The onset of COVID-19 pandemic and its global spread has resulted in a fall in oil prices due to subdued demand foreseen and the price war between Russia and Saudi Arabia. The prices recovered, however, partially after hopes for an agreement between Russia and OPEC increased.

Nevertheless, the prices will remain volatile for at least six months after the COVID-19 pandemic, as seen from the results of a poll Verdict conducted recently to assess how lasting the impact of the pandemic will be on oil price volatility.

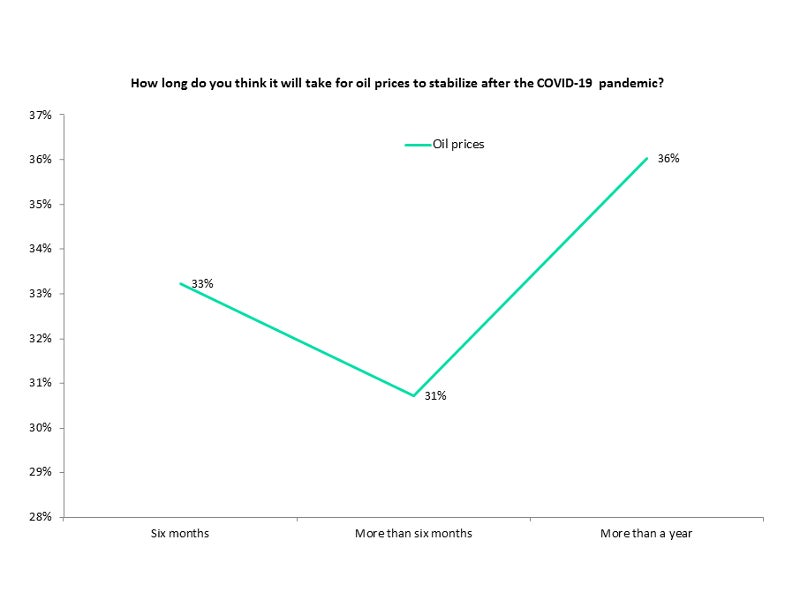

Two-third (67%) of the respondents opined that the impact will last for six months to more than a year following the pandemic. While 36% believe the volatility will stay for more than a year following the pandemic, 31% believe that it’ll last for more than six months.

One-third (33%) of the respondents believe that the oil prices won’t be volatile for more than six months following the COVID-19 pandemic.

The analysis is based on 358 responses received between 26 March and 09 April.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCOVID-19 and oil price affect ongoing upstream projects and jobs, says GlobalData

The COVID-19 pandemic and the oil price fall has resulted in Capex reductions by companies such as Woodside and Santos, according to the analytics firm, GlobalData, whose Upstream Analytics has identified certain ongoing upstream projects in Oceania that are impacted.

Immediate impacts are evident in companies’ responses to the pandemic, namely project delays and Capex reduction for the year, says GlobalData, whose Job Trends analysis shows that openings have reduced in the oil and gas sector while job closings have increased, although the long-term impact is still unknown.

Deferrals of final investment decisions and delay of ongoing developments are seen in at least 11 projects in Oceania in 2020, as tracked by GlobalData Upstream Analytics as on 08 April 2020.