US-based Chesapeake Energy is reportedly in advanced talks to buy domestic peer Chief Oil & Gas, in a deal worth approximately $2.4bn, including debt.

A deal could be signed as early as this week, reported Reuters, citing sources with knowledge of the matter.

The sources, however, said that the negotiations between the firms could dissolve at the last moment.

In October 2021, Reuters reported that Chief Oil & Gas was looking for a possible sale to capitalise on increased energy prices.

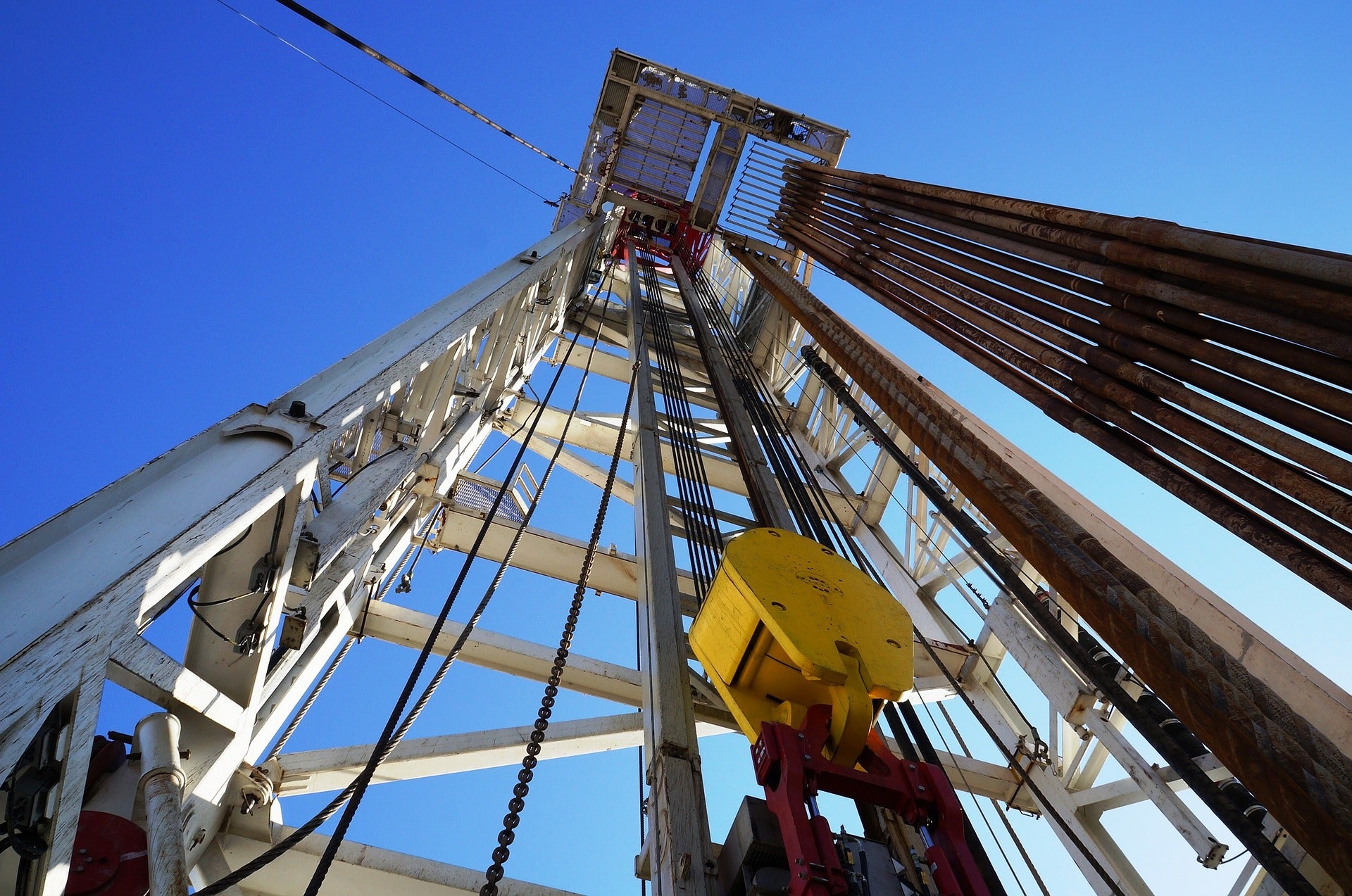

Founded in 1994, Chief Oil & Gas is engaged in the exploration and production of oil and natural gas reserves, situated in the Marcellus shale in northeastern Pennsylvania.

In 2020, the firm achieved a gross production milestone of two trillion cubic feet of natural gas in the Marcellus shale.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe deal between Chesapeake and Chief Oil & Gas, if executed, will mark the former’s second acquisition since its exit from Chapter 11 bankruptcy in February 2021.

In November 2021, Chesapeake closed a $2.2bn acquisition of US-based natural gas producer Vine Energy, which owned assets in the Haynesville and Mid-Bossier shale plays in the Haynesville basin of north-west Louisiana.

The acquisition increased Chesapeake’s position in the Haynesville shale, with more than 900 additional drilling locations.

Chesapeake Energy, which focuses on developing unconventional oil and natural gas assets in the US, had emerged from bankruptcy and equitised a debt of $7.8bn.