As an industry, oil and gas has received the third-greatest value of fines from the US Government, according to data by thinktank Good Jobs First. The database covers fines settled or ruled on by US Government agencies since 2000. Banking, pharmaceuticals, and oil and gas all face image problems, but all have faced the most financial punishment of any industry, with some of the biggest fines ever recorded.

1. BP leads with $29.2bn in fines, mostly after Deepwater Horizon

UK operator BP has received far more fines from US authorities than any other oil and gas company. The company’s $29.2bn of settlements leave it as the third most-fined company, surrounded on the list by banks. The only other member of the top 10 that is not a bank is Volkswagen, due to its manipulation of vehicle emissions testing.

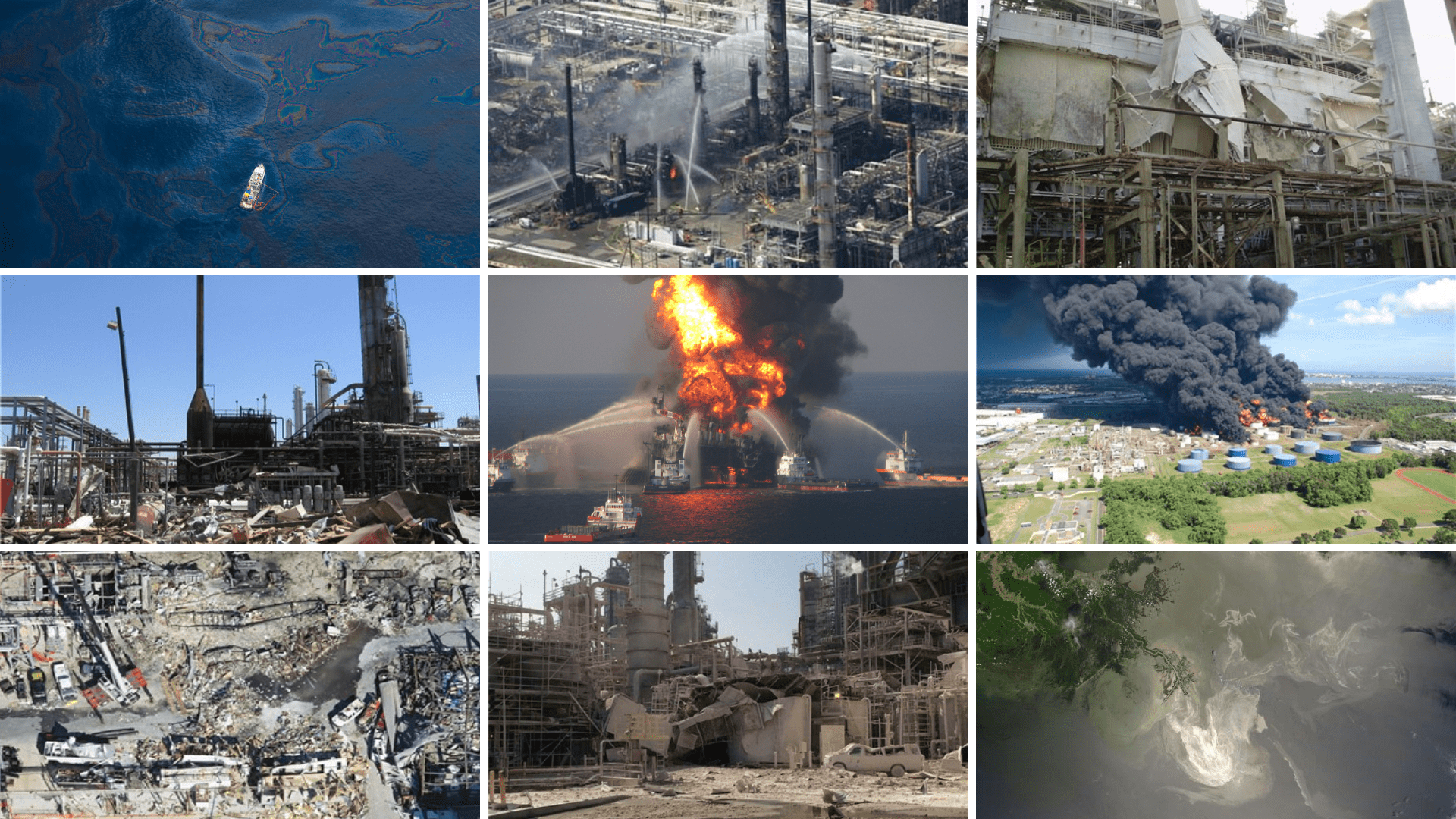

Most of BP’s payments stem from the 2010 Deepwater Horizon disaster, in which a Gulf of Mexico platform caught fire following a blowout and sank. The resulting oil spill covered approximately 180,000 km² of the Gulf of Mexico. The spill reached the shores of Louisiana, Mississippi, Alabama, and Florida. There, locals were saw their beaches contaminated and wild birds suffering in the oil.

As a direct result, BP received seven of the 10 largest fines ever given to oil and gas companies by US authorities. The largest of these was a $20.8bn fine given by the US Department of Justice (DOJ) in 2015. This marks the largest single environmental fine ever recorded.

In 2020, one decade after the original spill, BP accounted more than $11bn of payables related to the oil spill.

In the same year as Deepwater Horizon, BP agreed to pay the largest logged fine for health and safety violations. These related to the Texas City Refinery explosion, where 15 workers died in a vapour cloud fire. A BP investigation stated that these vapours likely ignited when coming into contact with a vehicle engine.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe company had previously received warnings that the lack of flares could lead to hazardous gas accumulations.

BP Products North America agreed to pay $50.6m, but contested more than $30m of the proposed fine. It also paid “generous”, undisclosed sums to the families of those who died. BP later sold the refinery to Marathon Petroleum, which is now bound by the same settlement BP made.

2. Occidental Petroleum takes responsibility for Kerr-McGee Corp

Texan company Occidental Petroleum also has one stand-out incident responsible for most of its fines. This came through Occidental’s acquisition of Anadarko Petroleum in 2019.

Anadarko held a 25% interest in the Macondo Prospect, the field that contained Deepwater Horizon. This left it open to costs and lawsuits, unless field operator BP were guilty of gross negligence or wilful misconduct. Anadarko initially accused BP of this, but escaped fines by settling all claims with BP for $4bn in 2011.

In 2006, Anadarko acquired the oil exploration and production company Kerr-McGee Corp. This company had recently spun-off its chemicals business as Tronox, which inherited uranium mines and several nuclear waste sites.

However, Tronox claimed Kerr-McGee had lied about the severity of contamination at these sites and not given Tronox enough resources to adequately clean the sites up. In January 2015, Anadarko and Kerr McGee reached a $5.15bn settlement that marked the largest environmental fine in US history at the time.

The US Environmental Protection Agency (EPA) said: “With more than 2,700 sites in 47 states at issue in the case, the settlement addresses Kerr-McGee’s enormous legacy environmental and tort liabilities.”

US Attorney Preet Bharara said at the time of the judgment: “The Kerr-McGee Corporation spent decades despoiling our nation’s natural resources, leaving a toxic legacy for communities across the nation, from Sidney, New York, to the Navajo nation.

“Then, Kerr-McGee tried to escape the consequences of its misdeeds by transferring its most valuable assets to affiliates, leaving an insolvent Shell behind, unable to pay its environmental liabilities. As today’s historic payment shows, the government will not allow polluters to escape paying for the damage they inflict on our land.”

3. ExxonMobil pays $1.57bn over 388 incidents

ExxonMobil’s largest fines are much more evenly distributed than those of BP or Occidental. All but four of its fines cost below $50m, while the four largest all cost more than $200m.

All of these relate to environmental violations, such as a $236m ruling against ExxonMobil for polluting groundwater with a petrol additive. The company’s largest settlement came in 2005, when it paid $589m in relation to alleged breaches of the US’ Clean Air Act.

All but $18.4m of the out of court settlement went toward enforcing new emissions controls at the company’s seven refineries. The government collected the rest of the proceeds, some of which funded local emissions reduction projects and conservation projects in Louisiana. The settlement was the 17th reached by the EPA under the act, which aims to reduce harmful air emissions.

4. Marathon Petroleum, with $1.48bn over 346 incidents

Continuing this trend, Marathon Petroleum has had only four fines costing it more than $100m.

Marathon owns Tesoro Corp, which was also accused of violations of the Clean Air Act. In 2016, the company reached a settlement alongside Par Hawaii Refining, leading it to spend $403m on pollution control equipment. It would also pay $12m toward environmental projects impacted by its pollution and $10.5m in civil penalties.

The company’s next three largest settlements all relate to similar alleged violations of the Clean Air Act. According to the US DOJ, these agreements led the company “to significantly reduce emissions from stacks, wastewater vents, leaking valves, and flares throughout its refineries”.

5. Royal Dutch Shell pays fines second most often in oil and gas

Shell has received fines more frequently than most other oil and gas companies. Of the larger producers, only Chevron has received fines more frequently, on 711 occasions.

Of Shell’s 621 fines, 485 have concerned environmental violations. Three of its five largest fines relate to Clean Air Act cases, with fines totalling more than $394m. However, the company’s third largest fine instead relates to overstating its proven reserves in its accounts. The fifth largest fine since 2000 related to contract offences, when Shell underpaid the royalties it owed on US leases up to 1998.