BP Egypt drilling.jpg” />

As depressed oil prices continue to bite deep into the oil and gas industry and the oilfield services sector that supplies it, budgets for new exploration and production (E&P) projects have taken a swift nosedive.

A Wood Mackenzie report published in July 2015 – when oil prices were hovering at around $55 per barrel and still declining from a peak of around $115 per barrel a year previously – found that the industry as a whole had cut $200bn worth of new projects. Companies across the board, including supermajors such as BP, Chevron and Royal Dutch Shell, are deferring investments into high-cost developments and withdrawing into safer territory while they assess the length and depth of the downturn. By January 2016, the backlog of delayed work had reached an estimated value of $400bn, spread across 68 major projects.

Balancing budgets

Given that prices have only recently (as of late May 2016) rallied back to just under $50 per barrel, after slumping to less than $30 per barrel at the start of 2016, major cuts to capital expenditure (CAPEX) budgets and severe job losses are likely to continue for the foreseeable future. A January 2016 survey on the oil and gas industry outlook by DNV GL found that 31% of senior executives surveyed were prioritising headcount reduction in 2016, up from 25% the year before.

But there is a delicate balance to be struck for companies considering where to spend and where to save amid these bleak market conditions. Firms must not only consider how to cut spending to remain viable in the short term while maintaining the infrastructure and capacity to take advantage of a future price rebound (the extent and timing of which are still difficult to predict), but they must also consider the impact of spending cuts on investor confidence.

“In this market, [energy companies] can’t win,” Snow Capital Management senior portfolio manager Joshua Schachter told the Wall Street Journal in January. “If they cut, it’s a sign of weakness. If they don’t, it’s a sign of weakness…Right now, it’s very precarious times for them.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataWith these complex considerations in mind, are companies cutting in the right places and spending wisely?

Big cuts: CAPEX and operating costs

“The upstream industry is winding back its investment in big pre-final investment decision developments as fast as it can,” noted last year’s Wood Mackenzie report. “This is partly because it is one of the quickest ways to free up capital in response to low oil prices.”

In short, it’s a terrible time for megaprojects and the other high-cost developments in which the industry was happily investing during the boom times. These cutbacks are inevitable. If final investment decisions on large, expensive projects have not been made – meaning they have not crossed the Rubicon in terms of spending commitment – then it makes little sense to plough on with them when market conditions make it likely that they will operate and produce at a loss. Mature regions such as the Gulf of Mexico and the North Sea are already struggling enough to remain profitable, without adding into the mix a wave of new surplus capacity, much of which would come from high-cost ultra-deepwater projects.

The bubble that ballooned due to sustained $100-plus oil prices has burst, and the industry has contracted to protect itself, as it always has done during downturns. Large-scale spending and borrowing during the bubble has left many companies with high debt burdens, increasing the need to mothball big projects to free up capital and protect dividend payouts and shore up investor confidence.

The oil industry’s annual CAPEX quadrupled to $356bn between 2004 and 2013, according to Bloomberg data, necessitating a similarly massive increase in the industry’s debt burden, which surged from $1.1tn to $3tn by the time the oil price peaked in 2014. As tends to happen when bubbles pop, easy access to credit spells hard times when the market turns sour.

“It was irrational investment – expecting prices to rise continually,” said energy economist Philip Verleger in a March 2016 interview with the Financial Times. “Companies that borrowed heavily when prices were high are going to have a very tough time.”

Understandably, a great deal of industry focus has fallen on cost efficiency as a means of achieving savings on operating costs. An estimated 350,000 jobs have been cut from the global oil sector, and oil companies are squeezing the oilfield services industry hard to make the most of contract flexibility and hold out for better prices.

While these measures have made a significant impact on the per-barrel cost of production in many regions – the North Sea costs are expected to drop to around $17 per barrel by the end of 2016, a 42% reduction on two years before – many experts are calling for more long-term thinking to cut costs with less reliance on slashing jobs and squeezing suppliers, leaving the industry with a more sustainable route to growth.

“To prevent repeating past mistakes, real change is needed now – cutting complexity, increasing collaboration and driving standardization,” said DNV GL Oil & Gas CEO Elisabeth Tørstad. “These measures will enable the industry to adjust to the new reality and put it on a sustainable growth path for the long-term.”

Offshore projects: more selective spending

Large oil companies are adopting a range of strategies to prioritise spending on cheaper sources of production. US-centric multinationals such as Chevron and ConocoPhillips are pulling out of more expensive deep and shallow water activities to focus more on domestic shale oil opportunities. Chevron has withdrawn from shallow development in the Gulf of Mexico entirely while also carrying out early termination of its contract for the Maersk Deliverer ultra-deepwater semisubmersible drilling offshore Angola.

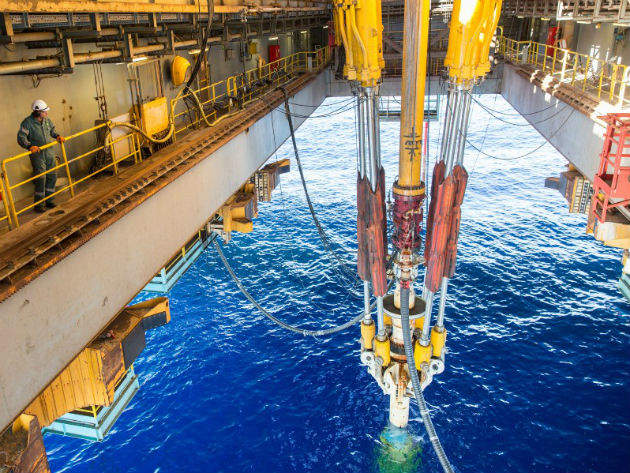

BP, meanwhile, has targeted offshore Egypt for heavy investment with the $12bn West Nile Delta gas project, which aims to develop five trillion cubic feet of gas and 55 billion barrels of condensates, with production scheduled to begin in 2017. In December 2015, BP announced it had increased its stake in the project to 82.75% in both concession areas as the company looks to the region as a major source of production growth in the coming years.

In the Gulf of Mexico, BP announced last year that it was delaying its final investment decision on the Mad Dog 2 deepwater project to the middle of 2016 in anticipation of reducing the project’s costs to around $10bn, less than half of the original budget. The company invited revised bids for the project in March 2016. It appears deep-pocketed players are still willing to spend money on new projects, even in deep waters, but only if the price is right.

Shell has taken an entirely different route in its quest to achieve secure growth, with its $50bn acquisition of UK-based BG Group. The merger, which was completed in February 2016, represents a huge outlay in an uncertain market, but the newly-combined group will have a significantly expanded footprint offshore Brazil, where Shell is betting that a low-cost production boost, increased reserves and a leading position in the burgeoning liquefied natural gas market, will make the company more attractive to shareholders, more predictable for investors and more resilient to fluctuating oil prices.

The move is not without risk, however, as Brazilian offshore legislation and national oil company Petrobras – beset by corruption scandals and required by law to hold a 30% stake and sole operatorship of the country’s lucrative pre-salt fields – may prove to be a tricky mix.

The oil price slump has necessitated a painful period of adaptation and readjustment in the global oil and gas industry, a period in which companies’ spending plans and cost-saving measures are under an incredible amount of scrutiny. Board-level strategies are attempting to walk a precarious tightrope between short-term subsistence and positioning for long-term growth, where bets are made more against the potential market conditions of tomorrow than those of today. Given the unpredictability of the market and the uncertainty over whether the current price rally truly represents a sustained path back to supply/demand balance, it will likely be months or even years before we find out which players made the right bets.