Oil and gas explorer Empyrean Energy has signed a deal with Australian-based natural gas developer and producer Sacgasco to farm-in to a package of gas projects in the Sacramento Basin onshore California.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The company intends to expand its exploration portfolio by adding onshore and offshore assets that are geographically diverse.

The package of gas projects includes two mature, multi-trillion cubic feet (tcf) gas prospects, Dempsey and Alvares, and an area that comprises at least three already identified Dempsey-style follow up prospects.

Empyrean CEO Tom Kelly said: “We hope to help Sacgasco leverage many determined years of pre-drilling geological exploration and experience to unlock the potential that these large conventional gas prospects hold.”

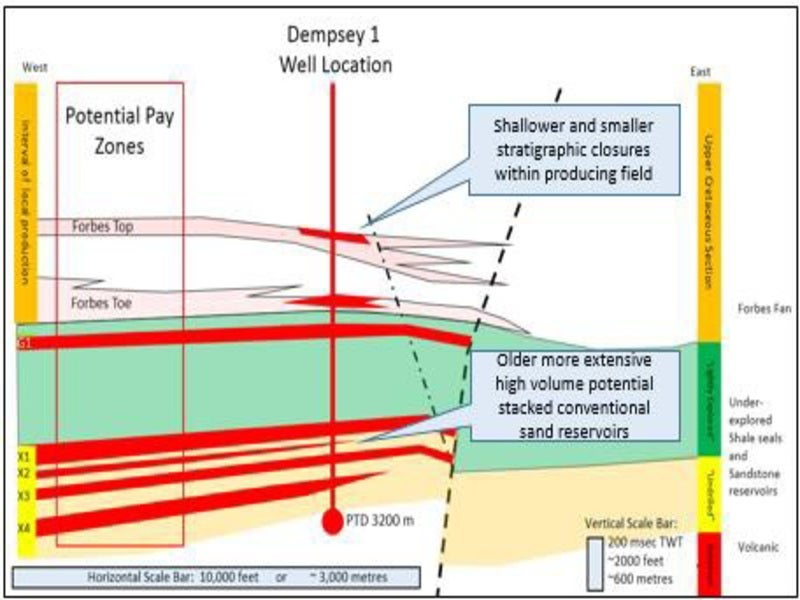

Dempsey has the potential to hold prospect resource of more than 1tcf of gas in up to seven stacked target reservoirs.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataUnder the deal in relation to Dempsey, Empyrean will pay an initial $10,000 followed by $90,000 in a subsequent payment to be paid upon signing a definitive farm-out agreement and Joint Operating Agreement (JOA) with Sacgasco.

Furthermore, Empyrean will have to make an investment of $1.5m by 17 June towards the dry hole cost of the Dempsey-1 Well, in order for Empyrean to earn a 25% working interest (WI) in the Dempsey prospect.

The Dempsey-1 Well is a 3,200m (10,500ft) combined appraisal and exploration well to be commenced in the third quarter of this year.

Empyrean will also pay 13.33% of the dry hole well costs for Alvares, which is estimated to hold prospective resources of more than 2tcf of estimated potential recoverable gas, to earn a 10% working interest in the Alvares prospect.

With regards to Alvares, the company’s 13.33% earn-in is capped at a total well cost of $10m, of which it will pay 10% moving forward.

Empyrean will also pay $20,000 upon signing the farm-out agreement and JOA to reimburse Sacgasco for back costs related to leasing and permitting the Alvares prospect.

In relation to the area containing at least three other Dempsey-style prospects, Empyrean will earn a 25% WI in exchange for technical assistance to Sacgasco to further mature prospects within the area.

The company also has an option to participate in the follow-up prospects by paying 50% of the dry hole cost in the first prospect, 37.5% of the dry hole cost in the second prospect and 37.5% of the dry hole cost in the third prospect, enabling it to acquire a 25% WI in each of the three prospects.

Image: Cross section through Proposed Dempsey 1 well. Photo: courtesy of Empyrean Energy.