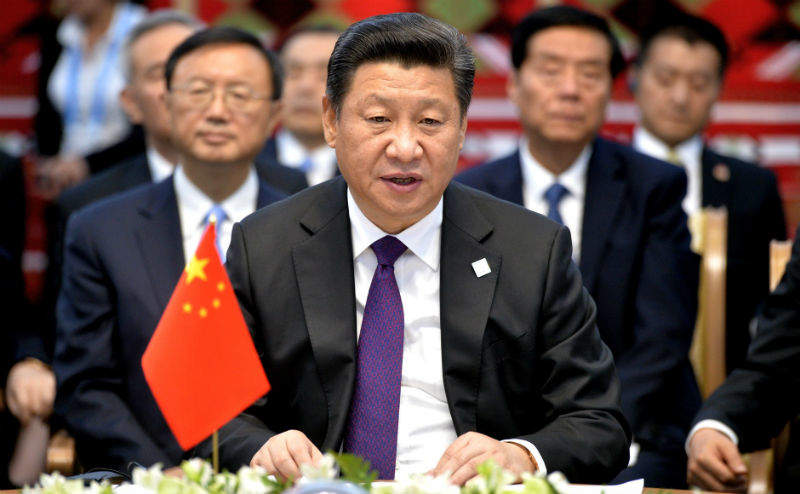

Following the instruction from President Xi Jinping to boost national energy security, a group of major energy companies has pledged to expand Chinese oil and gas production, with a greater focus on natural gas supplies, in particular.

China National Offshore Oil Company (CNOOC) said it aims to boost domestic oil and gas reserves as part of a ten-year plan to reach an annual output of 30 million tonnes at its Baohai Bay fields.

CNOOC joint company secretary Li Jiewen said: “[in implementing top-level instructions] companies will follow their own development characteristics and proceed with plans accordingly.”

China currently has the world’s highest energy consumption rate and is also the largest oil importer, but domestically the country is facing declining reserves and soaring development costs at proven oilfields.

In response to Xi’s call, the China National Petroleum Company said it would focus on fast-tracking investments in natural gas production and infrastructure, including underground storage.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe Chinese natural gas industry suffered a shortage last winter as Beijing’s gasification drive increased demand at a much faster rate than domestic fields could supply. Gas deliveries were delayed by a lack of pipeline and storage infrastructure.

The International Energy Agency estimated that natural gas imports made up 45% of China’s total consumption in 2017. Rapid growth in the demand for imports could see China overtake Japan as the world’s largest importer of natural gas, as early as this year.

Chinese oil and gas tariffs

The expansion of domestic oil and gas comes at a time when China is embroiled in a trade war with the US.

The threat of $60bn tariffs on US imports is likely to impact the Chinese oil and gas sector, and as Xi is currently looking to natural gas as a way to clean up its air pollution, it is becoming a politically sensitive issue.

The US is currently the top producer of natural gas and its LNG exports are said to be growing, with the government hoping to turn the country into an energy superpower.

Verisk Maplecroft senior Asia analyst Hugo Brennan said an implemented tariff on LNG imports would “deal a serious blow to the US gas industry and President Trump’s ‘energy dominance’ agenda”.

Brennan added: “Chinese gas demand forecasts are underpinning a raft of proposed LNG export terminals along America’s East Coast, which align with the Trump administration’s bid to turn the US into an energy superpower. But some of these projects will struggle to attract financing if [China] goes ahead and raises tariff barriers on US LNG.”