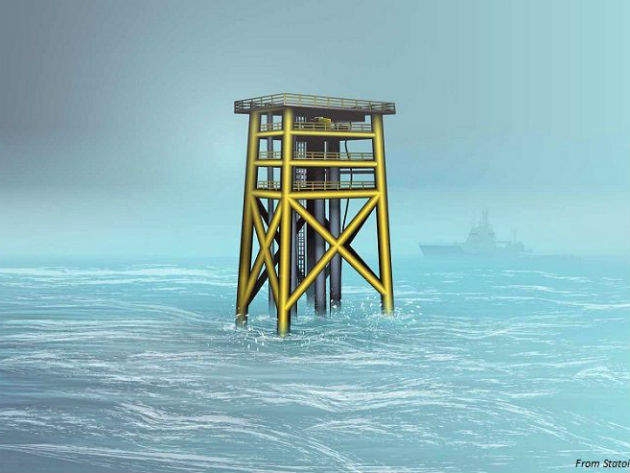

The NPD was suitably impressed and has now called for unmanned wellhead platforms to be considered as an alternative to subsea tiebacks when development decisions are made. The major leap forward is likely to come in 2018 when Norway’s Oseberg Vestflanken 2 unmanned project comes on-stream. This Statoil-led project aims to extend the life of the Oseberg field to 2040, which could pave the way for a spate of unmanned platform projects in the region.

The development will consist of an unmanned wellhead platform with ten well slots, which will tap into 110 million barrels of oil equivalent (MMboe). Two existing subsea wells will be reused and remotely controlled from the Oseberg field centre.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataA pioneer project and the first of many

This pioneer project is merely the first of three planned phases for development of the remaining reserves in the Oseberg area. As Torger Rod, Statoil’s senior vice president for project management, explained, “the project is a pilot that other operators, public authorities and the rest of Statoil’s project portfolio are already learning from.”

He added that Statoil has managed to cut the breakeven price of the project by about 30% as a result of a reduced capital expenditure (capex) and by increasing the recoverable resources in the area.

ConocoPhillips is also looking into using unmanned platforms as a means to cut costs at its stalled Eldfisk field development – the second largest of three producing fields in the Greater Ekofisk Area off Norway. The US operator had planned to drill six long-reach wells in the northern part of the field but reported in October, after drilling just two wells, that it was experiencing technical difficulties with the third probe.

The company recently received consent from Norway’s Petroleum & Energy Ministry to postpone the deadline to submit its development plan to 31 December 2018. In its application, ConocoPhillips said that it is now looking at lower-cost solutions, such as unmanned wellhead platforms and subsea production. It expects the concepts to “be matured in the course of 2016 and 2017,” and expects that lessons gained from similar development concepts on the Norwegian Continental Shelf “will be worked into the project.”

BP has also been given consent by the Norwegian offshore safety watchdog, the Petroleum Safety Authority (PSA), to extend production at its unmanned Tambar field platform until January 2022. The field is located around 16kmsoutheast of the North Sea’s Ula field.

Managing data and enabling automation

Data management and automation is crucial to the future success of unmanned platforms. “As companies move oil platforms farther offshore and into other remote, challenging locations to find oil and gas, managing those operations efficiently while reducing risk to workers will become increasingly important,” Explains Pieter Krynauw, vice president of Honeywell Process Solutions’ (HPS) projects and automation solutions business.

Honeywell will serve as the EPC automation contractor for Statoil’s Valemon periodically manned platform in the NCS, which will be the company’s first platform operated from shore. Control operations will be located in Bergen, some 160km away from the platform. Honeywell will provide a range of control and safety technologies, including systems at the Bergen operations centre that will communicate with Valemon.

The platform sits at a depth of 135m and will produce natural gas and condensate from one of the biggest undeveloped natural gas fields in the North Sea. Once drilling is complete in 2017, the platform will have ten production wells.

Yet Norway still has a considerable way to go. So far UWHPs make up only 5% of the Norwegian Continental Shelf’s99 platforms, mainly on account of the region’s water depth, field size and distance to infrastructure, and regulatory requirements. This is substantially below the average elsewhere.

According to Ramboll, more than half of the platforms in the Abu Dhabi/Middle Eastern waters, for instance, use UWHPs. The company says that the Persian Gulf’s shallow water depths are ideal for unmanned platforms. Even offshore UK, where around 25% of 148 platforms are unmanned, fares better than Norway.

The main challenge: Going deep

The challenge for both the UK and Norway is to extend this concept for marginal pools to deeper waters. And that is precisely what makes the Oseberg development, which is taking place in a water depth of about 110m, so important.

In its submission to the NPD, Ramboll Oil & Gas recommends a number of unmanned platform specifications. For some reservoirs, a Type 3 minimalistic platform, with typically between two and twelve wells and capable of operating unmanned for up two years, would suffice. The platform would be accessible via walk-to-work bridges on a standby vessel or an offshore support rig. Type 3 platforms are monitored by CCTV and remote shutdowns can be carried out. Wellhead control, emergency shutdown systems, fire and gas systems and SCADA systems are all integrated.

For more complex reservoirs, such as those with frequent well intervention operations and down-hole pumps, Ramboll recommends Type 0 or Type 1 platforms. Both are equipped with helidecks and cranes, and are designed to be operated unmanned for a few weeks. Type 0 platforms have fire, water and processing equipment and are most similar to manned platforms, according to the report.

Ramboll Oil & Gas UK’s managing director Tim Martin believes that now is the time for the offshore industry to move to unmanned platforms. “A traditional subsea installation or wellhead platform is three times the cost of a minimum facility platform,” he says “We know that the development of small pools, which are essential to the future of the North Sea but are difficult to develop because of their size or geographic remoteness, is unpalatable because of traditionally high costs, yet we have seen little evidence of a move towards unmanned platforms.”

But, he warns, “there is a danger that many of these projects will remain on a shelf gathering dust,” and calls for safety regimes to “support this approach and not be used as an excuse not to embrace minimum platforms.”