GlobalData analysts have predicted US shale gas production will fall by 1.45 billion cubic feet per day in 2020. Meanwhile, Rystad Energy analysts have said US gas production will continue to decline until November.

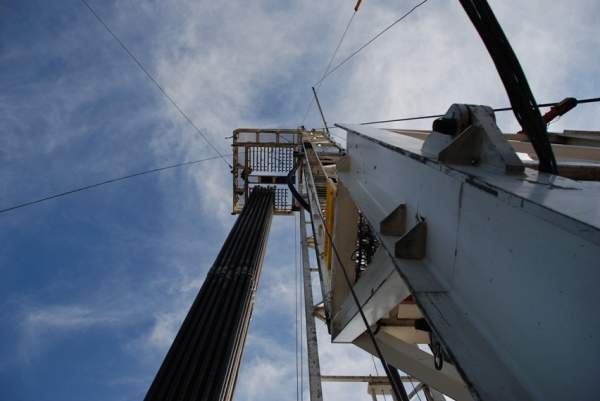

Operators were quick to divest from US shale field projects during the Covid-19 downturn due to their short lifespan.

GlobalData oil and gas analyst Steven Ho said: “From GlobalData’s analysis of 15 company positions, rig count is expected to drop by six rigs, from 41 as of the end of March 2020 to 35 rigs by the end of 2020. Overall, this reduction is a result of capex cuts summing up to approximately $1.5bn reported by operators.”

“We took gas wells drilled between 2018 to date as the most representative sample set to determine the economic viability of future wells to be developed in Marcellus and Utica. The sample set consists of slightly more than 2,800 wells; of those, less than 25% have breakeven below $2.05 per thousand cubic feet (mcf).”

How far will shale gas production fall?

Ho expects consumption to fall further in coming months. This will mostly be down to decreased consumption from commerce and industry. However, this could be partly offset by increased electricity use during summer in the Northern Hemisphere.

He continued: “The natural gas industry will not recover in the near term through 2020, with dry gas production expected to remain at approximately similar level as 2019, accompanied by a high level of working natural gas inventory and reduced demand due to current economic slowdown.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAnalysts at Rystad Energy expect US production to fall to 82.5 billion cubic feet per day (bcfd). After this low point, recovery will be slow. The firm expects a gain of only 2 bcfd by the end of 2021.

This would mean an initial decline of 11.5 bcfd compared to the year before. Of this, only 1.7 bcfd would be because of shale gas shut-ins, with the rest down to natural decline.

This scenario assumes a Henry Hub gas price of $2.5 per million British thermal units (MMBtu), and a West Texas Intermediate oil price of $35 per barrel. Rystad expects gas basin development to recover when prices range between $2.5-3 MMBtu.