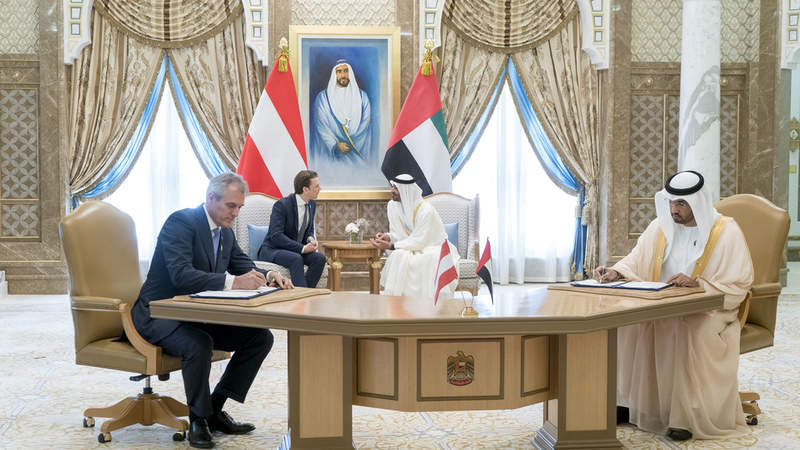

OMV signed $1.5bn deal for two Abu Dhabi offshore concessions

Austrian oil and gas company OMV signed an agreement with Abu Dhabi National Oil Company (ADNOC) for a 20% stake in Satah Al Razboot (SARB) and Umm Lulu offshore oil concessions in the UAE.

OMV contributed a participation fee of $1.5bn for the 40-year contract, which also includes infrastructure associated with the concessions.

While ADNOC is set to retain a 60% stake in the offshore concession, which will be operated by its subsidiary, the award for OMV is intended to maximise returns from its resources and bolster the downstream business.

Optical remote sensing provided ocean oil spill data

Researchers found that using operational civilian satellites may provide close estimates of relative oil thickness and volume for large-scale oil spills in the ocean.

The results were published in the Journal of Applied Remote Sensing and according to its associate editor, Weilin Hou, it is a ‘critical scientific advancement for monitoring large-scale oil spills’.

Hou also believes that the research will make it easier to assess and understand the impact of oil spills on marine and coastal resources, as well as making it easier to prepare appropriate responses for future spills.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataShell and Inpex to compete over Browse Basin natural gas reserves

Shell and Inpex are set to deploy some of the largest vessels ever built to compete for natural gas reserves beneath the Browse Basin, situated off the north-west coast of Australia.

Shell’s Prelude is the ‘largest offshore floating facility ever built’, according to the company. It stands at 488m long and has a larger volume than six aircraft carriers combined. The floating liquefied natural gas facility will remain 201km from the Australian coast, and draw in 50 million litres of water from the ocean every hour to help cool the natural gas that is collected.

Shell estimates that the vessel alone could meet 117% of Hong Kong’s annual natural gas demand.

ABB selected to supply HVDC converters for Johan Sverdrup project in Norway

ABB was selected to supply High Voltage Direct Current (HVDC) converters to electrify the first phase of the Johan Sverdrup field development project located 160km west of Stavanger in south-west Norway.

The Johan Sverdrup offshore field will have an estimated production peak of around 660,000 barrels of oil equivalent per day.

For the initial phase of the oil field development, which consists of four platforms, ABB’s HVDC system has a capacity of 100 megawatts (MW).

Sembcorp Marine completed FSO Ailsa for Culzean gas field

Sembcorp Marine completed FSO Ailsa, the floating storage and offloading (FSO) vessel, which will now sail next month for the Culzean gas field in the UK North Sea.

The vessel has a 40-year hull lifespan and was built for Modec and the company’s yard at Tuas Boulevard.

Total, BP, and JX Nippon will serve as the joint owners of FSO Ailsa, which is set to enter service with a hull designed to have twice the average hull fatigue lifespan of other newbuild FSOs.

Brazil hoped to raise $1.89bn through pre-salt offshore auction

Brazil hoped to secure R$6.8bn ($1.89bn) through the fifth round of bidding on pre-salt offshore oil areas.

These plays are estimated to contain billions of barrels of oil under salt beneath the ocean floor, reported Reuters.

Winning companies are required to offer the largest percentage of oil after cost to the government.

Keppel agreed to divest five rigs to Borr Drilling for $745m

Singaporean company Keppel Offshore & Marine entered a master agreement through its wholly owned subsidiary Keppel FELS to sell five existing jackup rigs to Bermuda-based Borr Drilling for around $745m.

Under the deal, Borr Drilling will pay $288m in the first instalment within 20 business days from the effective date of the agreement.

The remaining amounts will be paid within five years from the respective delivery dates of each rig.

Total to quit South Pars 11 project in Iran if US sanctions not waived

Oil and gas major Total threatened to pull out of the South Pars 11 (SP11) gas development project in Iran in the wake of impending US sanctions on the Middle-Eastern nation.

The SP11 project is aimed at supplying domestic gas to the Iranian market and the French firm signed a contract to develop it with an initial investment of $1bn.

The latest announcement made by Total is in response to the decision taken by US President Donald Trump to withdraw from the 2015 nuclear deal reached with Iran.

Culzean field’s three fixed platform topsides completed at Sembcorp

Three fixed platform topsides intended for the High-Pressure High-Temperature (HPHT) Culzean gas field in the UK North Sea were completed at Sembcorp Marine Admiralty Yard.

Consisting of Well Head, Utilities & Living Quarters, as well as Central Processing Facility, the integrated topsides of approximately 30,000t will be able to handle up to 500 million standard cubic feet per day of gas and 25,000 barrels per day of condensate.

The topsides also comply with UK safety regulations for harsh-environment operations in the Culzean field.

OGA awarded 123 licences under 30th Offshore Licensing Round

The Oil and Gas Authority (OGA) has granted 123 licences of more than 229 blocks or part-blocks to 61 companies under the 30th Offshore Licensing Round.

These awards will serve as a platform for future exploration and production across the UK Continental Shelf (UKCS).

OGA has offered a total of 26,659km² for awards. The additional area under licence will be a 50% increase on the existing acreage.