Midstream oil and gas company Enterprise Products Partners (EPD), through its affiliate, has agreed to acquire Navitas Midstream Partners in a debt-free transaction for $3.25bn in cash.

The company will acquire Navitas from an affiliate of Warburg Pincus.

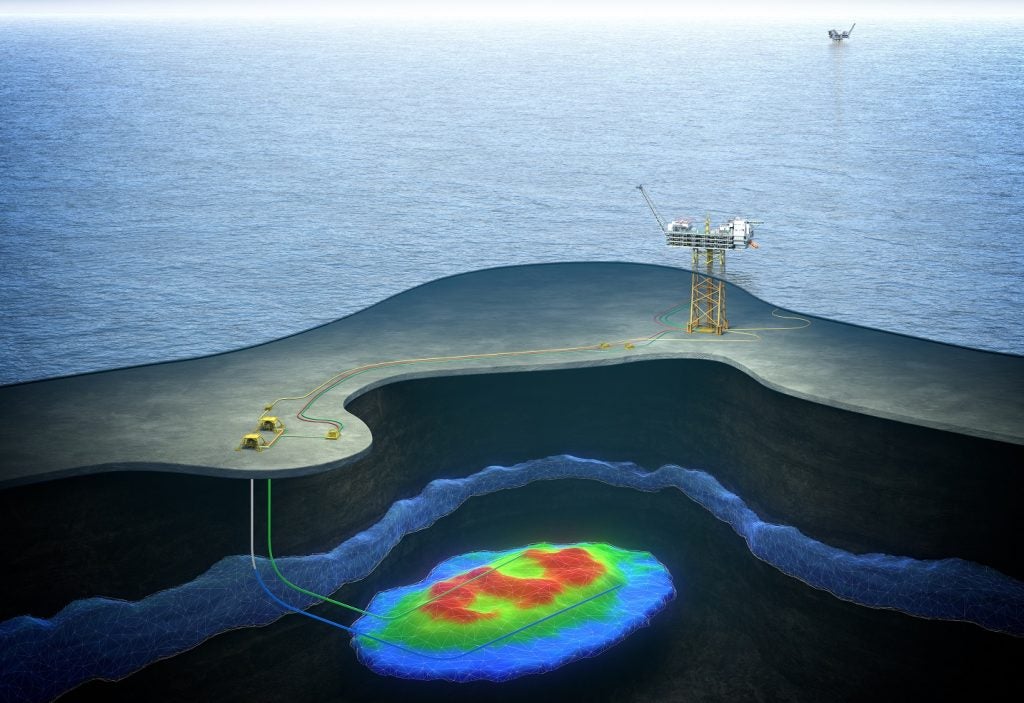

Navitas provides natural gas gathering, treating, and processing services in the Midland Basin, located in the Permian Basin.

It owns 1,750 miles (2,816km) of pipelines, as well as the Leiker processing plant, which is due to be commissioned in the first quarter of 2022.

Once the Leiker plant comes on stream, Navitas will have a processing capacity of more than one billion cubic feet of cryogenic natural gas per day.

See Also:

Enterprise’s general partner co-chief executive officer and chief financial officer Randy Fowler said: “The system, including its large footprint of low-pressure natural gas gathering, is an attractive processing franchise that provides value-added services to producers.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“We believe this acquisition will be immediately accretive to distributable cash flow per unit. Based on the current outlook for commodity prices in 2023, which would be our first full year of ownership, we believe distributable cash flow accretion will be in the range of $0.18 to $0.22 per unit.

“This investment will provide Enterprise with an attractive return on capital, and support additional capital returns to our limited partners through distribution growth and buybacks of common units.”

Enterprise expects the acquisition will enable its natural gas processing and NGL business to extend further into the Midland Basin, where drilling activity accounts for nearly 20% of the active onshore drilling rigs in the country.

Subject to customary regulatory approvals, the transaction is planned for completion in the first quarter of 2022.

Last year, Reuters reported that Warburg Pincus and the Ontario Teachers’ Pension Plan (OTPP) were looking to sell US-based oil and gas company Chisholm Energy.