Crestwood Equity Partners has agreed to sell its Marcellus Shale gas gathering and compression assets to US-based Antero Midstream in a deal valued at $205m in cash.

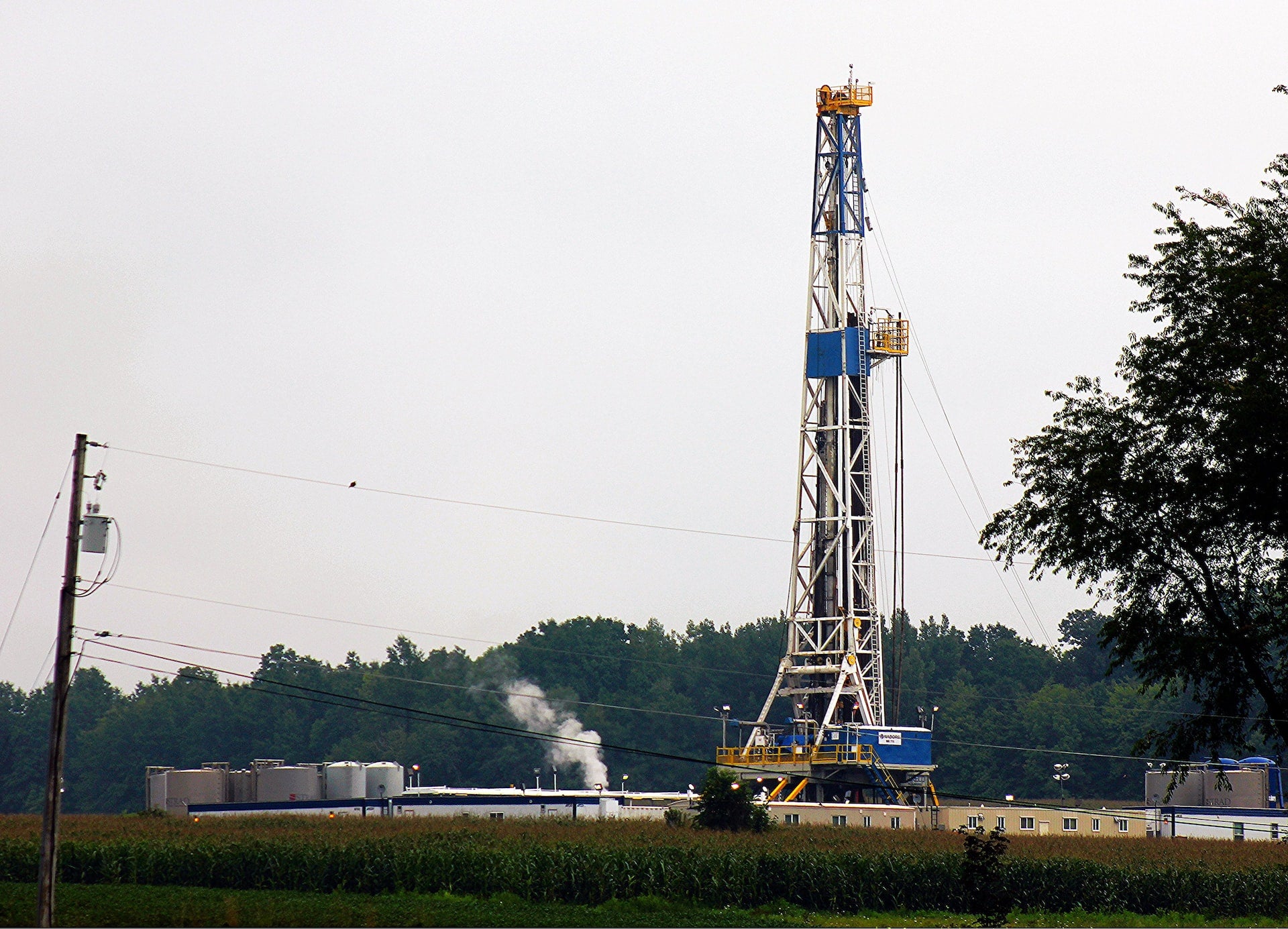

The assets covered under the sale include 72 miles of dry gas gathering pipelines and nine compressor stations, with a compression capacity of approximately 700 million cubic feet per day.

The sale forms part of Crestwood’s long-term growth strategy to offload non-core assets to become a leading midstream operator in the Williston, Delaware, and Power River basins.

Proceeds from the sale will be used by Crestwood to enhance its financial flexibility by reducing debt and undertaking opportunistic common unit repurchases.

Crestwood founder, chairman, and CEO Robert Phillips said: “Over the past 18 months, Crestwood has strategically enhanced its asset portfolio to build competitive scale in its core basins, and as we focus on optimising and integrating the Oasis Midstream, Sendero Midstream, and CPJV acquisitions, today’s announcement highlights our confidence in the portfolio achieving our long-term leverage ratio target of sub 3.5x in 2023 and demonstrates our commitment to generating accretive unitholder returns and solidifying our financial flexibility for the future.”

Antero Midstream expects the acquisition to add nearly 425 undeveloped drilling locations, as well as increase its compression capacity by 20% and its gathering pipeline mileage by 15%.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAntero Midstream chairman and CEO Paul Rady the acquisition will provide the firm with significant synergies that not only boost economics, but also lead to immediate free cash flow accretion.

Rady added: “The acquisition is consistent with Antero Midstream’s strategy of investing in infrastructure in the Marcellus, the lowest cost shale play, for high visibility customers, particularly Antero Resources.

“Importantly, the assets include underutilised gathering and compression capacity for capital efficient development from both Antero Resources and other third parties.”

Subject to customary regulatory approvals, the transaction is planned to close in the fourth quarter of 2022.